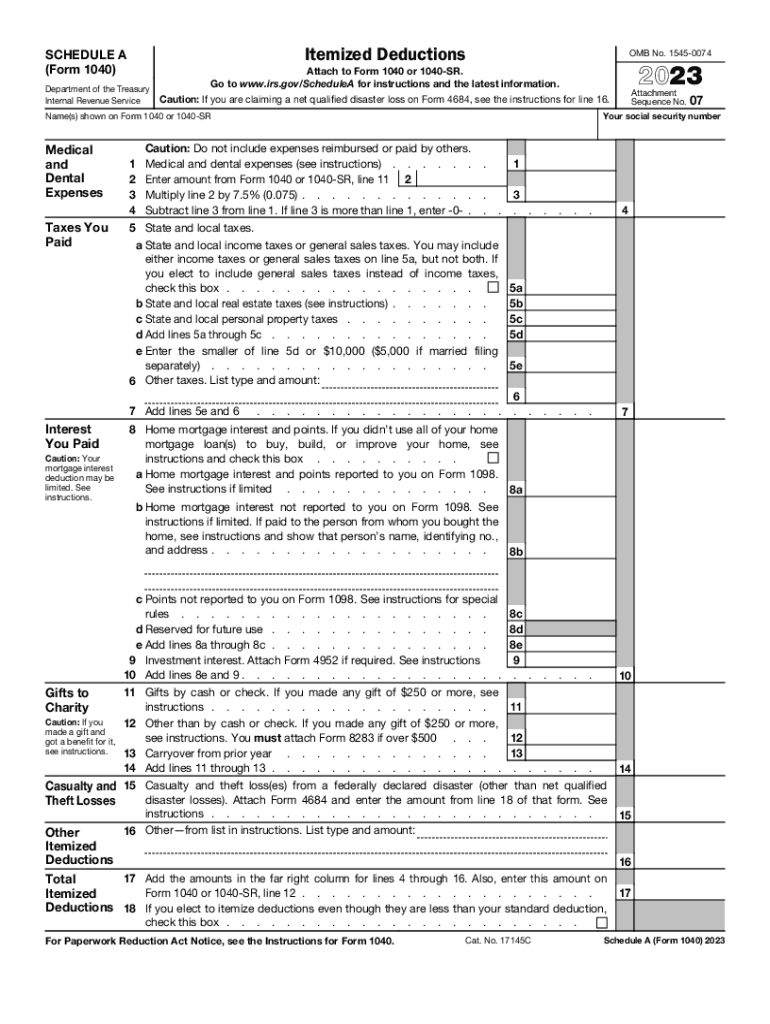

IRS 1040 - Schedule A 2023 free printable template

Instructions and Help about IRS 1040 - Schedule A

How to edit IRS 1040 - Schedule A

How to fill out IRS 1040 - Schedule A

About IRS 1040 - Schedule A 2023 previous version

What is IRS 1040 - Schedule A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule A

What should I do if I realize I've made a mistake on my filed IRS 1040 - Schedule A?

If you discover a mistake after submitting your IRS 1040 - Schedule A, you will need to file an amended return using Form 1040-X. This form allows you to correct errors or provide additional information. Ensure to specify the changes made and the reason for the amendment in your submission.

How can I check the status of my IRS 1040 - Schedule A filing?

To check the status of your IRS 1040 - Schedule A filing, you can use the IRS 'Where's My Refund?' tool on their website. It allows you to verify the receipt and processing status of your return. Ensure you have personal information handy, such as your filing status and the exact amount of your refund.

What should I do if my e-file submission of the IRS 1040 - Schedule A gets rejected?

In case your e-file submission of the IRS 1040 - Schedule A is rejected, check the specific error code provided by the IRS. Each code indicates a different issue that you can correct. After addressing the problem, resubmit your application as soon as possible to avoid any delays in processing.

Are there specific circumstances where I can file an IRS 1040 - Schedule A on behalf of someone else?

Yes, you can file an IRS 1040 - Schedule A on behalf of someone else if you have the proper authorization, like a Power of Attorney (POA). Ensure that the POA documentation is submitted with the form, and that you're familiar with the individual's financial situation to accurately report their itemized deductions.

What records should I retain after filing the IRS 1040 - Schedule A?

After filing your IRS 1040 - Schedule A, it is important to retain all supporting documentation, including receipts and statements for itemized deductions, for at least three years. This helps in case of audits or inquiries from the IRS regarding your deductions and ensures compliance with record retention guidelines.

See what our users say