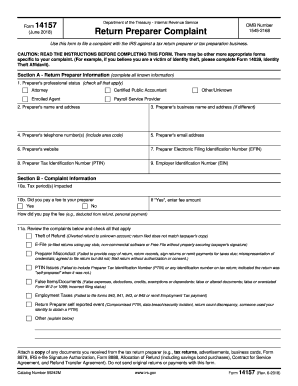

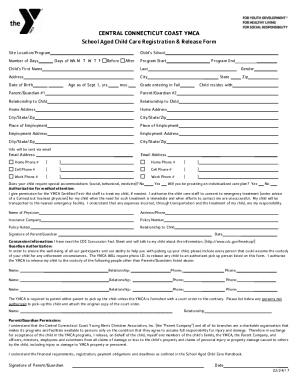

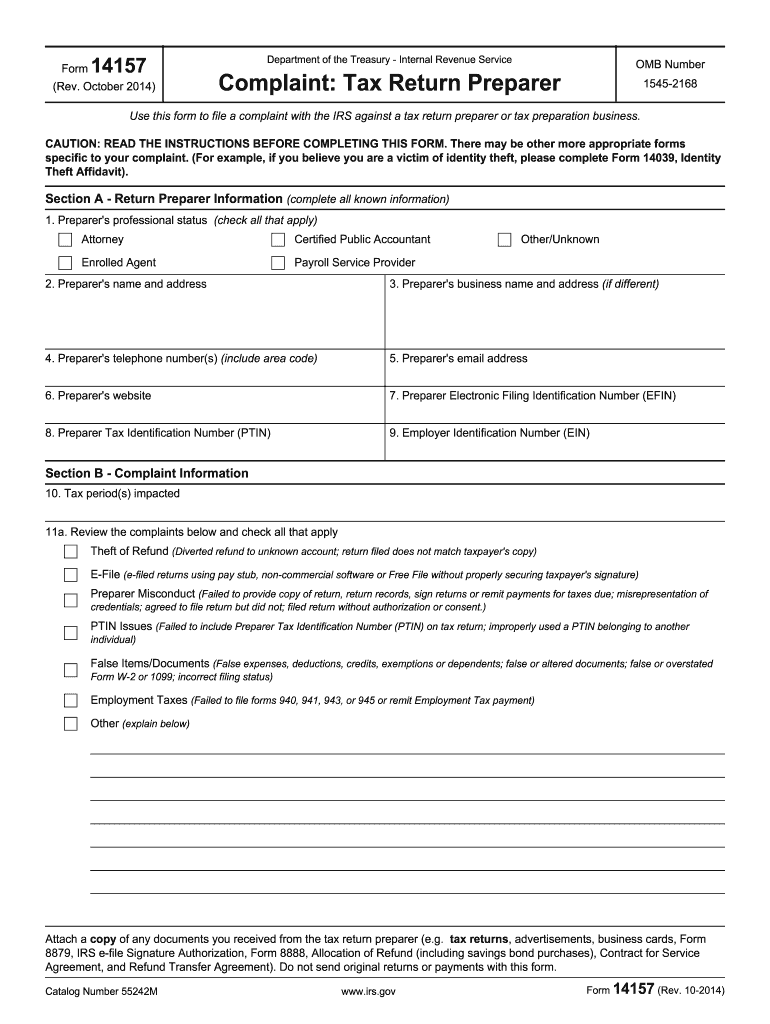

IRS 14157 2014 free printable template

Instructions and Help about IRS 14157

How to edit IRS 14157

How to fill out IRS 14157

About IRS 14 previous version

What is IRS 14157?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 14157

What should I do if I realize I've made a mistake after submitting form 14157 2014?

If you discover an error after submitting form 14157 2014, you should file an amended form or correction as soon as possible. This process will allow you to update any inaccurate information and ensure your records are correct. It's advisable to check the specific guidelines for submitting corrections to avoid further issues.

How can I track the status of my form 14157 2014 submission?

You can track the status of your form 14157 2014 submission by using the designated online portal provided by the relevant tax authority. This portal often allows you to see whether your form has been received, processed, and if any actions are required on your part. Keep your confirmation number handy for easier tracking.

Are there any specific privacy concerns to be aware of when filing form 14157 2014?

When filing form 14157 2014, it's crucial to consider data security and privacy issues. Ensure that you're submitting the form through secure channels, particularly if you are using electronic filing options. Retain your documentation securely, as the retention period for records can vary based on the specifics of your filing.

What common errors should I be aware of when completing form 14157 2014?

Common errors when completing form 14157 2014 include providing incorrect identification numbers, missing signatures, or omitting required fields. To avoid these pitfalls, double-check all entries against your records and ensure every section is properly filled out before submission.

What should I do if I receive a notice regarding my form 14157 2014 submission?

If you receive a notice related to your form 14157 2014 submission, read it carefully to understand the context and any required actions. Gather relevant documentation that supports your original filing and respond promptly according to the instructions provided in the notice.