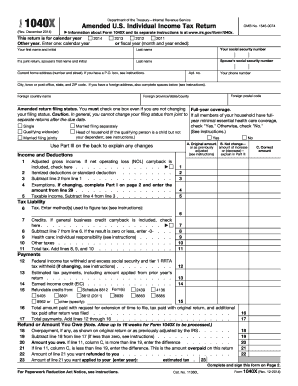

IRS Instructions 1040X 2014 free printable template

FAQ about IRS Instructions 1040X

What should I do if my IRS Instructions 1040X is rejected?

If your IRS Instructions 1040X gets rejected, you should carefully review the rejection notice to understand the reason. Common issues include discrepancies in personal information or math errors. After addressing the problem, correct the errors and resubmit your amended return.

How can I check the status of my IRS Instructions 1040X?

You can check the status of your IRS Instructions 1040X by visiting the 'Where's My Amended Return?' tool on the IRS website. Be sure to have your personal details, including your Social Security number, date of birth, and ZIP code handy for verification.

What should I know about privacy and data security when filing IRS Instructions 1040X?

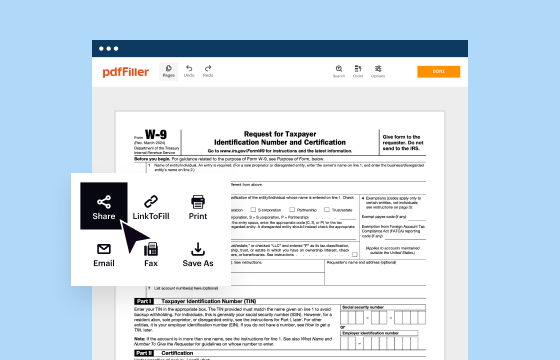

When filing IRS Instructions 1040X, it is crucial to ensure your data security. Use secure internet connections and reputable tax software that complies with data protection regulations. Additionally, avoid sharing sensitive information through unsecured channels.

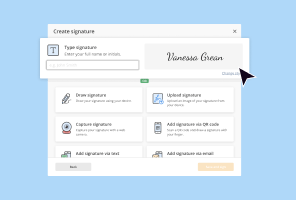

Can I e-file my IRS Instructions 1040X, and what are the requirements?

Yes, e-filing for IRS Instructions 1040X is permitted. Ensure you use approved tax software that supports amended returns and meets IRS guidelines. You must also have access to a valid email address to receive confirmation from the IRS.