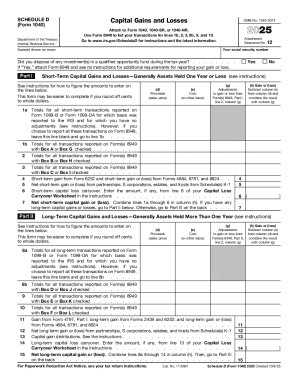

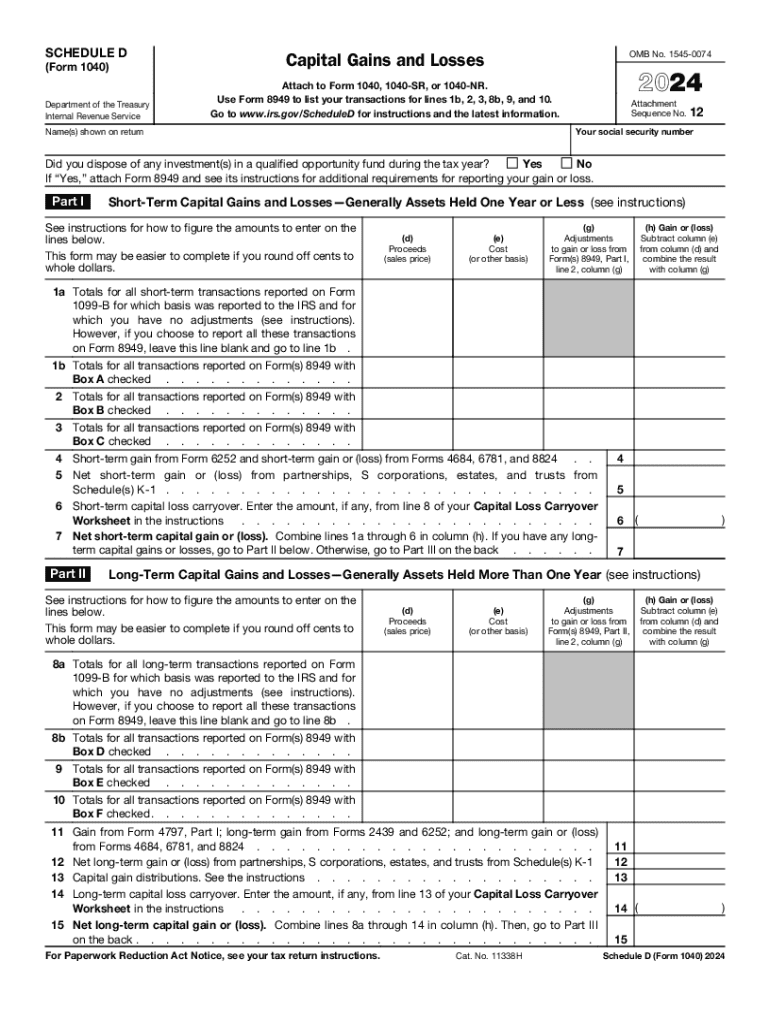

IRS 1040 - Schedule D 2024 free printable template

Instructions and Help about IRS 1040 - Schedule D

How to edit IRS 1040 - Schedule D

How to fill out IRS 1040 - Schedule D

Latest updates to IRS 1040 - Schedule D

About IRS 1040 - Schedule D 2024 previous version

What is IRS 1040 - Schedule D?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule D

What should I do if I need to amend my IRS 1040 - Schedule D?

If you need to correct mistakes on your IRS 1040 - Schedule D, you should file Form 1040-X to amend your tax return. Ensure that you highlight the changes made to your Schedule D and follow the IRS guidelines for amendments. Keep records of all documentation that supports your changes.

How can I track the status of my IRS 1040 - Schedule D submission?

To verify the receipt and processing of your IRS 1040 - Schedule D, you can use the IRS 'Where's My Refund?' tool available on their website. If you filed electronically, check for any common e-file rejection codes that may impact your return. Be prepared to address any issues that could arise during processing.

What are some common errors to avoid when filing the IRS 1040 - Schedule D?

Common mistakes when filing the IRS 1040 - Schedule D include misreporting capital gains or losses and failing to include all relevant transactions. Ensure that you're accurately calculating each entry and keeping detailed records to avoid discrepancies. Double-check your work before submission to minimize errors.

Are electronic signatures acceptable for submitting the IRS 1040 - Schedule D?

Yes, electronic signatures are acceptable for the IRS 1040 - Schedule D when filed electronically. If you’re using software to e-file, follow the specific prompts to ensure your e-signature is compliant. Remember to keep all electronic records securely for your privacy and security.

What should I do if I receive an audit notice related to my IRS 1040 - Schedule D?

If you receive an audit notice regarding your IRS 1040 - Schedule D, promptly review the correspondence to understand the IRS's questions or concerns. Prepare all related documentation that supports your reported information, and consider consulting with a tax professional for guidance on responding effectively.

See what our users say