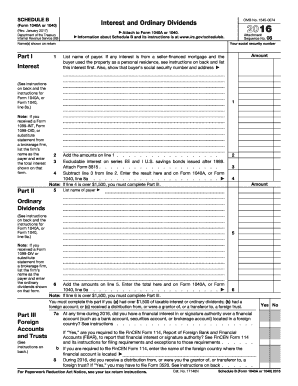

IRS 1040 - Schedule B 2015 free printable template

FAQ about IRS 1040 - Schedule B

What should I do if I realize I made a mistake on my IRS 1040 - Schedule B after filing?

If you discover an error on your IRS 1040 - Schedule B after submission, you should file an amended return using Form 1040-X. Ensure to correct the mistake specifically in the Schedule B section and clearly indicate the changes. It’s a good idea to keep records of all documentation related to the amendment for your records.

How can I verify the status of my IRS 1040 - Schedule B after e-filing?

To check the status of your submitted IRS 1040 - Schedule B, you can use the IRS 'Where's My Refund?' tool available on their website. This tool can provide updates on processing status after a submission, including any potential issues that may lead to rejection.

What common errors should I be aware of when submitting IRS 1040 - Schedule B?

When submitting your IRS 1040 - Schedule B, be mindful of common errors such as misreporting income or failing to include required information about foreign accounts. Double-check that all amounts are accurate and that you’ve correctly indicated any that apply to your reporting requirements.

How long should I retain records related to my IRS 1040 - Schedule B?

For the IRS 1040 - Schedule B, it’s recommended to retain your tax records for at least three years after the date of filing. This includes keeping copies of your Schedule B, any supporting documents, and your amended forms in case the IRS requires them during an audit.

What actions should I take if I receive a notice from the IRS regarding my Schedule B?

If you receive a notice from the IRS concerning your IRS 1040 - Schedule B, carefully review the notice for specific issues. Depending on the type of notice, you may need to provide additional information or clarification. Always respond promptly and keep copies of your correspondence for your records.

See what our users say