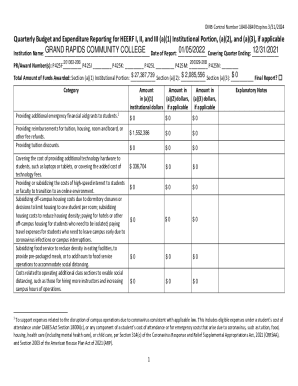

IRS W-2 2009 free printable template

Instructions and Help about IRS W-2

How to edit IRS W-2

How to fill out IRS W-2

About IRS W-2 2009 previous version

What is IRS W-2?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-2

What should I do if I realize I made an error on my IRS W-2 after submission?

If you discover an error on your IRS W-2 after submission, you will need to file a corrected form known as the W-2c. This allows you to amend any inaccuracies, ensuring your tax filings are accurate. It's important to notify affected parties, such as employees or contractors, about the correction.

How can I verify whether my IRS W-2 has been processed by the IRS?

To verify receipt and processing of your IRS W-2, you may use the IRS's online tools or contact their helpline. Keep records of any confirmations you receive. Tracking your submission helps ensure your tax information is correctly reflected in the system.

What are common mistakes people make when submitting their IRS W-2?

Common errors include incorrect Social Security numbers, misspelled names, and wrong income amounts. To avoid these mistakes, double-check all entered information against your records before submission and ensure all fields are accurately filled.

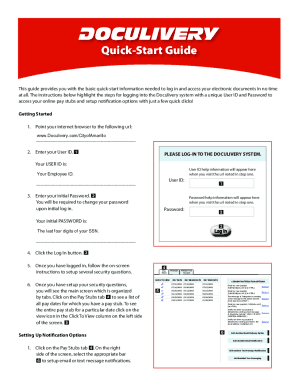

Can I e-file my IRS W-2, and what technical requirements do I need to meet?

Yes, you can e-file your IRS W-2 using approved software. Ensure your system meets the technical requirements specified by the IRS, including compatibility with supported browsers and necessary updates to your e-filing software.

What steps should I take if I receive a notice or audit letter related to my IRS W-2?

If you receive a notice or audit letter regarding your IRS W-2, carefully review the communication for requested information. Prepare relevant documentation and consider seeking advice from a tax professional to effectively respond to the IRS.

See what our users say