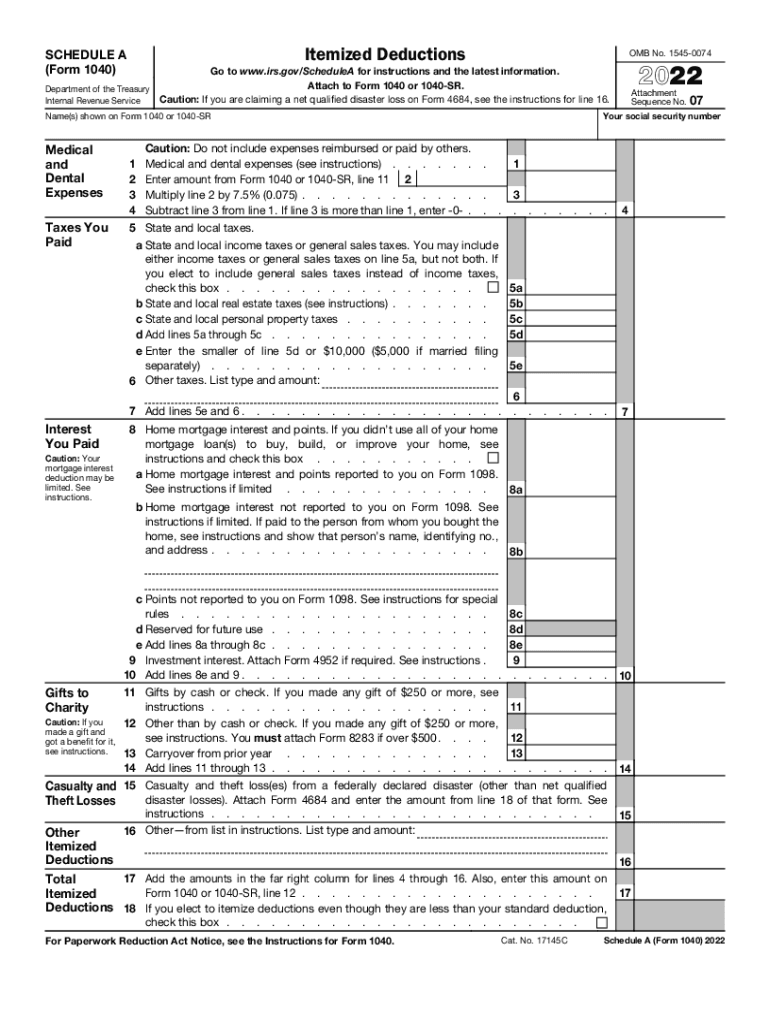

About IRS 1040 - Schedule A 2022 previous version

What is IRS 1040 - Schedule A?

IRS 1040 - Schedule A is a form used by U.S. taxpayers to itemize deductions instead of taking the standard deduction. This form allows for detailed reporting of various deductible expenses incurred over the tax year. Taxpayers typically use this form when their total itemized deductions exceed the standard deduction, enabling them to potentially lower their taxable income.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule A is to allow taxpayers to report and claim itemized deductions on their federal income tax return. By submitting this form, taxpayers can detail eligible expenses that reduce their overall income tax liability. This specific form is vital for those who wish to maximize their deductions and receive a tax benefit associated with their detailed expenses.

Who needs the form?

Taxpayers who itemize their deductions rather than taking the standard deduction need to file IRS 1040 - Schedule A. This typically includes individuals with significant medical expenses, mortgage interest, charitable contributions, and other allowable deductions. If your deductible expenses surpass the standard deduction applicable to your filing status, you should complete this form.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1040 - Schedule A if you choose to take the standard deduction, which simplifies your tax filing process. Additionally, if your total itemized deductions do not exceed the standard deduction amount applicable for your filing status, then it may not be worthwhile to fill out this form. Certain taxpayers, such as those with specific income levels or filing status, may also be disqualified from itemizing deductions.

Components of the form

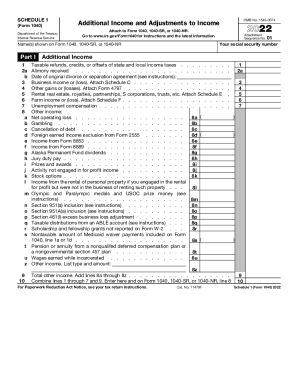

IRS 1040 - Schedule A contains several sections, each dedicated to different types of deductions. Main components include sections for medical and dental expenses, taxes you paid, interest you paid, gifts to charity, casualty and theft losses, and other itemized deductions. Each section guides you in reporting eligible expenses accurately, ensuring compliance with IRS requirements.

What payments and purchases are reported?

Payments and purchases reported on IRS 1040 - Schedule A include unreimbursed medical expenses, state and local taxes, mortgage interest, points paid on a mortgage, and qualified charitable contributions. It also encompasses certain expenses for investment and tax preparation fees that may qualify. Taxpayers need to keep detailed records of these expenses to substantiate their claims when filling out the form.

How many copies of the form should I complete?

Typically, you only need to complete one copy of IRS 1040 - Schedule A for your federal tax return. However, if you are filing multiple state returns or need additional copies for your records, you can create those as necessary. Always ensure that the submitted copy is clean, without any errors, and reflects accurate information on your tax filings.

What are the penalties for not issuing the form?

Failing to issue IRS 1040 - Schedule A when required may result in penalties, including fines for inaccuracies or omissions on your tax return. The IRS may categorize these as failures to file or pay the correct amount of tax. Additionally, incorrect filings can lead to audits or adjustments in your tax return, potentially increasing your liability.

What information do you need when you file the form?

When filing IRS 1040 - Schedule A, gather necessary documents that support your itemized deductions. This includes receipts for medical expenses, records of state and local taxes, mortgage interest statements, and documentation for charitable donations. Accurate reporting of this information is crucial to substantiate your claims and avoid future tax issues.

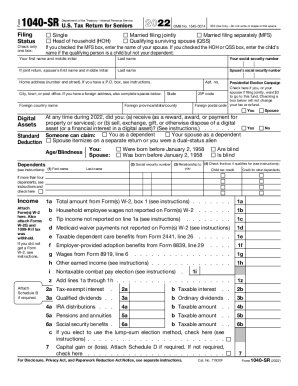

Is the form accompanied by other forms?

IRS 1040 - Schedule A is often submitted with Form 1040, the main Individual Income Tax Return. In some cases, additional forms may accompany depending on the specific deductions claimed. For example, if you are reporting charitable contributions, you may need Form 8283 if certain limits are exceeded. Always review submission requirements based on your unique tax situation.

Where do I send the form?

The submission destination for IRS 1040 - Schedule A depends on your filing status and whether you submit by mail or electronically. If filing by mail, you will send it to the address specified in the instruction booklet based on your state residency. For e-filing, ensure your tax preparation software guides you in submitting the form correctly and in compliance with IRS protocols.