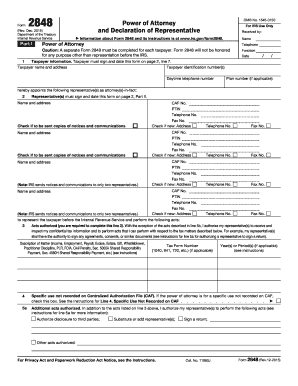

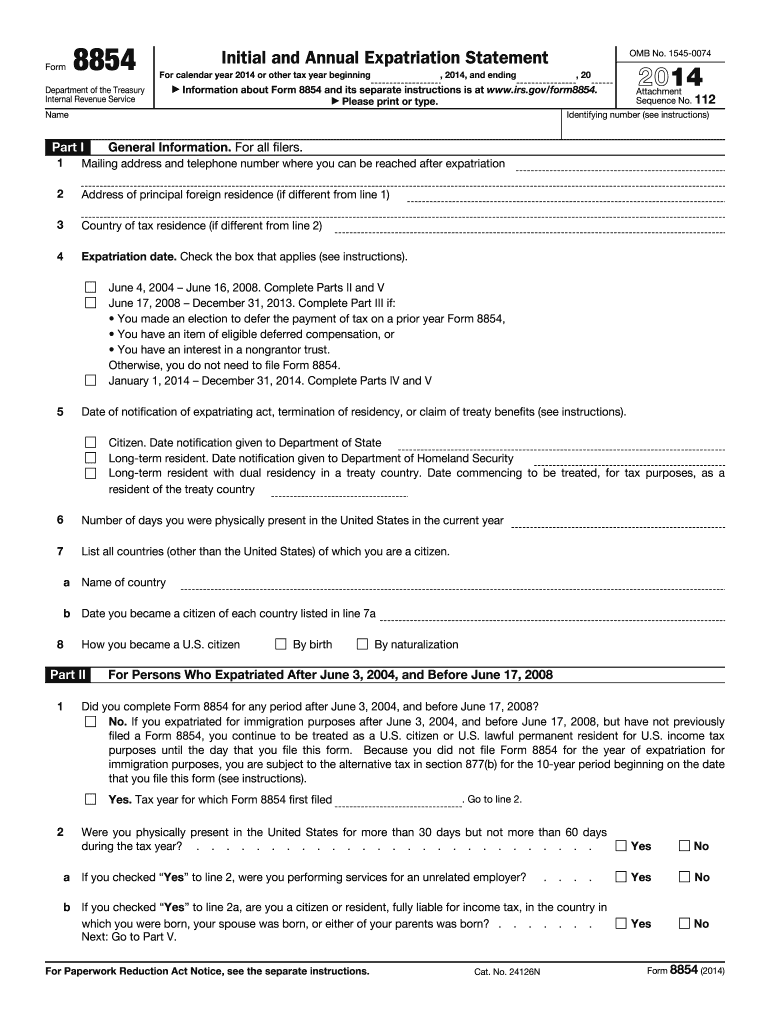

IRS 8854 2014 free printable template

Instructions and Help about IRS 8854

How to edit IRS 8854

How to fill out IRS 8854

About IRS 8 previous version

What is IRS 8854?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8854

What should I do if I realize I've made an error after submitting the check form box that?

If you need to correct mistakes in your submitted check form box that, you can file an amended return. Ensure to include an explanation of the corrections being made. It's recommended to keep records of any communications or submissions related to the amendment for your reference.

How can I check the status of my submitted check form box that?

To verify the receipt or processing of your check form box that, use the designated tracking system provided by the filing authority. Be attentive to any common e-file rejection codes that may arise, as these will guide you in addressing any issues with your submission.

Are e-signatures accepted when filing the check form box that?

Yes, e-signatures are typically accepted for the check form box that, making the filing process more convenient. However, be sure to check the specific requirements of the filing authority to ensure compliance with their e-signature policies.

What are some common mistakes to avoid when filing the check form box that?

Common errors include using incorrect taxpayer identification numbers or misreporting amounts that lead to discrepancies. Double-checking your entries against supporting documentation can help you avoid these pitfalls and ensure a smooth filing process.

Can nonresidents file the check form box that?

Yes, nonresidents can file the check form box that; however, certain rules may apply based on their residency status. It's important to familiarize yourself with the specific guidelines regarding foreign payees to ensure compliance.