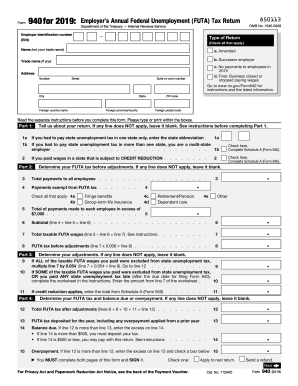

CA DE 9 2014-2025 free printable template

Show details

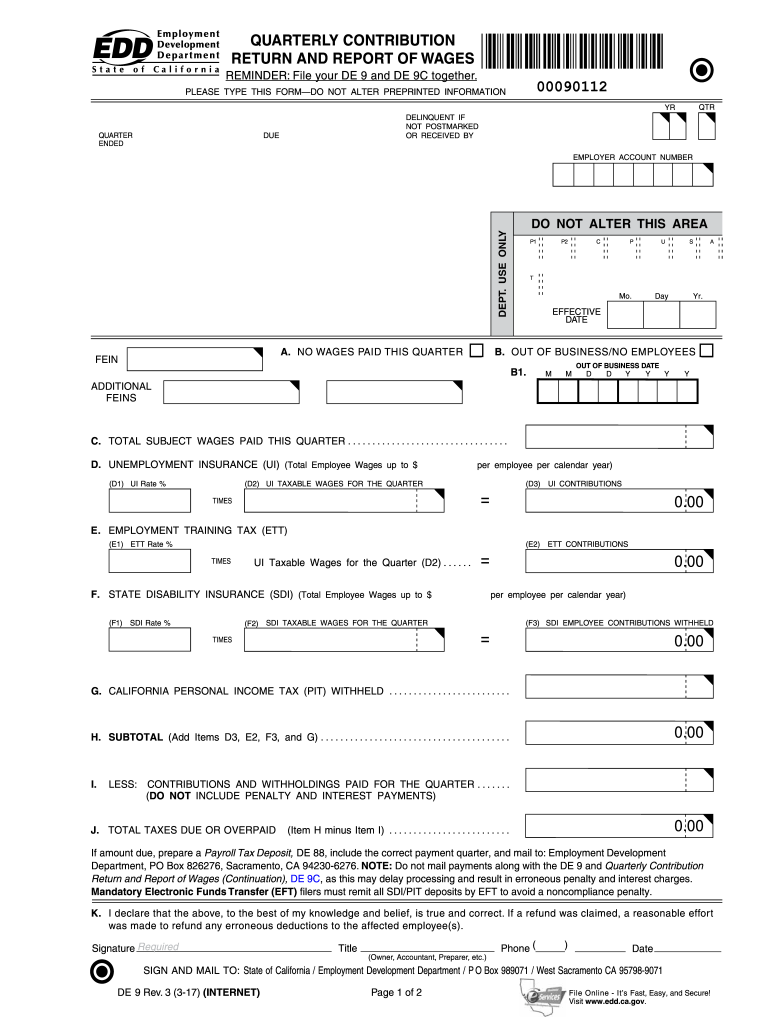

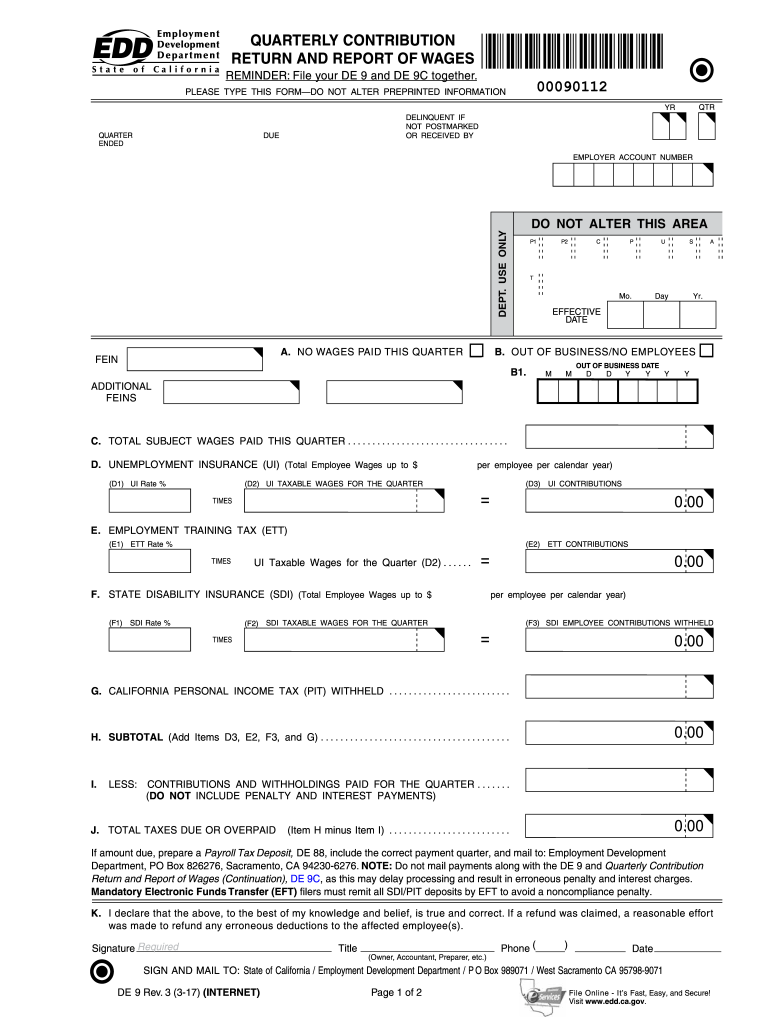

ITEM B1. Enter the OB/NE date where indicated and complete Line K. NOTE If you closed the business this quarter you must file the DE 9 and DE 9C within ten days of closing the business to avoid any penalties. O. Box 826276 Sacramento CA 94230-6276. NOTE Do not mail payments along with the DE 9 and Quarterly Contribution Return and Report of Wages Continuation DE 9C as this may delay processing and result in erroneous penalty and interest charges. NOTE Mailing payments with the DE 9 form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign de9 form

Edit your edd form de 9 trial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your you de9 2014-2025 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing you de9 2014-2025 form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit you de9 2014-2025 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DE 9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out you de9 2014-2025 form

How to fill out CA DE 9

01

Obtain the CA DE 9 form from the Employment Development Department (EDD) website or local office.

02

Fill in your business name, address, and federal employer identification number (FEIN) at the top of the form.

03

Provide the total wages paid to employees during the reporting period in the designated section.

04

Include the total California state income taxes withheld from employee wages.

05

List the number of employees in California for the reporting period.

06

Report any adjustments or corrections if applicable.

07

Sign and date the form as the employer or authorized representative.

08

Submit the form electronically or by mail by the specified deadline.

Who needs CA DE 9?

01

Employers in California who pay wages to employees.

02

Businesses required to report employee wages and withholdings to the California EDD.

03

Employers who have employees that are subject to California income tax withholding.

Video instructions and help with filling out and completing you de9 fillable

Instructions and Help about you de9 2014-2025 form

Fill

form

: Try Risk Free

People Also Ask about

What is DE9C vs DE9?

The EDD payroll tax returns are the (DE 9) and (DE 9C). Employers are required to file a Quarterly (DE 9) and the Quarterly (DE 9C) each quarter.

What is a de 9 form?

What is the DE 9 Form? The Quarterly Contribution Return and Report of Wages – or DE 9 Form – is a form required of all employers by the California Employment Development Department (EDD). ing to the EDD, the DE 9 Form reconciles reported wages and paid taxes for each quarter.

What is a de 9C form for payroll?

What is de 9c form? Form DE9C is the quarterly wage and withholding report for California employers. The form is used to report wage and payroll tax withholding information for California employers. In a way, it is the California equivalent of the Form 941 except the detailed withholding for each employee is reported.

What is a DE9 form?

The Quarterly Contribution Return and Report of Wages – or DE 9 Form – is a form required of all employers by the California Employment Development Department (EDD). ing to the EDD, the DE 9 Form reconciles reported wages and paid taxes for each quarter. Employers are required to file the DE 9 form each quarter.

Where do I find a DE9 form?

Where can i find my previously filed DE9 and DE9C tax liability Go to Taxes > Payroll Tax. In the Forms section. Select DE9 or DE9C from the second drop-down menu and click form name link to view the information. Click the View button and this will open the PDF on a new window. Select the Download or Print icon.

Is form 941 same as DE9C?

Form DE9C is the quarterly wage and withholding report for California employers. The form is used to report wage and payroll tax withholding information for California employers. In a way, it is the California equivalent of the Form 941 except the detailed withholding for each employee is reported.

What is DE9?

What is the DE 9 Form? The Quarterly Contribution Return and Report of Wages – or DE 9 Form – is a form required of all employers by the California Employment Development Department (EDD). ing to the EDD, the DE 9 Form reconciles reported wages and paid taxes for each quarter.

What is a de 9 and DE9C?

Quarterly Contribution Return and Report of Wages (DE 9) and (Continuation) (DE 9C) You must file both a Quarterly Contribution Return and Report of Wages (DE 9) and the Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) each quarter.

What does DE9 stand for?

What is the DE 9 Form? The Quarterly Contribution Return and Report of Wages – or DE 9 Form – is a form required of all employers by the California Employment Development Department (EDD). ing to the EDD, the DE 9 Form reconciles reported wages and paid taxes for each quarter.

What is de 9 for payroll?

DE 9. The DE 9 reconciles reported wages and paid taxes for each quarter. If your DE 9 shows an overpayment, we will send you a refund automatically. If a tax payment is due, you should submit your payment separately with a Payroll Tax Deposit (DE 88/DE 88ALL).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get you de9 2014-2025 form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific you de9 2014-2025 form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in you de9 2014-2025 form without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your you de9 2014-2025 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the you de9 2014-2025 form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign you de9 2014-2025 form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is CA DE 9?

CA DE 9 is the California Quarterly Contribution Return and Report of Wages, which is used by employers to report wages paid to employees and calculate unemployment insurance contributions.

Who is required to file CA DE 9?

Employers who pay wages in California and are subject to the state's unemployment insurance laws are required to file CA DE 9.

How to fill out CA DE 9?

To fill out CA DE 9, employers must provide information such as their business name, address, phone number, the quarter for which they are reporting, total wages paid, and the number of employees. They should follow the specific instructions provided by the California Employment Development Department (EDD).

What is the purpose of CA DE 9?

The purpose of CA DE 9 is to report employee wages and calculate the employer's contributions to California's unemployment insurance program, which funds unemployment benefits for eligible workers.

What information must be reported on CA DE 9?

Information that must be reported on CA DE 9 includes the employer's identification number, the total amount of wages paid during the quarter, the total number of employees, and any adjustments to previous reports.

Fill out your you de9 2014-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

You de9 2014-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.