IL ADJ020FC 2015-2025 free printable template

Show details

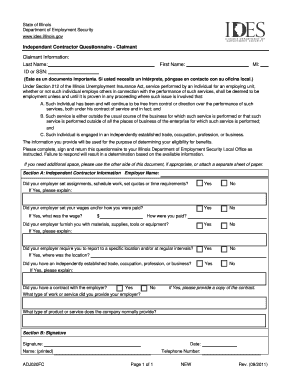

State of Illinois Department of Employment Security www.ides.illinois.govIndependent Contractor Questionnaire Claimant Information: Last Name: Employer Name:First Name:MI: SSN: Employer Account #:Under

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign adj020fc independent contractor questionnaireclaimant

Edit your adj020fc independent contractor questionnaireclaimant form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your adj020fc independent contractor questionnaireclaimant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit adj020fc independent contractor questionnaireclaimant online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit adj020fc independent contractor questionnaireclaimant. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL ADJ020FC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out adj020fc independent contractor questionnaireclaimant

How to fill out IL ADJ020FC

01

Begin by obtaining the IL ADJ020FC form from the Illinois Department of Agriculture website or your local office.

02

Fill out the section with your personal information, including your name, address, and contact details.

03

Specify the type of adjustment you are requesting in the appropriate section.

04

Provide any required supporting documents as outlined in the form instructions.

05

Review your completed form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form according to the provided instructions, either by mail or in person.

Who needs IL ADJ020FC?

01

Individuals or organizations seeking to make changes to existing agricultural licenses or registrations in Illinois.

02

Farmers or agricultural producers who need to report adjustments in their operations.

03

Anyone involved in agricultural regulatory compliance in Illinois.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my 1099 from unemployment online Illinois?

After you have successfully logged into your IDES account, navigate to the dropdown menu titled “Individual Home” in orange. Select Request 1099G. Answer the security questions. If your responses are verified, you will be able to view your 1099-G form.

Can I get a copy of my 1099 online?

Get a copy of your Social Security 1099 (SSA-1099) tax form online. Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

How do I get my 1099 G form from Illinois unemployment?

All claimants may also access and their 1099-G tax form online by logging into their IDES account or calling Tele-Serve at (312) 338-4337. Claimants can also access their last seven years of 1099-G tax forms via their online account. Please note that all IDES online accounts require ILogin verification.

Can an independent contractor collect unemployment in Illinois?

In Illinois, every individual who is unemployed or underemployed should file a claim for unemployment benefits, even if they have been told they're not covered by the state's regular unemployment insurance program - because they're an independent contractor, part of the “gig economy,” or for some other reason.

What are the certification questions for unemployment in Illinois?

Certification Questions Have you received or will you receive holiday pay during the period of Sunday (week 1 beginning date) through Saturday (week 2 ending date)? Did you work during the period of Sunday (week 1 beginning date) through Saturday (week 2 ending date)?

What is the difference between an employee and a contractor in Illinois?

If the person is an employee, you must withhold income taxes, withhold and pay Social Security and Medicare taxes and pay unemployment taxes on the wages you pay. On the other hand, if the person is an independent contractor, you do not need to withhold or pay any taxes on your payments to him or her.

What disqualifies you from unemployment in Illinois?

There are several ways you can be disqualified from receiving unemployment benefits in Illinois: You quit your job without good cause. You were fired due to misconduct connected to your work. You did not have a good reason to apply for Illinois unemployment or did not accept a suitable job offered to you.

What is considered an employee in Illinois?

Section 3401(c) and 26 CFR 31.3401(c)-l.” With regard to tax withholding, the Illinois Department of Revenue defines the term “employee” as either: “a person who performs services subject to the legal control and direction of an employer, or an Illinois resident who receives payments on which federal income tax is

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in adj020fc independent contractor questionnaireclaimant?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your adj020fc independent contractor questionnaireclaimant to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in adj020fc independent contractor questionnaireclaimant without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your adj020fc independent contractor questionnaireclaimant, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the adj020fc independent contractor questionnaireclaimant in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your adj020fc independent contractor questionnaireclaimant and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is IL ADJ020FC?

IL ADJ020FC is a form used in Illinois for reporting adjustments to a taxpayer's income and business-related expenses.

Who is required to file IL ADJ020FC?

Taxpayers who need to report adjustments to their previously filed tax returns or who have changes in their business income or expenses are required to file IL ADJ020FC.

How to fill out IL ADJ020FC?

To fill out IL ADJ020FC, taxpayers must provide detailed information about their adjustments, including income and expenses, ensuring all relevant fields are accurately completed according to the instructions provided with the form.

What is the purpose of IL ADJ020FC?

The purpose of IL ADJ020FC is to allow taxpayers to formally report corrections or changes to previously filed income tax returns in Illinois.

What information must be reported on IL ADJ020FC?

IL ADJ020FC requires reporting adjustments related to income, business expenses, and any other relevant financial changes that necessitate an amendment to the tax return.

Fill out your adj020fc independent contractor questionnaireclaimant online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

adj020fc Independent Contractor Questionnaireclaimant is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.