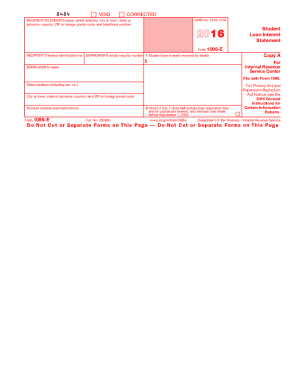

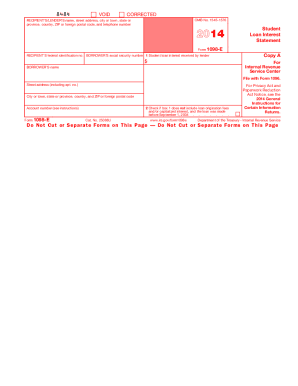

IRS 1098-E 2015 free printable template

Instructions and Help about IRS 1098-E

How to edit IRS 1098-E

How to fill out IRS 1098-E

About IRS 1098-E 2015 previous version

What is IRS 1098-E?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

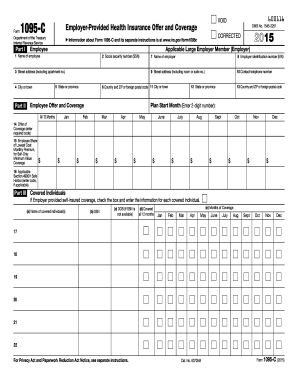

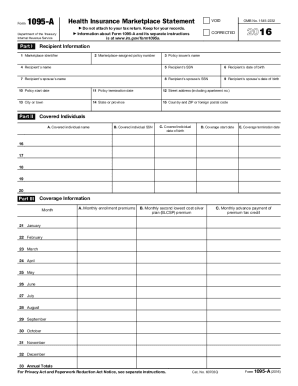

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1098-E

What should I do if I realize I made a mistake on my 2015 IRS student form after submitting it?

If you discover an error after filing your 2015 IRS student form, you can submit an amended return using the correct form. Depending on the nature of the mistake, this might involve either filing Form 1040X or correcting specifically related areas on the originally submitted form. It’s important to file this amendment as soon as possible to avoid potential penalties.

How can I verify that my 2015 IRS student form has been accepted or processed?

To check the status of your 2015 IRS student form, you can utilize the IRS 'Where’s My Refund?' tool online, or contact the IRS directly for updates. Be prepared to provide your details for verification purposes. Tracking your submission helps ensure your form was successfully processed.

Are e-signatures accepted for the 2015 IRS student form, and what should I know about privacy when submitting electronically?

Yes, e-signatures are accepted for the 2015 IRS student form. However, ensure you're using IRS-approved software that complies with e-filing regulations to protect your data. Always prioritize privacy and data security by using secure internet connections and keeping your personal information confidential.

What common errors should I avoid when submitting my 2015 IRS student form?

When submitting your 2015 IRS student form, pay attention to common issues like incorrect Social Security numbers, inconsistencies with income figures, and missing signatures. Double-check all entries and review the form for accuracy to prevent delays or rejections.

What actions should I take if I receive an audit notice regarding my 2015 IRS student form?

If you receive an audit notice related to your 2015 IRS student form, first read the notice carefully to understand what information the IRS requests. Gather the necessary documentation and prepare a clear response. It may also be wise to consult a tax professional to assist you in addressing the audit effectively.