IRS 944 2015 free printable template

Show details

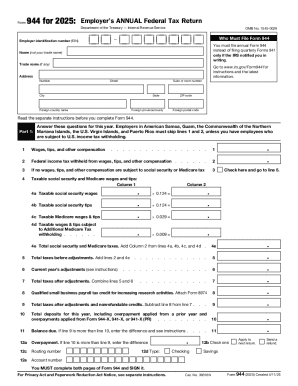

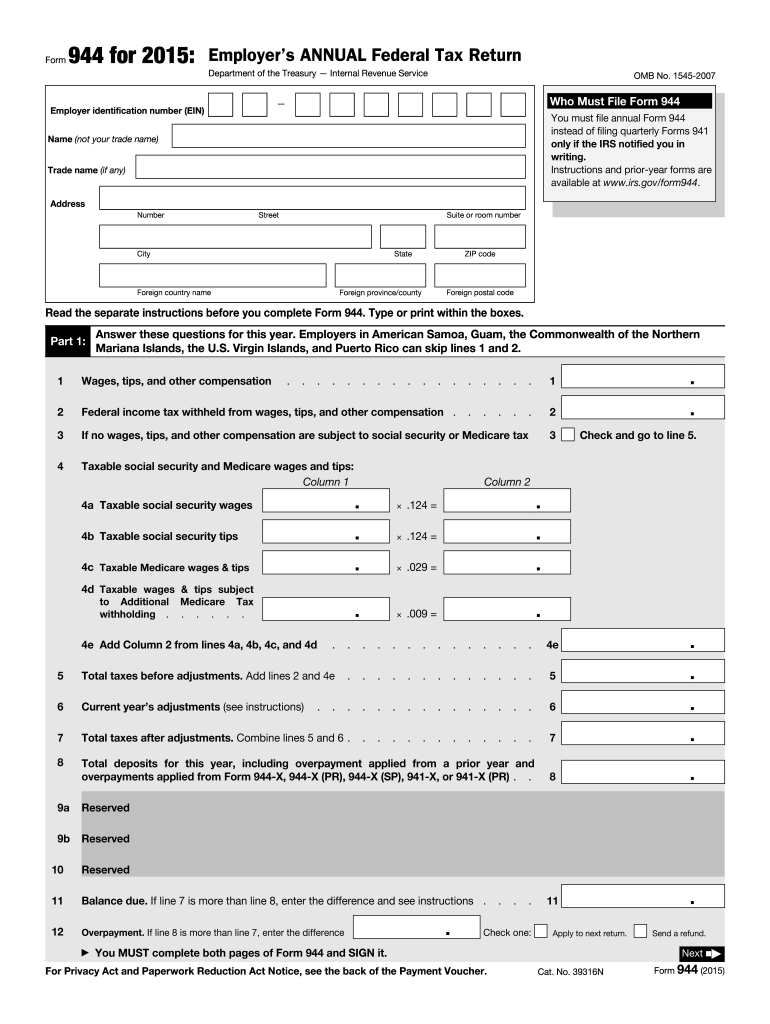

Form 944 for 2015 Employer s ANNUAL Federal Tax Return Department of the Treasury Internal Revenue Service OMB No. 1545-2007 Who Must File Form 944 Employer identification number EIN You must file annual Form 944 instead of filing quarterly Forms 941 only if the IRS notified you in writing. Next Cat. No. 39316N Form 944 2015 Part 2 Tell us about your deposit schedule and tax liability for this year. Enclose your check or money order made payable to United States Treasury and write your EIN ...Form 944 and 2015 on your check or money order. Your net taxes for the year Form 944 line 7 are less than 2 500 and you are paying in full with a timely filed return. You already deposited the taxes you owed for the first second and third quarters of 2015 and the tax you owe for the fourth quarter of 2015 is less than 2 500 and you are paying in full the tax you owe for the fourth quarter of 2015 with a timely filed return. net taxes for the fourth quarter are less than 2 500 and you didn t...incur a 100 000 next-day deposit obligation during the fourth quarter. See Deposit Penalties in section 11 of Pub. 15. Making Payments With Form 944 Specific Instructions To avoid a penalty make your payment with your 2015 Form 944 only if one of the following applies. Instructions and prior-year forms are available at www*irs*gov/form944. Name not your trade name Trade name if any Address Number Street Suite or room number City ZIP code State Foreign country name Foreign postal code Foreign...province/county Read the separate instructions before you complete Form 944. Type or print within the boxes. Part 1 Answer these questions for this year. Employers in American Samoa Guam the Commonwealth of the Northern Mariana Islands the U*S* Virgin Islands and Puerto Rico can skip lines 1 and 2. Wages tips and other compensation. Federal income tax withheld from wages tips and other compensation. If no wages tips and other compensation are subject to social security or Medicare tax Check and...go to line 5. Taxable social security and Medicare wages and tips Column 1 4c Taxable Medicare wages tips 4d Taxable wages tips subject to Additional withholding. Medicare Tax. 4e Total taxes before adjustments. Add lines 2 and 4e Current year s adjustments see instructions Total taxes after adjustments. Combine lines 5 and 6. Total deposits for this year including overpayment applied from a prior year and overpayments applied from Form 944-X 944-X PR 944-X SP 941-X or 941-X PR. 4e Add Column 2...from lines 4a 4b 4c and 4d 9a Reserved 9b Balance due. If line 7 is more than line 8 enter the difference and see instructions. Overpayment. If line 8 is more than line 7 enter the difference Check one Apply to next return* You MUST complete both pages of Form 944 and SIGN it. For Privacy Act and Paperwork Reduction Act Notice see the back of the Payment Voucher. Send a refund. Line 7 is less than 2 500. Go to Part 3. Line 7 is 2 500 or more. Enter your tax liability for each month. If you are a...semiweekly depositor or you accumulate 100 000 or more of liability on any day during a deposit period you must complete Form 945-A instead of the boxes below.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 944

How to edit IRS 944

How to fill out IRS 944

Instructions and Help about IRS 944

How to edit IRS 944

To edit IRS 944, ensure you have the most recent version of the form available from the IRS website. You can use pdfFiller for making edits to the form. Simply upload your PDF, make the necessary changes, and save the updated file for your records.

How to fill out IRS 944

Filling out IRS 944 requires accurate reporting of wages and taxes. Follow these steps:

01

Obtain a copy of IRS 944 from the IRS website or a trusted source.

02

Provide your business name, EIN, and address in the designated fields.

03

Report total wages paid, taxes withheld, and any applicable credits.

Ensure that all information is accurate to avoid penalties. Review your entries for consistency before submission.

About IRS previous version

What is IRS 944?

IRS 944 is the Employer’s Annual Federal Tax Return form used by eligible small employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Businesses using this form may report their tax liability on an annual basis rather than quarterly.

Who needs the form?

Eligible employers must file IRS 944 if they have a relatively small payroll and expect their annual employment tax liability to be below a certain threshold. Generally, businesses with $1,000 or less in aggregate payroll taxes for the year qualify to use this form instead of the quarterly filing requirements of IRS 941.

Components of the form

IRS 944 consists of several key components, including sections for your business information, total payments made, taxes withheld, and any credits or adjustments. A thorough understanding of these components ensures accurate reporting and compliance with tax laws.

What are the penalties for not issuing the form?

The penalties for failing to file IRS 944 by the due date can add up quickly. Businesses may incur fines based on the tax amount owed, as well as additional penalties for filing late. It is crucial to file accurately and on time to avoid these financial repercussions.

Is the form accompanied by other forms?

IRS 944 is typically filed independently; however, you may need to include various forms depending on your business's specific circumstances, such as forms related to employee benefits or adjustments. Be sure to check if any additional forms are required to support your 944 submission.

What is the purpose of this form?

The purpose of IRS 944 is to simplify tax reporting for small businesses that expect to owe less than $1,000 in payroll taxes for the calendar year. This form consolidates reporting into one annual submission, reducing the administrative burden on small employers.

When am I exempt from filling out this form?

You may be exempt from filing IRS 944 if your business does not pay wages subject to federal taxes or if you expect your annual payroll tax liability to exceed the thresholds set by the IRS. Additionally, if you have closed your business or ceased hiring eligible employees, you are not required to file.

Due date

The due date for filing IRS 944 is January 31 of the year following the tax year being reported. If January 31 falls on a weekend or legal holiday, the due date is extended to the next business day. Make sure to submit your form by this deadline to avoid penalties.

What information do you need when you file the form?

When filing IRS 944, you will need your Employer Identification Number (EIN), business name, total wages paid, and the respective taxes withheld. Additionally, gather any relevant records regarding tax credits that may apply to your business. This documentation helps facilitate accurate completion of the form.

Where do I send the form?

The address for submitting IRS 944 depends on your location. Generally, forms can be mailed to the appropriate IRS processing center as indicated in the form instructions. It is essential to verify the correct mailing address to ensure timely processing of your return.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

App is to use for my duty!

App is to use for my duty!

Thanks a lot!

Very fast and excellent support

Very fast and excellent support

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.