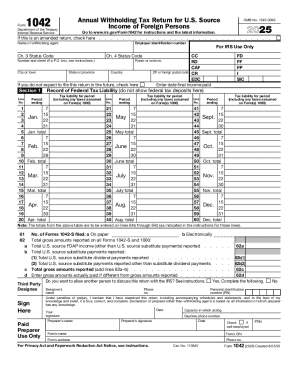

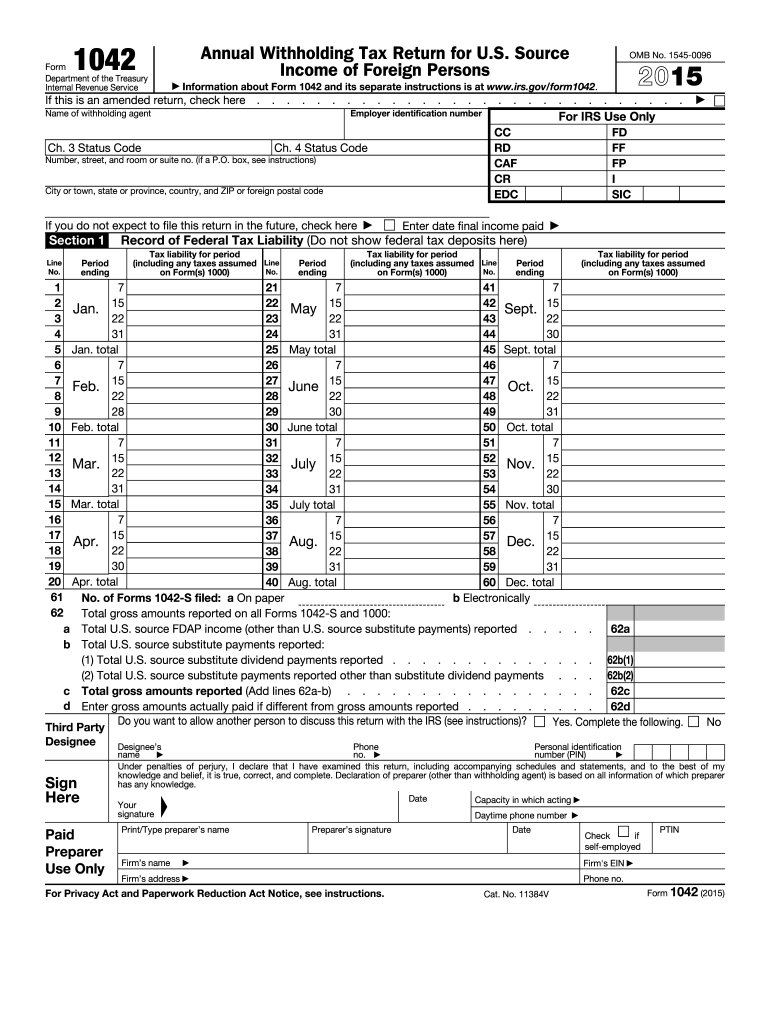

IRS 1042 2015 free printable template

Instructions and Help about IRS 1042

How to edit IRS 1042

How to fill out IRS 1042

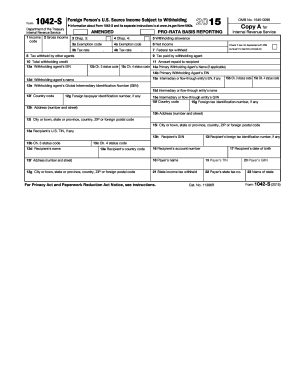

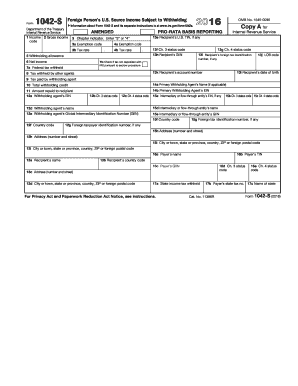

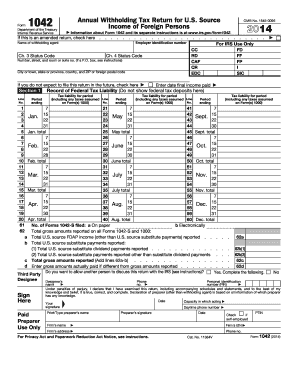

About IRS previous version

What is IRS 1042?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1042

How can I correct mistakes on my 2015 form 1042?

To rectify errors on your 2015 form 1042, you must file an amended return. This involves submitting a new form indicating the corrections and checking the box that indicates it's an amended return. Ensure you provide an explanation for the changes made to avoid delays in processing.

How can I verify the status of my 2015 form 1042 submission?

You can track the status of your 2015 form 1042 by contacting the IRS directly or using their online status check tools. Keep your submission confirmation number handy, as this will facilitate the status inquiry, especially if you filed electronically.

What should I do if my e-filing of the 2015 form 1042 gets rejected?

If your e-filing of the 2015 form 1042 is rejected, carefully review the rejection notice to identify the issue. Common causes include incorrect taxpayer identification numbers and formatting errors. Correct the noted issues and resubmit your form as soon as possible to avoid penalties.

What privacy measures should I consider when submitting the 2015 form 1042 electronically?

When e-filing the 2015 form 1042, ensure you're using a secure internet connection and reputable software compliant with IRS standards. Additionally, store your submission records securely and avoid sharing sensitive personal information unnecessarily to protect your data privacy.