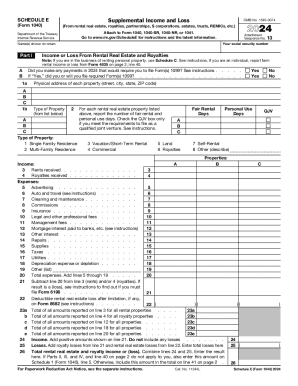

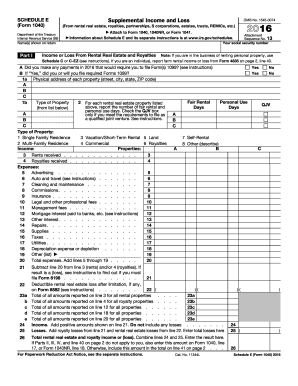

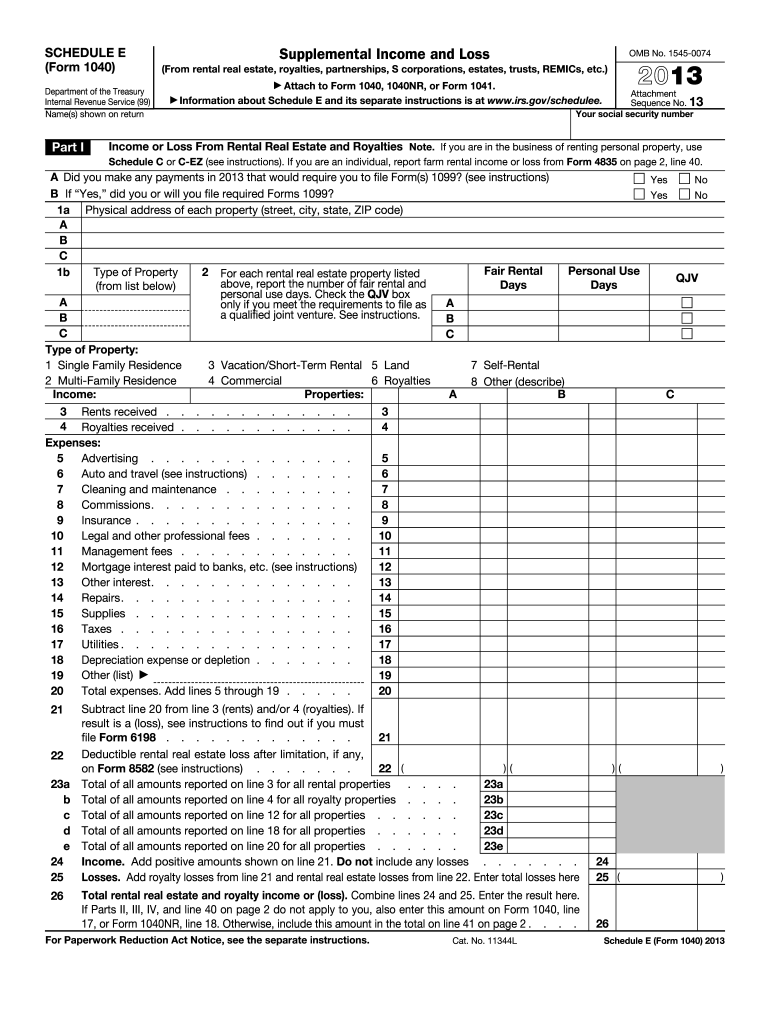

IRS 1040 - Schedule E 2013 free printable template

Instructions and Help about IRS 1040 - Schedule E

How to edit IRS 1040 - Schedule E

How to fill out IRS 1040 - Schedule E

About IRS 1040 - Schedule E 2013 previous version

What is IRS 1040 - Schedule E?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about irs schedule e 2013

How can I get [SKS]?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the [SKS] in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete [SKS] on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your [SKS] from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit [SKS] on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as [SKS]. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is IRS 1040 - Schedule E?

IRS 1040 - Schedule E is a tax form used to report income or loss from rental real estate, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

Who is required to file IRS 1040 - Schedule E?

Taxpayers who receive income from rental properties, partnerships, S corporations, estates, trusts, or certain other entities are required to file IRS 1040 - Schedule E.

How to fill out IRS 1040 - Schedule E?

To fill out IRS 1040 - Schedule E, start by providing your identifying information, list the properties or entities that generate income, report rental income, allowable expenses, and calculate net income or loss.

What is the purpose of IRS 1040 - Schedule E?

The purpose of IRS 1040 - Schedule E is to report supplemental income received from various sources, primarily rental income and income from partnerships and S corporations.

What information must be reported on IRS 1040 - Schedule E?

The information that must be reported on IRS 1040 - Schedule E includes the type of property or interest, income received, expenses incurred, and the total net income or loss for each property or entity.

See what our users say