CO DoR DR 0100 2009 free printable template

Show details

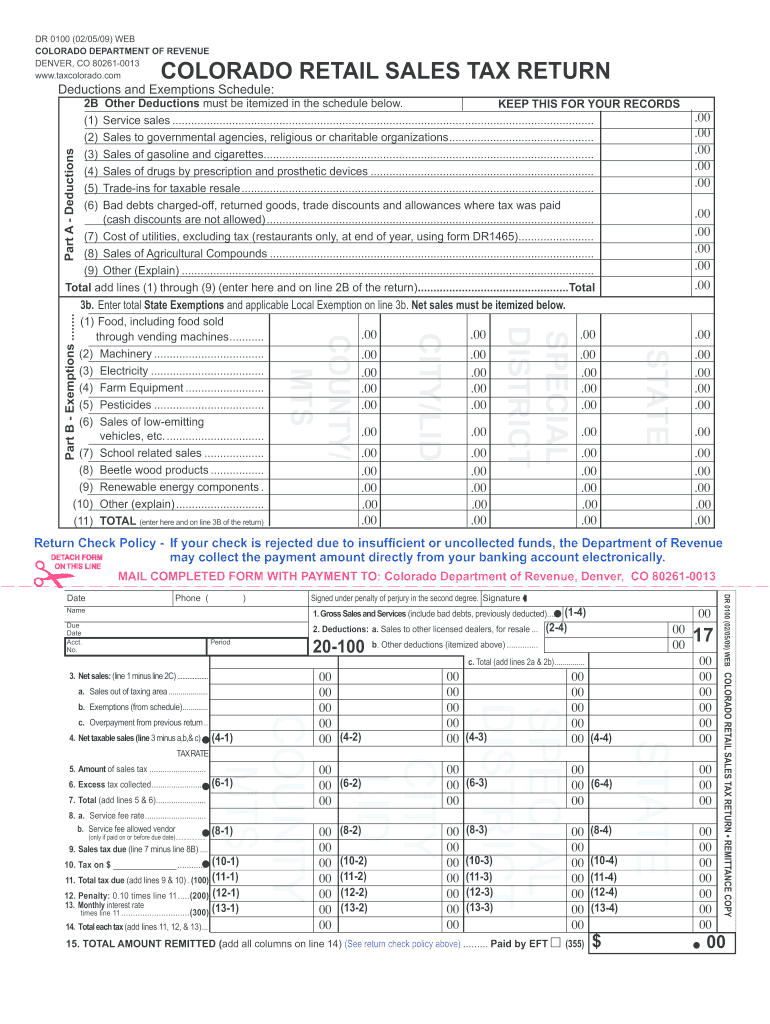

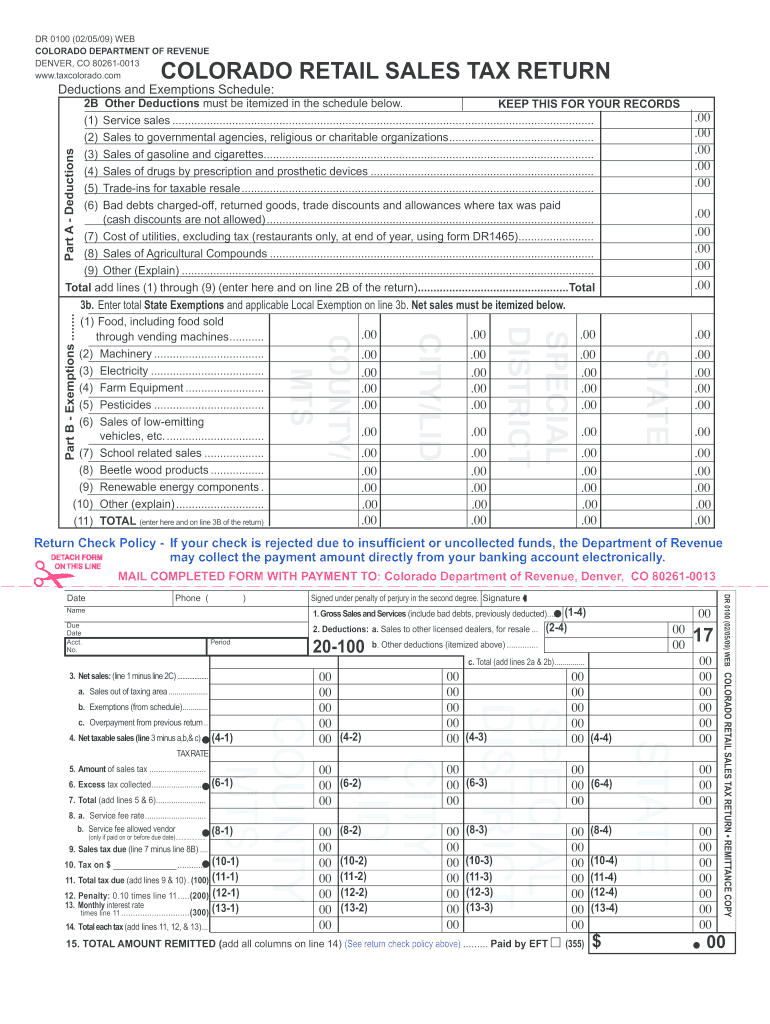

DR 0100 (02/05/09) Web COLORADO DEPARTMENT OF REVENUE Denver, CO 80261-0013 www.taxcolorado.com Colorado Retail Sales Tax Return General Instructions The state sales tax rate is 2.9% Rounding Instructions:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DoR DR 0100

Edit your CO DoR DR 0100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DoR DR 0100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CO DoR DR 0100 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CO DoR DR 0100. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DoR DR 0100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DoR DR 0100

How to fill out CO DoR DR 0100

01

Obtain the CO DoR DR 0100 form from the appropriate state department website or office.

02

Read the instructions accompanying the form carefully to understand the requirements.

03

Fill out the identification section with your personal information such as name, address, and contact details.

04

Complete the section related to the specific purpose of the document, providing relevant details as needed.

05

If applicable, attach any required supporting documents that validate your request.

06

Review all entries to ensure accuracy and completeness.

07

Sign and date the form as required before submission.

08

Submit the completed form either online, by mail, or in person as directed in the instructions.

Who needs CO DoR DR 0100?

01

Individuals or organizations that are required to submit this document for legal, regulatory or compliance purposes.

02

Business owners applying for specific permits or licenses.

03

Residents fulfilling local or state-level documentation requirements.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from Colorado state income tax?

Colorado charges the same income tax rate for its residents regardless of how much you make. The standard deduction in Colorado is $12,550 for single taxpayers and $25,100 for married filers. The state does not have personal exemptions.

What is a DR 0100 form Colorado?

The Colorado Retail Sales Tax Return (DR 0100) is used to report not only Colorado sales tax, but also sales taxes administered by the Colorado Department of Revenue for various cities, counties, and special districts in the state.

How do I get agricultural tax exemption in Colorado?

To qualify for the exemption, purchasers must present an Affidavit for Colorado Sales Tax Exemption for Farm Equipment (Form DR 0511) to vendors stating that they meet the qualifications for the exemption.

How do you qualify for Ag status in Colorado?

In order for the assessor to classify a property as "agricultural land," the property must qualify under Colorado law, which states the owner must submit documentation of such qualification to the assessor's office, and the land must show signs of agricultural use when physically inspected.

How to qualify for agricultural property tax exemption in Colorado?

1) The parcel of land must have been used as a farm or ranch during the previous two years, as well as during the current year. To be designated as a “farm or ranch” the property must be either producing agricultural products or being used to graze livestock.

What is the RTD tax in Colorado?

RTD's chief source of revenue is through a 1.0% sales and use tax. Purchases made within the RTD boundary are subject to the tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CO DoR DR 0100 online?

pdfFiller has made it easy to fill out and sign CO DoR DR 0100. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I fill out CO DoR DR 0100 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your CO DoR DR 0100 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit CO DoR DR 0100 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute CO DoR DR 0100 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is CO DoR DR 0100?

CO DoR DR 0100 is a form used for reporting income tax details in the state of Colorado.

Who is required to file CO DoR DR 0100?

Individuals and businesses in Colorado that meet certain income thresholds and types of income must file CO DoR DR 0100.

How to fill out CO DoR DR 0100?

To fill out CO DoR DR 0100, gather all relevant financial information, complete the sections regarding income and deductions, and submit the form to the Colorado Department of Revenue.

What is the purpose of CO DoR DR 0100?

The purpose of CO DoR DR 0100 is to report income and calculate tax liabilities for residents and any entities conducting business within Colorado.

What information must be reported on CO DoR DR 0100?

The information that must be reported on CO DoR DR 0100 includes total income, deductions, and applicable tax credits as well as personal identification details.

Fill out your CO DoR DR 0100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DoR DR 0100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.