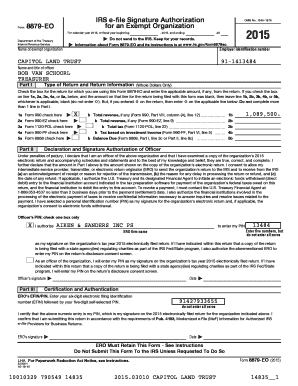

MI DoT 4891 2014 free printable template

Get, Create, Make and Sign 2014 form 4891

How to edit 2014 form 4891 online

Uncompromising security for your PDF editing and eSignature needs

MI DoT 4891 Form Versions

How to fill out 2014 form 4891

How to fill out MI DoT 4891

Who needs MI DoT 4891?

Instructions and Help about 2014 form 4891

Welcome to stave drawers this is the manual of procreate part 14 colors section 4 fill with color fill with color drop is procreates answer to the well-known Paint Bucket it's been fine-tuned to give amazing fills when you quickly need to block out color drop a great time-saver for graphic artists who often work with large blocks of flat color drop lets you quickly fill in shape and build your artwork engage color drop drag the color icon out onto the canvas and let go you see the color drop onto the canvas and fill out until it finds a boundary if your color drop leaks through a gap try closing the gap before filling again you could also tweak the color drop threshold which determines how aggressively the algorithm detects edges color drop threshold tweak the way color drop the text edges to get the best results adjust the threshold begin your color drop by dragging your color to your canvas without lifting your finger pulls over the desired file area color drop threshold will activate, and before you lift your finger slide left and right to adjust how aggressively it tacks edges lifting your finger will commit color drop and from then on color drop will remember the threshold setting until you change it again reference layer non-trans feature designed for cartoonists and concept artists that keeps color fills and inks separate preference layer works exclusively with collar drop to reference the active RAF layer indicated by a purple layer preview and fill to the normal selected layer swipe a layer with two fingers to activate it as a reference select another layer and color drop can fill into the selected layer based on the reference to turn reference they are off simply swipe it in the same way you did to activate it if you want to know more about procreate just visit my playlist and the playlist has all the topics about procreate

People Also Ask about

Who is subject to Michigan business tax?

What forms do I need to file Michigan taxes?

Who must file Michigan Form 4891?

What are filing requirements for Michigan?

What forms do I need to submit with my tax return?

Is there a Michigan S corporation tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2014 form 4891 for eSignature?

How do I make changes in 2014 form 4891?

How do I make edits in 2014 form 4891 without leaving Chrome?

What is MI DoT 4891?

Who is required to file MI DoT 4891?

How to fill out MI DoT 4891?

What is the purpose of MI DoT 4891?

What information must be reported on MI DoT 4891?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.