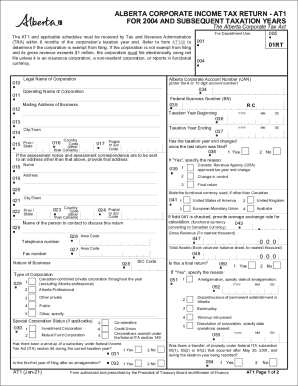

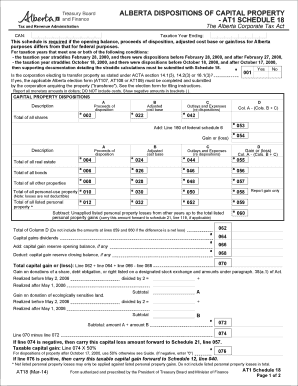

Canada AT1 2014 free printable template

Show details

If the corporation has no taxable income to report both federally and for Alberta purposes please refer to form AT100 to determine if the corporation is exempt from filing. Otherwise the AT1 and applicable schedules must be received by Tax and Revenue Administration TRA within 6 months of the corporation s taxation year end. ALBERTA CORPORATE INCOME TAX RETURN - AT1 FOR 1998 AND SUBSEQUENT TAXATION YEARS The Alberta Corporate Tax Act Tax and Revenue Administration For corporations with...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada AT1

Edit your Canada AT1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada AT1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada AT1 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada AT1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada AT1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada AT1

How to fill out Canada AT1

01

Obtain the Canada AT1 form from the Canada Revenue Agency website or local office.

02

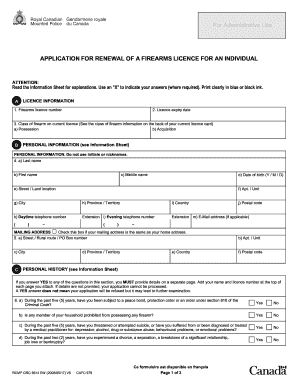

Fill in your personal information, including your name, address, and contact details.

03

Provide your business number if applicable.

04

Enter the reporting period for which you are filing the AT1.

05

Complete the income and expense sections, detailing all relevant financial information.

06

Calculate and enter the taxes owed or refund amount, if applicable.

07

Sign and date the form to certify the accuracy of the information provided.

08

Submit the completed form either online or by mail to the designated authority.

Who needs Canada AT1?

01

Individuals or businesses who are required to report income for tax purposes in Canada.

02

Self-employed individuals seeking to declare their income and expenses.

03

Corporations needing to file their annual tax returns.

04

Partnerships that must report partnership income and allocate it among partners.

Fill

form

: Try Risk Free

People Also Ask about

How much does an annual return cost in Alberta?

Alberta cooperative There is no fee to file the annual return.

How much is the corporate annual return fee in Alberta?

The role of the registry agent does not include providing legal advice, that is the role of a lawyer licensed to practice law in Alberta. Your annual return is due each year on the same month your company was incorporated. The cost is $90.00 per year.

How much is the corporate search fee in Alberta?

$16/20 - Online Alberta Corporate Registry Searches.

What does it mean when a company is struck in Alberta?

After three years, the province strikes your corporation from the corporate registry. Alternatively, another term used for this is that the dissolving of the corporation. This means that your company ceases to exist. It is no longer a legal entity in Alberta.

What is the annual return of a company?

Annual return is a yearly statement, required to be filed by every company irrespective of their nature or status, which highlights the information about company's various aspects pertaining to its composition, activities, and financial position.

Can I file Alberta corporate annual return online?

If there are no changes to be made to the recorded directors, shareholders, or associated addresses you may file your return online. Upon receipt of payment by our online processing department an authorized agent will process your return and email your proof of filing to you within one business day.

Who is considered an eligible dependent in Canada?

your parent or grandparent. your child, grandchild, brother, or sister under 18 years of age. your child, grandchild, brother, or sister 18 years of age or older with an impairment in physical or mental functions.

How do I file a Canadian income tax return?

Ways to do your taxes NETFILE-certified tax software (electronic filing) Through a tax preparer using EFILE-certified tax software (electronic filing) Community volunteer tax clinic. Paper tax return. File my Return - Automated phone line (by invitation only)

What qualifies someone as a dependent?

Who are dependents? Dependents are either a qualifying child or a qualifying relative of the taxpayer. The taxpayer's spouse cannot be claimed as a dependent. Some examples of dependents include a child, stepchild, brother, sister, or parent.

Who is an eligible dependent in Alberta?

Each dependant must be one of the following: your (or your spouse's or common-law partner's) child or grandchild. your (or your spouse's or common-law partner's) brother, sister, niece, nephew, aunt, uncle, parent, or grandparent who was a resident in Canada.

How do I pay my taxes in Alberta?

For COVID-19 updates, visit COVID-19 info for Albertans. Overview. Electronic payment. Credit card. Interac e-transfer. Cash or debit. PayPal. Cheque or money order. Wire transfer.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada AT1 to be eSigned by others?

To distribute your Canada AT1, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in Canada AT1?

The editing procedure is simple with pdfFiller. Open your Canada AT1 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete Canada AT1 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your Canada AT1, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is Canada AT1?

Canada AT1 is a tax form used by non-residents to report income earned in Canada and to determine the amount of tax that must be withheld.

Who is required to file Canada AT1?

Non-resident individuals or entities earning income from sources in Canada, such as interest, dividends, or royalties, are required to file Canada AT1.

How to fill out Canada AT1?

To fill out Canada AT1, gather all necessary income information, complete the required fields on the form including identification details and income sources, and submit it to the Canada Revenue Agency (CRA).

What is the purpose of Canada AT1?

The purpose of Canada AT1 is to enable the Canada Revenue Agency to assess and collect tax on income earned in Canada by non-residents.

What information must be reported on Canada AT1?

Canada AT1 must report information including the recipient's identification, the type of income earned, the amounts earned, and any applicable exemptions or withholding tax rates.

Fill out your Canada AT1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada at1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.