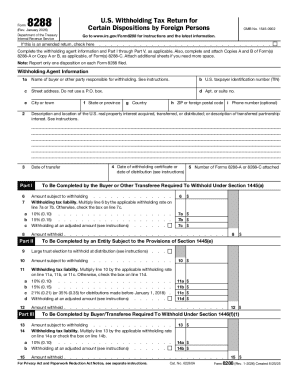

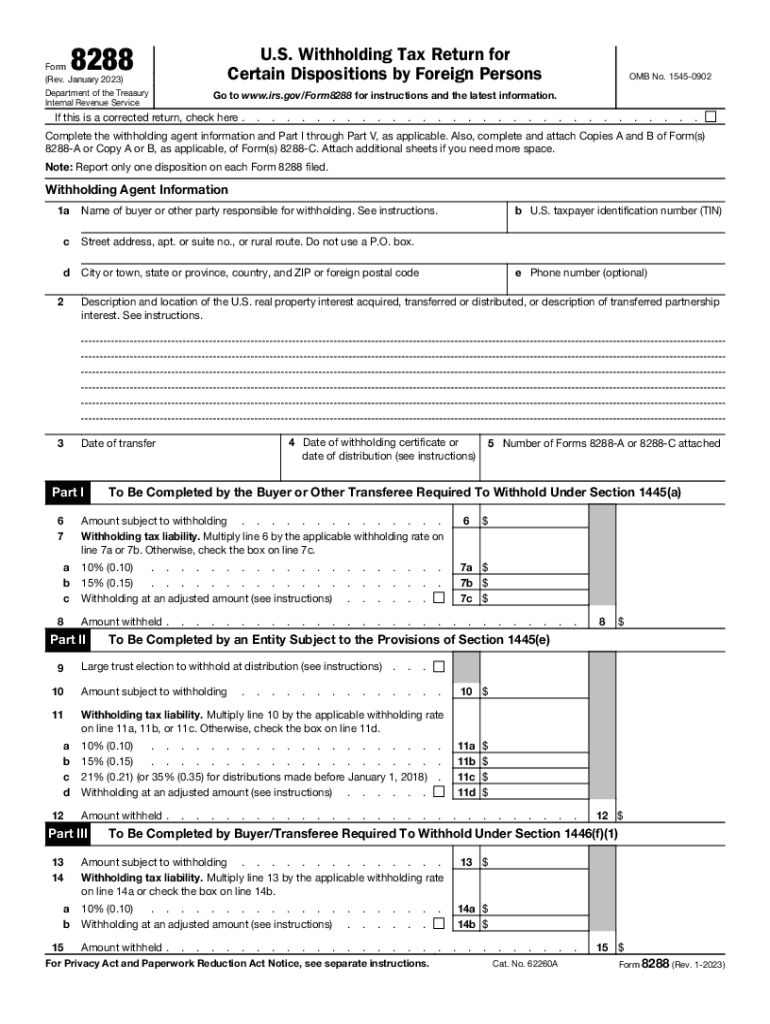

IRS 8288 2023 free printable template

Instructions and Help about IRS 8288

How to edit IRS 8288

How to fill out IRS 8288

Latest updates to IRS 8288

About IRS 8 previous version

What is IRS 8288?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8288

What should I do if I made a mistake on my IRS 8288?

If you discover an error after filing your IRS 8288, you can submit an amended form to correct the mistake. Ensure that you clearly indicate what has changed on the form and provide any supporting documentation if necessary. This process helps maintain accurate records and compliance with IRS regulations.

How can I track the status of my IRS 8288 submission?

To track your IRS 8288, you should use the IRS online tracking tool if you filed electronically, or check with the organization where you mailed your paper form. Keep an eye out for any communication from the IRS that may indicate whether your form is being processed or if there are any issues that need your attention.

Are there special considerations for nonresidents when filing IRS 8288?

Nonresidents and foreign payees must take specific steps when filing the IRS 8288, such as providing accurate information about their residency status. Additionally, it's often necessary to obtain a taxpayer identification number to ensure proper processing. Consulting with a tax professional familiar with international tax issues can be beneficial.

What are common errors to avoid when submitting IRS 8288?

Common errors when submitting IRS 8288 include incorrect taxpayer identification numbers, mismatches between reported amounts and supporting documents, and failing to provide all required signatures. Double-checking all information before submission can minimize the likelihood of these errors.

What should I do if my electronic IRS 8288 submission is rejected?

If your electronic IRS 8288 submission is rejected, review the error codes provided to identify the issue. Make the necessary corrections and re-submit the form. It's crucial to act promptly to avoid penalties associated with late filings.

See what our users say