IL ADJ020FC 2011 free printable template

Show details

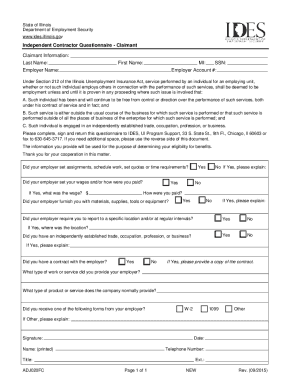

Print State of Illinois Department of Employment Security www.ides.illinois.gov Independent Contractor Questionnaire Claimant Information: Last Name: ID or SSN: First Name: MI: (Ester BS UN document

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL ADJ020FC

Edit your IL ADJ020FC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL ADJ020FC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL ADJ020FC online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL ADJ020FC. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL ADJ020FC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL ADJ020FC

How to fill out IL ADJ020FC

01

Obtain the IL ADJ020FC form from the official website or administrative office.

02

Read the instructions provided with the form carefully.

03

Fill out the personal information section, including your name, address, and contact details.

04

Provide the case information, including the case number and details relevant to the request.

05

Clearly state the purpose of the form in the designated section.

06

Include any supporting documentation required for your request.

07

Review the form for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the completed form through the specified method (e.g., mail, online submission).

10

Keep a copy of the submitted form for your records.

Who needs IL ADJ020FC?

01

Individuals involved in a legal case that requires a request to adjust or modify a previous decision or order.

02

Attorneys representing clients in cases needing adjustments in legal documentation.

03

Parties seeking administrative relief or modification from the court.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my 1099 from unemployment online Illinois?

After you have successfully logged into your IDES account, navigate to the dropdown menu titled “Individual Home” in orange. Select Request 1099G. Answer the security questions. If your responses are verified, you will be able to view your 1099-G form.

Can I get a copy of my 1099 online?

Get a copy of your Social Security 1099 (SSA-1099) tax form online. Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

How do I get my 1099 G form from Illinois unemployment?

All claimants may also access and their 1099-G tax form online by logging into their IDES account or calling Tele-Serve at (312) 338-4337. Claimants can also access their last seven years of 1099-G tax forms via their online account. Please note that all IDES online accounts require ILogin verification.

Can an independent contractor collect unemployment in Illinois?

In Illinois, every individual who is unemployed or underemployed should file a claim for unemployment benefits, even if they have been told they're not covered by the state's regular unemployment insurance program - because they're an independent contractor, part of the “gig economy,” or for some other reason.

What are the certification questions for unemployment in Illinois?

Certification Questions Have you received or will you receive holiday pay during the period of Sunday (week 1 beginning date) through Saturday (week 2 ending date)? Did you work during the period of Sunday (week 1 beginning date) through Saturday (week 2 ending date)?

What is the difference between an employee and a contractor in Illinois?

If the person is an employee, you must withhold income taxes, withhold and pay Social Security and Medicare taxes and pay unemployment taxes on the wages you pay. On the other hand, if the person is an independent contractor, you do not need to withhold or pay any taxes on your payments to him or her.

What disqualifies you from unemployment in Illinois?

There are several ways you can be disqualified from receiving unemployment benefits in Illinois: You quit your job without good cause. You were fired due to misconduct connected to your work. You did not have a good reason to apply for Illinois unemployment or did not accept a suitable job offered to you.

What is considered an employee in Illinois?

Section 3401(c) and 26 CFR 31.3401(c)-l.” With regard to tax withholding, the Illinois Department of Revenue defines the term “employee” as either: “a person who performs services subject to the legal control and direction of an employer, or an Illinois resident who receives payments on which federal income tax is

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IL ADJ020FC for eSignature?

Once your IL ADJ020FC is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in IL ADJ020FC without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your IL ADJ020FC, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the IL ADJ020FC in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your IL ADJ020FC right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is IL ADJ020FC?

IL ADJ020FC is a form used by businesses in Illinois to report adjustments to their previously filed Illinois income tax returns.

Who is required to file IL ADJ020FC?

Businesses and individuals who need to report changes or corrections to an Illinois income tax return must file IL ADJ020FC.

How to fill out IL ADJ020FC?

To fill out IL ADJ020FC, provide accurate information regarding the adjustments being made, including identifying information from the original return, the nature of the adjustment, and the new amounts being reported.

What is the purpose of IL ADJ020FC?

The purpose of IL ADJ020FC is to formally document changes to previously filed tax returns and ensure that the correct tax liability is assessed.

What information must be reported on IL ADJ020FC?

The IL ADJ020FC requires the reporting of the original return details, the specific adjustments being made, reasons for the adjustments, and any supporting documentation if necessary.

Fill out your IL ADJ020FC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL adj020fc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.