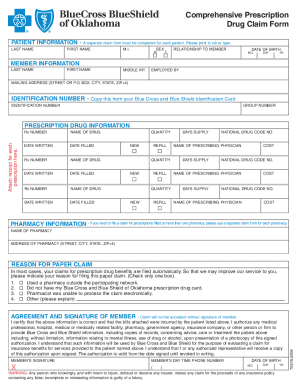

PA LS-1 2024 free printable template

Show details

LS1 2024LOCAL SERVICES TAX QUARTERLY

For Employers & Reemployed Individuals

City of PittsburghACCOUNT FEDERAL IDQUARTERRev 12/23

Amended Return(Written Request Required See Section

604 of the Local

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pennsylvania ls 1 form

Edit your pa ls 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa form ls 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form ls 1 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pittsburgh ls 1 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA LS-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax pa ls form

How to fill out PA LS-1

01

Obtain the PA LS-1 form from the appropriate state office or website.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide details regarding your employment history, including names of employers and dates of employment.

04

Fill out the sections pertaining to your education and any relevant certifications or licenses.

05

Review the form for completeness and accuracy before submitting.

06

Submit the PA LS-1 form to the designated department either online or by mailing it to the specified address.

Who needs PA LS-1?

01

Individuals applying for a license or registration in a specific profession regulated by the state.

02

Persons seeking to fulfill the application requirements set by Pennsylvania's licensing boards.

Video instructions and help with filling out and completing ls 1 local services tax quarterly

Instructions and Help about ls 1 form

Fill

pa ls 1 pdf form

: Try Risk Free

People Also Ask about ls 1 services tax

What income is subject to PA local tax?

Who must pay this tax? Any resident of a municipality and/or school district who was employed during the calendar year, and/or received taxable income during the calendar year is subject to the tax.

Who has to pay LST tax in PA?

The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. It is due quarterly on a prorated basis determined by the number of pay periods for a calendar year.

Who is exempt from PA LST?

Political subdivisions must exempt from the LST: (1) members of a reserve component of the armed forces called to duty and (2) honorably discharged veterans who served in any war or armed conflict who are blind, paraplegic, or a double or quadruple amputee as a result of military service or who are 100% disabled from a

Who is exempt from local services tax in Pittsburgh?

The municipality is required by law to exempt from the LST employees whose earned income from all sources (employers and self-employment) in their municipality is less than $12,000.

Who must file PA local tax return?

State law requires Pennsylvania residents with earned income, wages and/or net profits, to file an annual local earned income tax return and supply income and withholding documentation, such as a W-2. Even if you have employer withholding or are not expecting a refund, you must file an annual tax return.

How much is the LST in PA?

A $36 tax would be collected at 69 cents a week for taxpayers paid weekly, or at $3 a month for employees that are paid monthly. If the LST is levied at a combined rate of $10 or less, the tax may be collected in a lump sum.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pennsylvania form ls 1 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing form ls 1 type right away.

How do I complete services tax quarterly on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your ls 1 local. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out form ls 1 tax on an Android device?

Use the pdfFiller Android app to finish your ls 1 tax and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is PA LS-1?

PA LS-1 is a form used in Pennsylvania for reporting certain tax-related information about businesses operating in the state.

Who is required to file PA LS-1?

Any business entity registered in Pennsylvania that operates in the state is required to file PA LS-1.

How to fill out PA LS-1?

To fill out PA LS-1, provide all required business information in the designated fields, including identification numbers, financial data, and check off each section appropriately before submitting.

What is the purpose of PA LS-1?

The purpose of PA LS-1 is to collect necessary information from businesses for tax assessment and compliance purposes.

What information must be reported on PA LS-1?

The information that must be reported on PA LS-1 includes the business name, tax identification number, financial data, and any additional required disclosures related to tax compliance.

Fill out your PA LS-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pittsburgh ls1 Form is not the form you're looking for?Search for another form here.

Keywords relevant to pennsylvania ls 1 tax

Related to ls 1 pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.