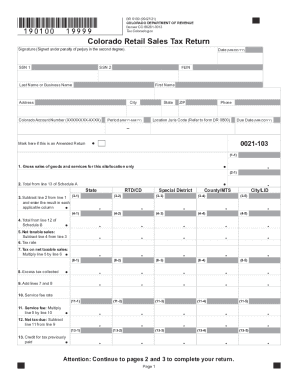

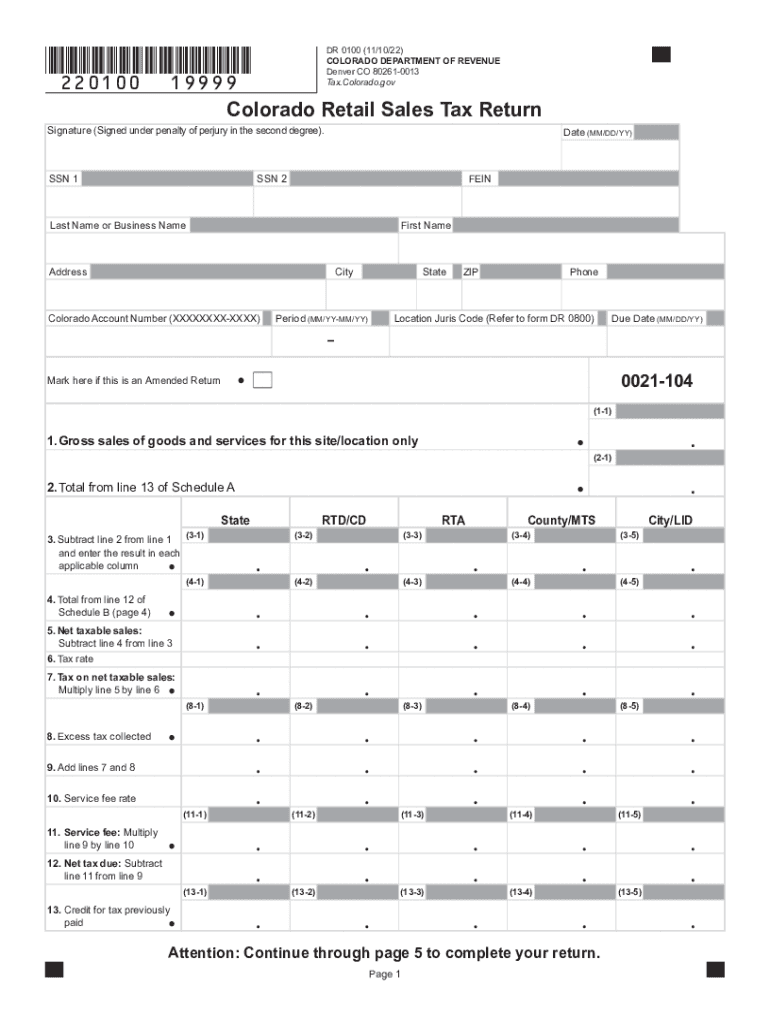

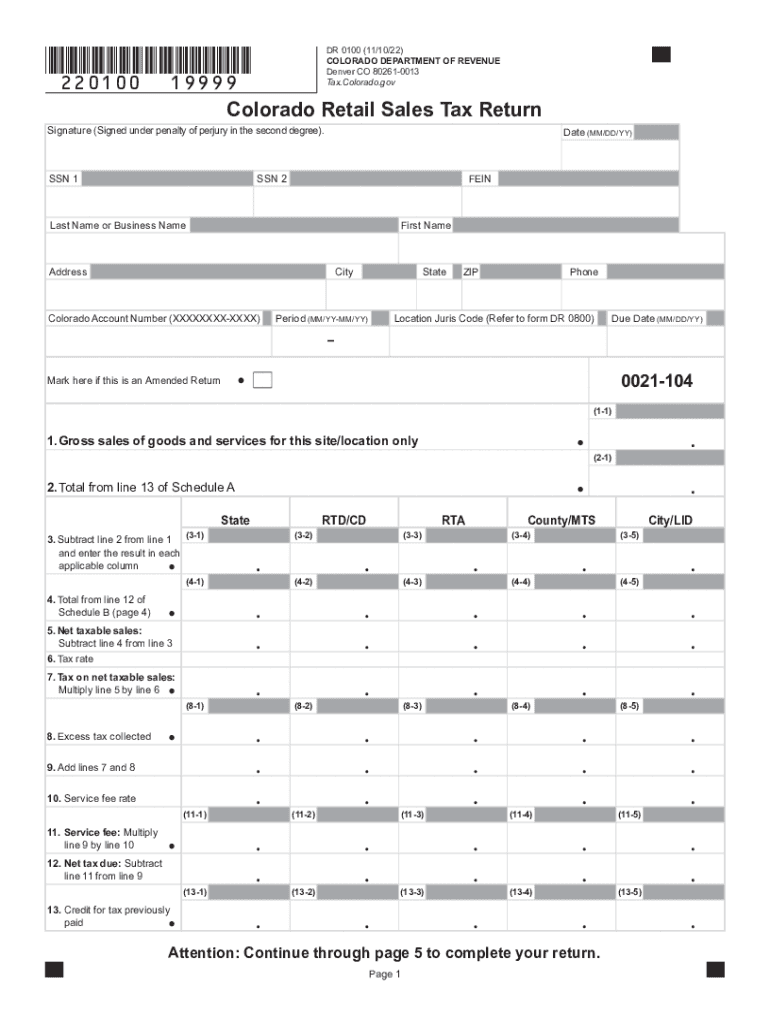

CO DoR DR 0100 2022 free printable template

Show details

Typically returns must be filed on a monthly basis. See Part 7 Filing and Remittance in the Colorado Sales Tax Guide for additional information regarding filing frequency. Colorado. gov. These resources include Colorado Sales Tax Guide Sales tax classes and videos available online at The Customer Contact Center which can be contacted at 303 238-7378. State and State-Collected Local Sales Taxes to report not only Colorado sales tax but also sales taxes administered by the Colorado Department...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DoR DR 0100

Edit your CO DoR DR 0100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DoR DR 0100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CO DoR DR 0100 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CO DoR DR 0100. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DoR DR 0100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DoR DR 0100

How to fill out CO DoR DR 0100

01

Begin by downloading the CO DoR DR 0100 form from the official website.

02

Read the instructions carefully before starting to fill out the form.

03

Enter your personal information in the designated fields, including your name, address, and contact information.

04

Provide details regarding your claim, including any relevant dates and events.

05

Include any necessary documentation or evidence to support your claim.

06

Review all the information for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form through the specified submission method, whether electronically or by mail.

Who needs CO DoR DR 0100?

01

Individuals or entities filing a claim or application related to Department of Revenue matters in Colorado.

02

Taxpayers who need to provide supporting documentation for their claims.

03

People seeking refunds or adjustments related to their financial accounts with the state.

Fill

form

: Try Risk Free

People Also Ask about

What is the Colorado 104 form?

Colorado Individual Income Tax Return. Colorado form 104 is designed for state individuals to report their annual income.

What is a DR 1778 form in Colorado?

The DR 1778 serves as a kind of "cover letter" for the documents when they arrive at the Department by mail and ensures that your supporting documentation is matched up with your return.

What is the discovery section Colorado Department of Revenue?

Discovery's fraud team is responsible for maintaining the department's controls to prevent and detect identity theft and fraud for individual income tax returns.

What is the form for a Colorado extension?

You must pay at least 90% of your tax liability with Form DR 0158-I by April 18 and the remainder by October 17 to avoid delinquent payment penalties. To calculate any tax due with Form DR 0158-I, visit Menu Path: Personal > 2022 Extension > Start your 2022 Extension.

Do I need to file a Colorado state income tax return?

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

Do I need to register with Colorado Department of Revenue?

Income Tax Corporation, Fiduciary and Partnership accounts must file a return with the Colorado Department of Revenue. The tax account is established when the first return is filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CO DoR DR 0100?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific CO DoR DR 0100 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit CO DoR DR 0100 on an Android device?

You can make any changes to PDF files, such as CO DoR DR 0100, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete CO DoR DR 0100 on an Android device?

Use the pdfFiller mobile app and complete your CO DoR DR 0100 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CO DoR DR 0100?

CO DoR DR 0100 is a specific form used for reporting purposes within the state of Colorado, typically related to tax and financial disclosures.

Who is required to file CO DoR DR 0100?

Individuals or entities that meet certain financial thresholds or jurisdictional requirements as set by Colorado's Department of Revenue are required to file this form.

How to fill out CO DoR DR 0100?

To fill out CO DoR DR 0100, you need to gather all necessary financial information and follow the instructions provided on the form to ensure accurate completion.

What is the purpose of CO DoR DR 0100?

The purpose of CO DoR DR 0100 is to collect and report specific financial data for taxation and regulatory compliance in Colorado.

What information must be reported on CO DoR DR 0100?

The information that must be reported on CO DoR DR 0100 typically includes income details, financial transactions, and any relevant tax exemptions or deductions.

Fill out your CO DoR DR 0100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DoR DR 0100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.