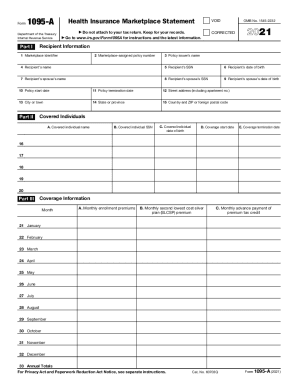

IRS 1095-A 2014 free printable template

Show details

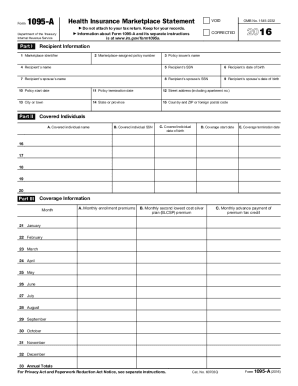

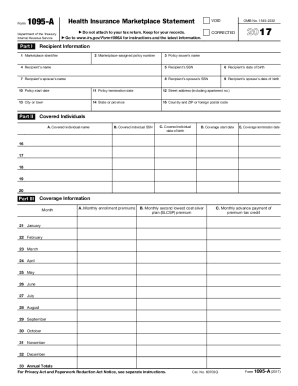

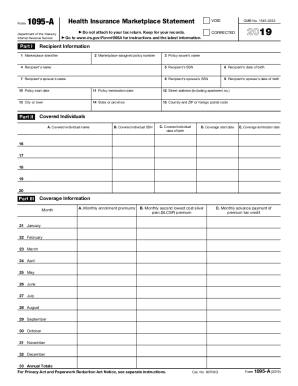

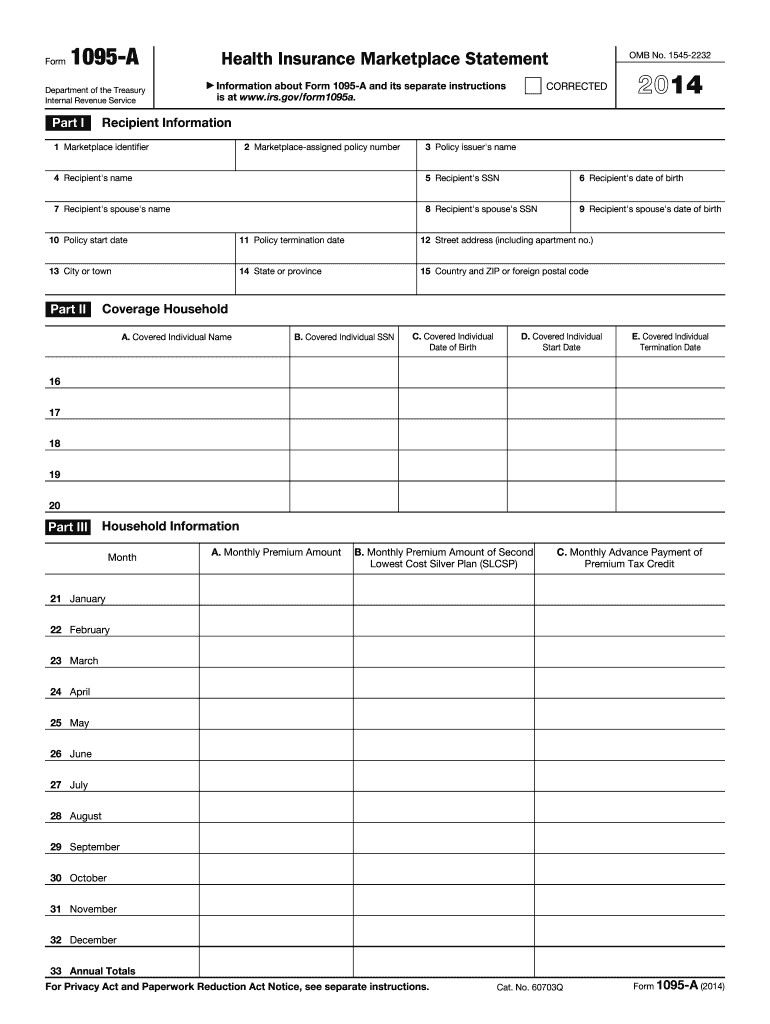

Cat. No. 60703Q Form 1095-A 2014 Page 2 Instructions for Recipient You received this Form 1095-A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace. Form 1095-A Department of the Treasury Internal Revenue Service Part I Health Insurance Marketplace Statement Information about Form 1095-A and its separate instructions is at www*irs*gov/form1095a* OMB No* 1545-2232 CORRECTED Recipient Information 1 Marketplace identifier 2...Marketplace-assigned policy number 3 Policy issuer s name 4 Recipient s name 5 Recipient s SSN 6 Recipient s date of birth 7 Recipient s spouse s name 10 Policy start date 11 Policy termination date 12 Street address including apartment no. 13 City or town 14 State or province 15 Country and ZIP or foreign postal code Coverage Household A. Covered Individual Name Date of Birth Start Date Termination Date Household Information Month A. Monthly Premium Amount Lowest Cost Silver Plan SLCSP C....Monthly Advance Payment of Premium Tax Credit 21 January 22 February 23 March 24 April 25 May 26 June 27 July 28 August 29 September 30 October 31 November 32 December 33 Annual Totals For Privacy Act and Paperwork Reduction Act Notice see separate instructions. This Form 1095-A provides information you need to complete Form 8962 Premium Tax Credit PTC. You must complete Form 8962 and file it with your tax return if you received premium assistance through advance credit payments whether or not...you otherwise are required to file a tax return or if you want to claim the premium tax credit when you file your return* The Marketplace has also reported the information on this form to the IRS* If you or your family members enrolled at the Marketplace in more than one qualified health plan policy you will receive a Form 1095-A for each policy. Check the information on this form carefully. Please contact your Marketplace if you have questions concerning its accuracy. Part I. Recipient...Information lines 1 15. Part I reports information about you the insurance company that issued your policy and the Marketplace where you enrolled in the coverage. Line 1. This line identifies the state where you enrolled in coverage through the Marketplace. are completing Part 4 of Form 8962 enter this number on line 30 31 32 or 33 box a* Line 3. This is the name of the insurance company that issued your policy. Line 4. You are the recipient because you are the person the tax return and who if...qualified would claim the premium tax credit for the year of coverage. Line 5. This is your social security number. For your protection this form may show only the last four digits. However the to the IRS* Line 6. A date of birth will be entered if there is no social security number on line 5. Lines 7 8 and 9. Information about your spouse will be entered only if advance credit payments were made for your coverage. The date of birth will be entered on line 9 only if line 8 is blank. Lines 10 and...11. These are the starting and ending dates of the policy.

pdfFiller is not affiliated with IRS

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I CAN EASILY FILL THE FORMS I NEED AND IT IS CHEAPER THAN OTHER PDF VENDORS.

It is sometimes challenging to fill out forms and have everything in place after printing. But overall - good.

See what our users say