PA LS-1 2023 free printable template

Show details

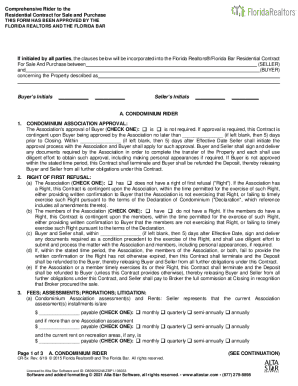

EMPLOYER REQUIREMENTS In the case of concurrent employment the employer shall refrain from withholding the Local Services Tax if the employee provides a recent pay statement from the principal employer that shows that the Local Services Tax is being withheld. PROFESSIONAL EMPLOYER ORGANIZATIONS-If you are a Professional Employer Organization who is responsible for filing the Local Services Tax on behalf of your clients complete the Local Services Tax Allocation Schedule for Professional...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA LS-1

Edit your PA LS-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA LS-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA LS-1 online

Use the instructions below to start using our professional PDF editor:

1

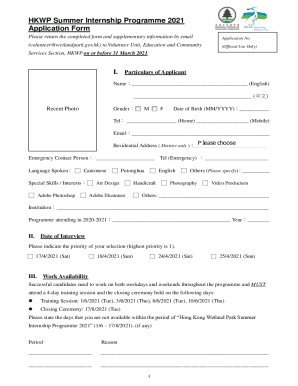

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA LS-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA LS-1 Form Versions

Version

Form Popularity

Fillable & printabley

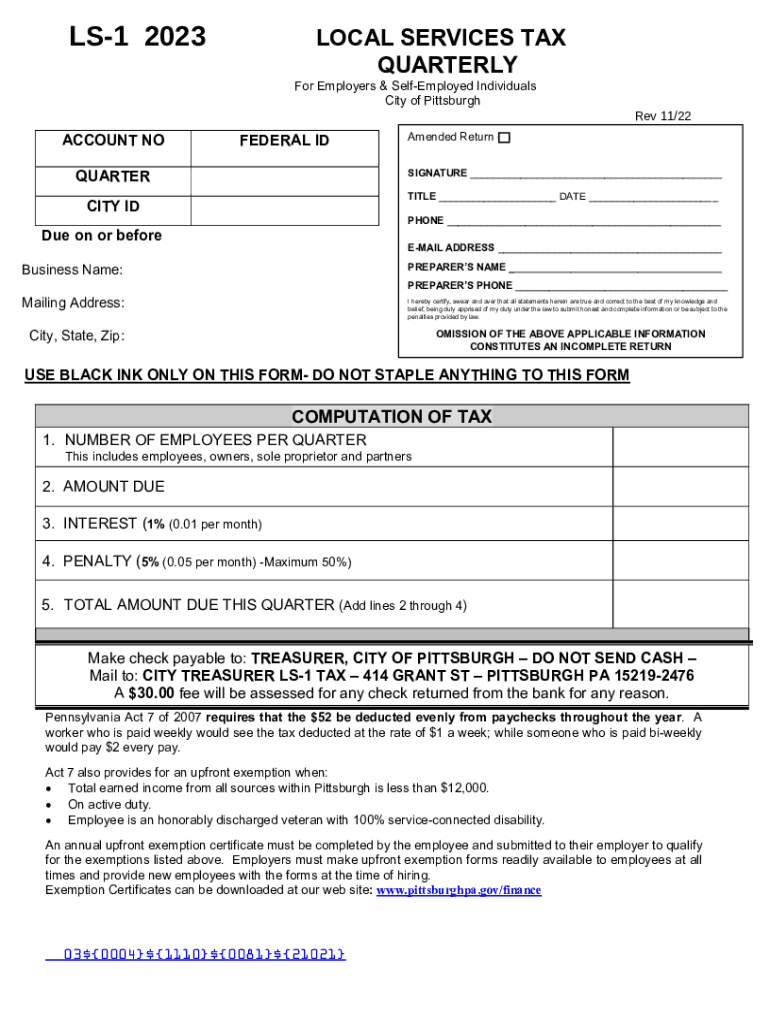

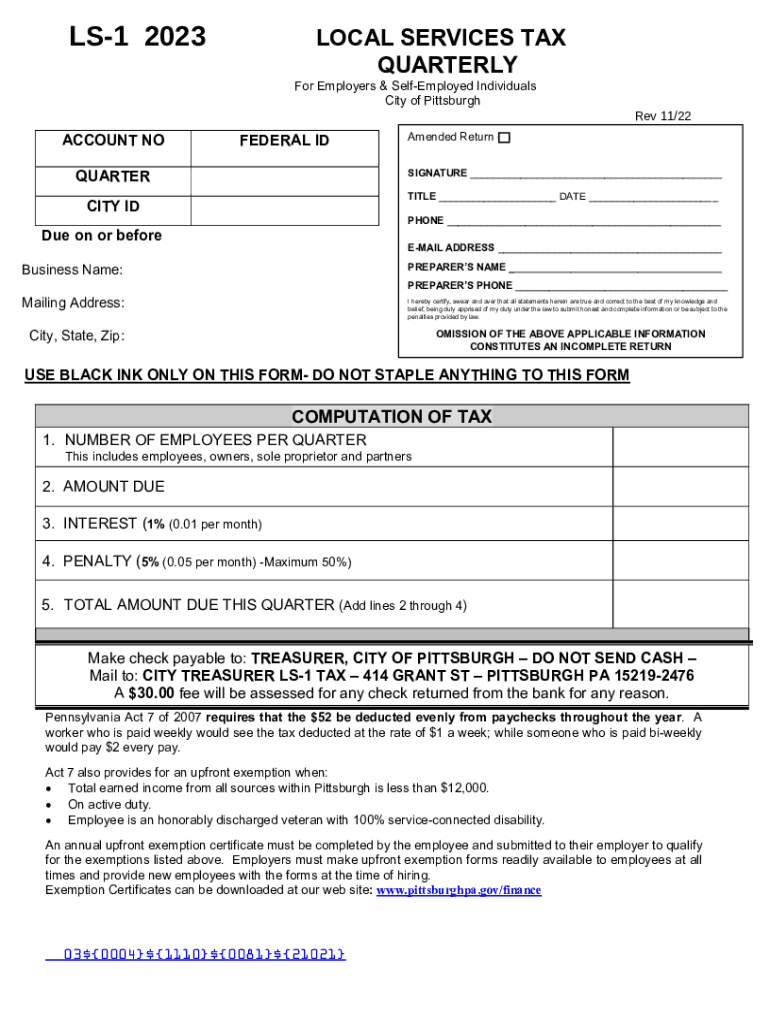

How to fill out PA LS-1

How to fill out PA LS-1

01

Obtain the PA LS-1 form from the appropriate state office or website.

02

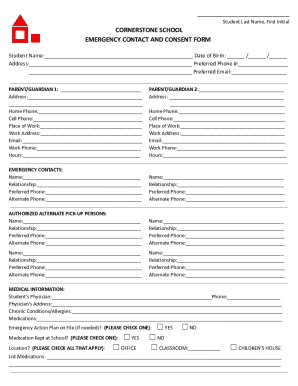

Fill in your personal information at the top of the form, such as name, address, and contact details.

03

State the purpose of the form in the designated section.

04

Provide any required financial information, including income and expenses.

05

Include supporting documentation as instructed, such as identification or proof of residency.

06

Review the completed form for accuracy and completeness.

07

Sign and date the application at the bottom of the form.

08

Submit the form according to the guidelines provided, either in person or by mail.

Who needs PA LS-1?

01

Individuals applying for specific state programs or assistance in Pennsylvania.

02

Residents needing to provide financial information for eligibility assessments.

03

Applicants seeking benefits, grants, or loans that require this form.

Instructions and Help about PA LS-1

Fill

form

: Try Risk Free

People Also Ask about

What income is subject to PA local tax?

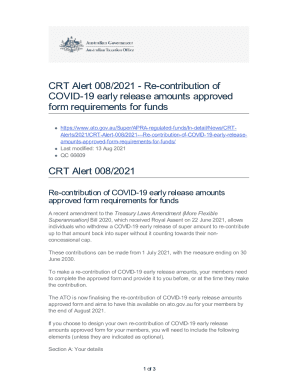

Who must pay this tax? Any resident of a municipality and/or school district who was employed during the calendar year, and/or received taxable income during the calendar year is subject to the tax.

Who has to pay LST tax in PA?

The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. It is due quarterly on a prorated basis determined by the number of pay periods for a calendar year.

Who is exempt from PA LST?

Political subdivisions must exempt from the LST: (1) members of a reserve component of the armed forces called to duty and (2) honorably discharged veterans who served in any war or armed conflict who are blind, paraplegic, or a double or quadruple amputee as a result of military service or who are 100% disabled from a

Who is exempt from local services tax in Pittsburgh?

The municipality is required by law to exempt from the LST employees whose earned income from all sources (employers and self-employment) in their municipality is less than $12,000.

Who must file PA local tax return?

State law requires Pennsylvania residents with earned income, wages and/or net profits, to file an annual local earned income tax return and supply income and withholding documentation, such as a W-2. Even if you have employer withholding or are not expecting a refund, you must file an annual tax return.

How much is the LST in PA?

A $36 tax would be collected at 69 cents a week for taxpayers paid weekly, or at $3 a month for employees that are paid monthly. If the LST is levied at a combined rate of $10 or less, the tax may be collected in a lump sum.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit PA LS-1 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your PA LS-1, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the PA LS-1 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your PA LS-1 in seconds.

How do I edit PA LS-1 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like PA LS-1. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is PA LS-1?

PA LS-1 is a form used in Pennsylvania for reporting the status of an individual's income tax liabilities and payments.

Who is required to file PA LS-1?

Individuals and businesses that have income tax liabilities in Pennsylvania are required to file PA LS-1.

How to fill out PA LS-1?

To fill out PA LS-1, gather your income information, report your tax payments, and follow the instructions provided on the form to complete it accurately.

What is the purpose of PA LS-1?

The purpose of PA LS-1 is to report the income tax liability and payment status to the Pennsylvania Department of Revenue.

What information must be reported on PA LS-1?

PA LS-1 requires reporting of personal identification information, income amounts, deductions, tax credits, and payment history.

Fill out your PA LS-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA LS-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.