CO DoR DR 0100 2023 free printable template

Show details

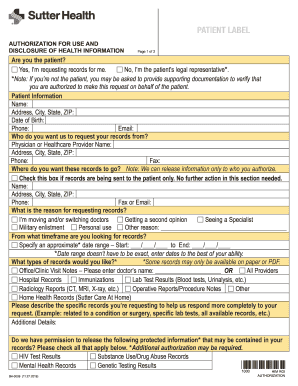

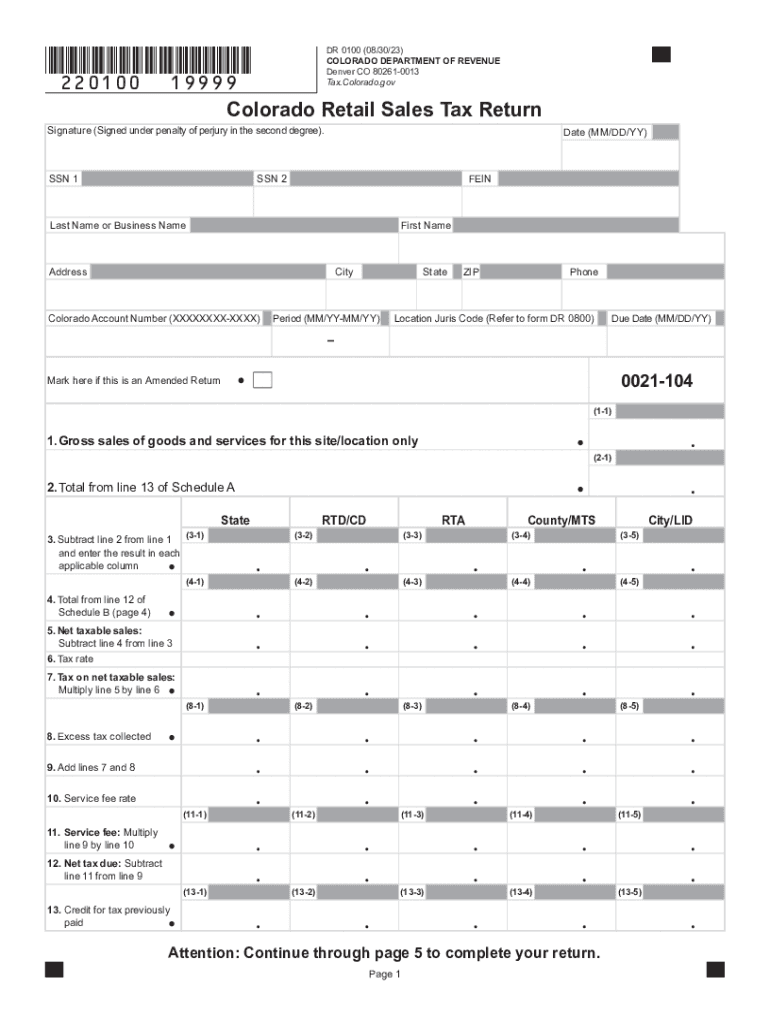

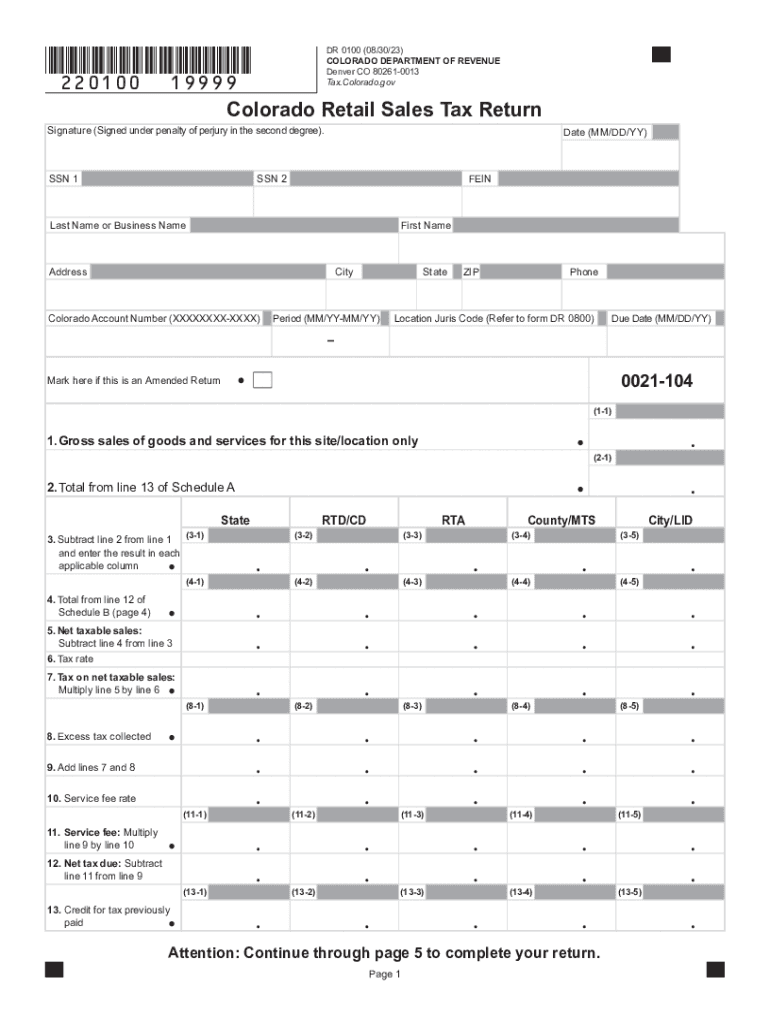

DONOTSEND DR 0100 08/30/23 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0013 Tax. Colorado. gov Colorado Retail Sales Tax Return This form is to be used for 2023 Filings only. Local sales taxes reported on the DR 0100 include RTA Sales taxes for the Regional Transportation Authority RTA are reported in the RTA column of the DR 0100. Colorado. gov. These resources include Colorado Sales Tax Guide Sales tax classes and videos available online at The Customer Contact Center which can be...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dr0100 colorado form

Edit your colorado sales state printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your colorado retail taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dr 0100 colorado retail sales tax return online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit colorado tax return form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DoR DR 0100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out colorado retail sales tax return for occasional sales form

How to fill out CO DoR DR 0100

01

Obtain the CO DoR DR 0100 form from the relevant authority or download it from their official website.

02

Carefully read the instructions provided with the form to understand the requirements and sections.

03

Begin filling out the personal information section at the top, including your name, address, and contact details.

04

Move to the next sections, which may include details about the purpose of the form and specific data being submitted.

05

If applicable, provide any required documentation or evidence as indicated on the form.

06

Review all entries for accuracy and completeness before submitting the form.

07

Sign and date the form where required.

Who needs CO DoR DR 0100?

01

Individuals or organizations who are required to report specific information to the Colorado Department of Revenue.

02

Professionals in industries regulated by the Colorado Department of Revenue that necessitate filing this particular form.

03

Businesses seeking to adhere to state compliance regulations and maintain accurate records.

Fill

sales return colorado fill

: Try Risk Free

People Also Ask about dr 0100 taxes

What is the Colorado 104 form?

Colorado Individual Income Tax Return. Colorado form 104 is designed for state individuals to report their annual income.

What is a DR 1778 form in Colorado?

The DR 1778 serves as a kind of "cover letter" for the documents when they arrive at the Department by mail and ensures that your supporting documentation is matched up with your return.

What is the discovery section Colorado Department of Revenue?

Discovery's fraud team is responsible for maintaining the department's controls to prevent and detect identity theft and fraud for individual income tax returns.

What is the form for a Colorado extension?

You must pay at least 90% of your tax liability with Form DR 0158-I by April 18 and the remainder by October 17 to avoid delinquent payment penalties. To calculate any tax due with Form DR 0158-I, visit Menu Path: Personal > 2022 Extension > Start your 2022 Extension.

Do I need to file a Colorado state income tax return?

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

Do I need to register with Colorado Department of Revenue?

Income Tax Corporation, Fiduciary and Partnership accounts must file a return with the Colorado Department of Revenue. The tax account is established when the first return is filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the colorado retail sales electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your sales return colorado online in seconds.

How do I fill out colorado return must using my mobile device?

Use the pdfFiller mobile app to complete and sign return colorado exemptions on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete form colorado dr0100 on an Android device?

Complete dr0100 form colorado and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is CO DoR DR 0100?

CO DoR DR 0100 is a form used by the Colorado Department of Revenue for reporting specific tax-related obligations and information.

Who is required to file CO DoR DR 0100?

Individuals and businesses that meet certain tax reporting criteria established by the Colorado Department of Revenue are required to file this form.

How to fill out CO DoR DR 0100?

To fill out CO DoR DR 0100, provide the requested personal or business information, complete the specific tax-related sections accurately, and follow the filing instructions provided by the Colorado Department of Revenue.

What is the purpose of CO DoR DR 0100?

The purpose of CO DoR DR 0100 is to collect tax information from individuals and businesses to ensure compliance with Colorado's tax laws.

What information must be reported on CO DoR DR 0100?

Information that must be reported on CO DoR DR 0100 includes identifying information, income and deduction details, and any applicable tax credits.

Fill out your CO DoR DR 0100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Colorado Retail Sales Tax Return is not the form you're looking for?Search for another form here.

Keywords relevant to how to dr 0100

Related to dr 0100 colorado retail sales tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.