MI DoT 4891 2019 free printable template

Show details

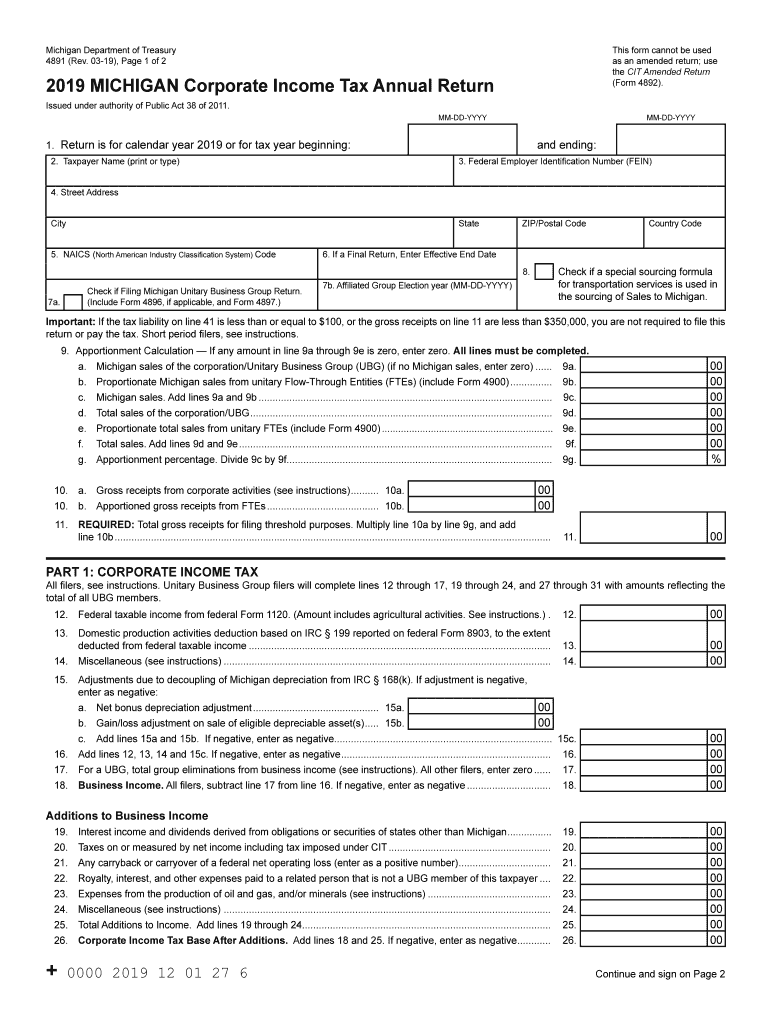

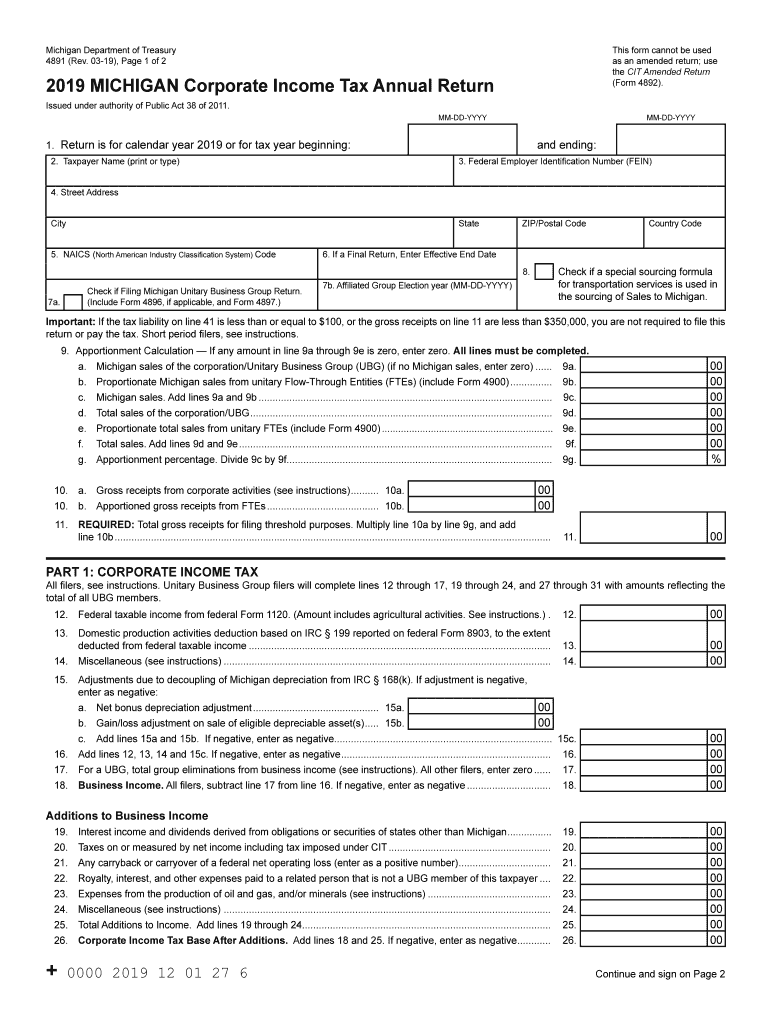

UBGs Complete Form 4897 and if necessary Form 4896 before beginning Form 4891. Answer lines 1 through 7 of Form 4891 as they apply to the DM. The amount in line 5 of this worksheet for each FTE must be added and the sum carried to Form 4891 line 10b. C. Multiply line A by line B. Carry amount from line C to Form 4891 line 51. Overdue Tax Interest worksheet. WORkShEET OVERDUE TAX PENALTY A. Tax due from Form 4891 line 49. B. Late/extension or insufficient payment penalty percentage. Do not...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT 4891

Edit your MI DoT 4891 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 4891 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI DoT 4891 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MI DoT 4891. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 4891 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 4891

How to fill out MI DoT 4891

01

Obtain MI DoT 4891 form from the Michigan Department of Transportation website or visit their office.

02

Fill in your personal information, including your full name, address, and contact information.

03

Provide details about the vehicle, such as the make, model, year, and Vehicle Identification Number (VIN).

04

Indicate the purpose of the form, whether it is for registration, title transfer, or another purpose.

05

Include any required documentation, such as proof of identity or previous vehicle titles, if applicable.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the local MI DoT office or process it online if available.

Who needs MI DoT 4891?

01

Individuals looking to register a vehicle in Michigan.

02

Those transferring the title of a vehicle.

03

Anyone needing to update vehicle information with the Michigan Department of Transportation.

Fill

form

: Try Risk Free

People Also Ask about

What does a tax return form?

A tax return is a form or forms filed with a tax authority that reports income, expenses, and other pertinent tax information. Tax returns allow taxpayers to calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes.

What is the 1040 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Are there 3 types of tax return forms?

There are three personal income tax forms — 1040, 1040A and 1040EZ — with each designed to get the appropriate amount of your money to the IRS.

What is 1040 vs 1099?

Form 1099: The Big Difference. The key difference between these forms is that Form 1040 calculates your tax or refund. It includes multiple details about your personal tax situation. Forms 1099 report only one source of income.

What is a 1040 vs W-2?

No, your W-2 and 1040 are different forms. A W-2 is the form that your employer will send to you with information on your income and tax rate, while a 1040 form is the form that you fill out and send to the IRS when filing your taxes.

How do you calculate your tax return?

Where to find income tax on 1040 IRS Form 1040: Subtract line 46 from line 56 and enter the total. IRS Form 1040A: Subtract line 36 from line 28 and enter the total. IRS Form 1040EZ: Use Line 10.

When can I expect my refund 2022?

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return.

What is a tax return and when is it due?

Individual income tax returns are typically due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15.

Do I need to mail my w2 with my tax return?

You don't need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return. Use Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-File Return to submit any paper documents that need to be sent after your return has been accepted electronically.

What forms do I need to mail in to the IRS with 1040?

n Attach a copy of Forms W-2, W-2G and 2439 to the front of Form 1040. Also attach Forms 1099-R if tax was withheld. n Use the coded envelope included with your tax package to mail your return.

What supporting documents do I need to mail in my tax return?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

What documents do I need to mail with my tax return?

These include: A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other tax-deductible expenses if you are itemizing your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MI DoT 4891 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your MI DoT 4891 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find MI DoT 4891?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific MI DoT 4891 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out the MI DoT 4891 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign MI DoT 4891 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is MI DoT 4891?

MI DoT 4891 is a form used in the state of Michigan for reporting certain transportation-related data or information.

Who is required to file MI DoT 4891?

Entities involved in transportation activities in Michigan, including transportation companies and individuals who meet specific criteria, are required to file MI DoT 4891.

How to fill out MI DoT 4891?

To fill out MI DoT 4891, gather the required information, follow the provided instructions on the form, and ensure all sections are completed accurately before submitting it to the appropriate authority.

What is the purpose of MI DoT 4891?

The purpose of MI DoT 4891 is to collect and report data necessary for transportation planning, regulatory compliance, and funding allocation in Michigan.

What information must be reported on MI DoT 4891?

The information that must be reported on MI DoT 4891 typically includes details about the transportation activities, vehicle information, and compliance data as specified in the form instructions.

Fill out your MI DoT 4891 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 4891 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.