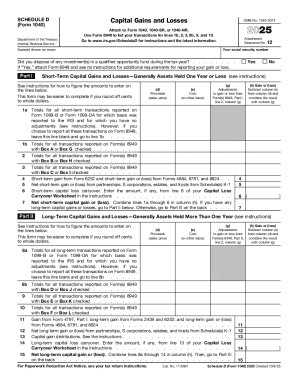

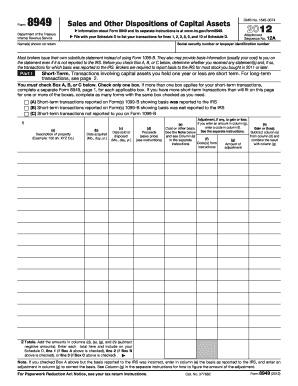

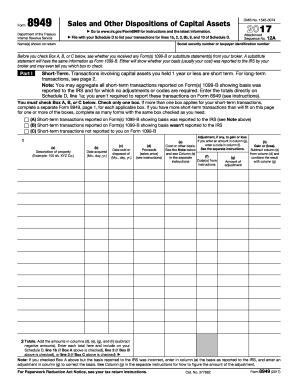

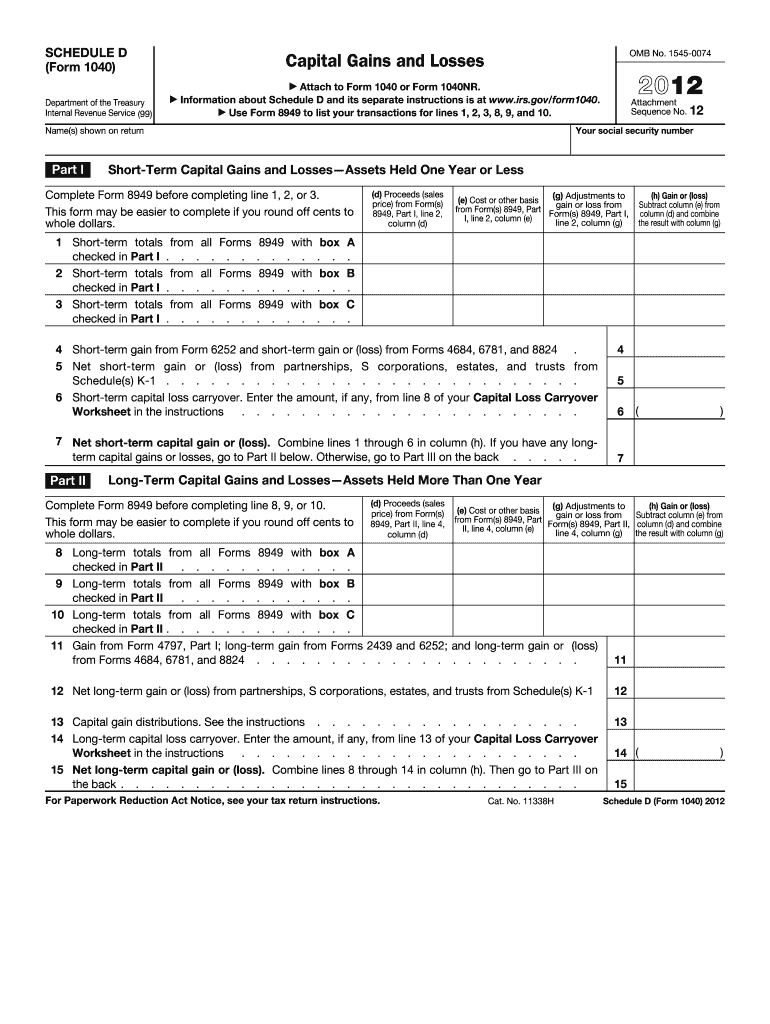

IRS 1040 - Schedule D 2012 free printable template

Instructions and Help about IRS 1040 - Schedule D

How to edit IRS 1040 - Schedule D

How to fill out IRS 1040 - Schedule D

About IRS 1040 - Schedule D 2012 previous version

What is IRS 1040 - Schedule D?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule D

What should you do if you notice an error on your filed IRS 1040 - Schedule D?

If you find a mistake on your filed IRS 1040 - Schedule D, you can file an amended return using Form 1040-X. Make sure to clearly indicate the changes made and include any necessary documentation to support your corrections. It's essential to address errors promptly to avoid potential penalties or delays.

How can you verify the status of your IRS 1040 - Schedule D submission?

To track the status of your IRS 1040 - Schedule D, you can use the IRS 'Where’s My Refund?' tool or check your e-file software if you submitted electronically. Ensure you have your personal information handy, such as Social Security number, filing status, and the exact refund amount, for accurate tracking.

What should you consider regarding privacy and data security when filing your IRS 1040 - Schedule D electronically?

When e-filing your IRS 1040 - Schedule D, ensure that you use a trustworthy tax software that encrypts your data. Keep your computer's antivirus software updated and consider using a secure Wi-Fi connection to protect your sensitive information while submitting your tax forms.

What common mistakes should filers avoid when submitting the IRS 1040 - Schedule D?

Common errors when filing your IRS 1040 - Schedule D include miscalculating gains/losses and failing to report all transactions. It’s crucial to double-check your entries and ensure that all relevant transactions are included to prevent any discrepancies that could trigger an audit.

How can non-residents or foreign payees file an IRS 1040 - Schedule D?

Non-residents or foreign payees are required to follow specific IRS guidelines to file an IRS 1040 - Schedule D. It's advisable to consult IRS resources or a tax professional who specializes in international taxation to navigate complexities like income sourcing and compliance with treaties.

See what our users say