SG Indian Bank Remittance Application Form/Transfer Form 2012-2026 free printable template

Show details

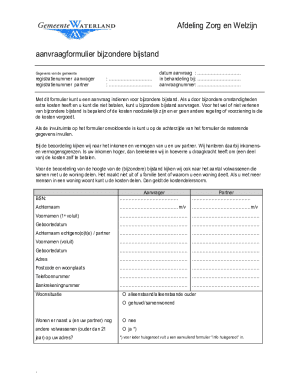

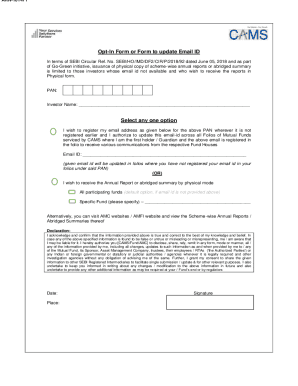

REMITTANCE APPLICATION FORM / TRANSFER FORM Date: Please ? Whichever applicable / delete whichever not applicable and complete in BLOCK LETTERS Electronic Transfer in INR to Indian Bank Electronic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign star insta remit application form

Edit your indian bank money transfer form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your remittance paper form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form of remittance online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bank remittance form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank remittance copy form

How to fill out remittance form:

01

Start by entering your personal information, such as your name, address, and contact details.

02

Provide the recipient's information accurately, including their name, address, and contact details.

03

Indicate the amount of money you are sending and the currency.

04

Choose the method of payment and specify any additional instructions.

05

Sign and date the form to verify the transaction.

06

Keep a copy of the remittance form for your records.

Who needs remittance form:

01

Individuals who need to send money to someone in another location or country.

02

Businesses that regularly make international payments or transactions.

03

Non-profit organizations that receive donations or funding from overseas.

Fill

sample remittance form

: Try Risk Free

People Also Ask about

What is an example of a remittance?

Though a remittance can refer to any kind of monetary transfer, it usually describes someone sending money to another country. For example, you might be sending funds to your family abroad, whether as a wedding gift, or contributing towards bills back home.

What is remittance for payment?

What is the meaning of Remittance? Payment remittance is a money exchange using a transfer. One party will send funds to another individual or entity, typically using electronic transfer or wire submission. Transactions of this kind are often done internationally and can be completed almost immediately.

What is a remittance form?

A remittance letter is a document sent by a customer, which is often a financial institution or another type of firm, to a creditor or supplier along with payment to briefly explain what the payment is for so that the customer's account will be credited properly.

What is the purpose of remittances?

Remittances play an increasingly large role in the economies of small and developing countries. They also play an important role in disaster relief, often exceeding official development assistance (ODA). They help raise the standard of living for people in low-income nations and help combat global poverty.

What are the types of purpose of remittance?

A remittance refers to the money sent by one party to another within or outside the country. Remittance is one of the important source of revenue for a country and plays a vital role in its economic growth and development. There are two types of remittance: Inward Remittance and Outward Remittance.

What are 2 benefits of remittances?

Pros. Remittances can increase the well-being of receiving households by smoothing consumption and improving living conditions. Remittances can facilitate the accumulation of human capital by making possible improved sanitary conditions, healthier life styles, proper healthcare, and greater educational attainment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find SG Indian Bank Remittance Application FormTransfer?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific SG Indian Bank Remittance Application FormTransfer and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make edits in SG Indian Bank Remittance Application FormTransfer without leaving Chrome?

SG Indian Bank Remittance Application FormTransfer can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit SG Indian Bank Remittance Application FormTransfer on an Android device?

The pdfFiller app for Android allows you to edit PDF files like SG Indian Bank Remittance Application FormTransfer. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is SG Indian Bank Remittance Application FormTransfer Form?

The SG Indian Bank Remittance Application Form is a document used by individuals and businesses to request the transfer of funds from an SG Indian Bank account to a recipient's bank account, either domestically or internationally.

Who is required to file SG Indian Bank Remittance Application FormTransfer Form?

Individuals and businesses who wish to send money through SG Indian Bank are required to file this form. It is necessary for those making remittances in compliance with the bank's policies and regulatory requirements.

How to fill out SG Indian Bank Remittance Application FormTransfer Form?

To fill out the SG Indian Bank Remittance Application Form, you need to provide your personal or business information, recipient's details, the amount to be transferred, the purpose of the transfer, and any supporting documentation required by the bank.

What is the purpose of SG Indian Bank Remittance Application FormTransfer Form?

The purpose of the SG Indian Bank Remittance Application Form is to formalize and document the request for remittance, ensuring compliance with legal and regulatory standards while enabling the bank to process the transfer accurately.

What information must be reported on SG Indian Bank Remittance Application FormTransfer Form?

The information that must be reported includes the sender's name, address, account number, recipient's name, address, account details, amount being sent, currency type, purpose of the remittance, and any applicable transaction fees.

Fill out your SG Indian Bank Remittance Application FormTransfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SG Indian Bank Remittance Application FormTransfer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.