IRS 1042-S 2016 free printable template

Show details

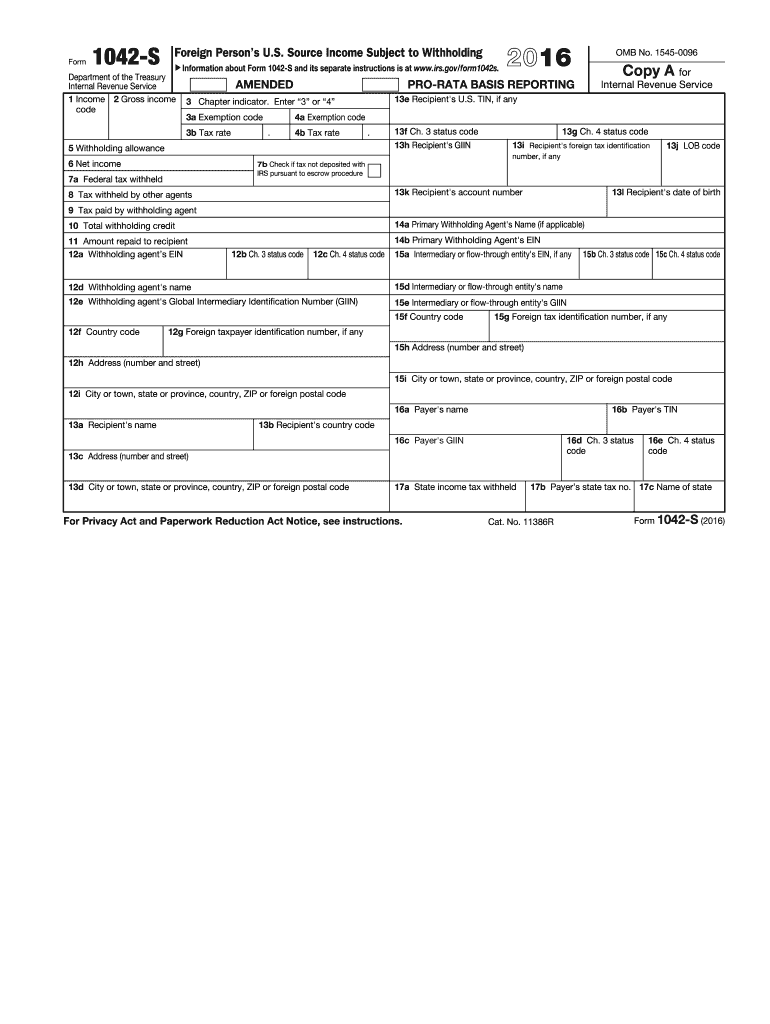

17b Payer s state tax no. 17c Name of state Cat. No. 11386R Form 1042-S 2016 Copy B for Recipient keep for your records U.S. Income Tax Filing Requirements Generally every nonresident alien individual nonresident alien fiduciary and foreign corporation with United States income including income that is effectively connected with the conduct of a trade or business in the United States must file a United States income tax return. However no return is required to be filed by a nonresident alien...individual nonresident alien fiduciary or foreign corporation if such person was not engaged in a trade or business in the United States at any time during the tax year and if the tax liability of such person was fully satisfied by the withholding of United States tax at the source. Form 1042-S Foreign Person s U*S* Source Income Subject to Withholding Information Department of the Treasury Internal Revenue Service 1 Income 2 Gross income code about Form 1042-S and its separate instructions is...at www*irs*gov/form1042s. AMENDED 3b Tax rate 4a Exemption code. 13f Ch* 3 status code 13h Recipient s GIIN 13i Recipient s foreign tax identification 13k Recipient s account number 8 Tax withheld by other agents 13j LOB code number if any 7b Check if tax not deposited with IRS pursuant to escrow procedure 7a Federal tax withheld Copy A for 13e Recipient s U*S* TIN if any 5 Withholding allowance 6 Net income OMB No* 1545-0096 PRO-RATA BASIS REPORTING 3 Chapter indicator. Enter 3 or 4 9 Tax paid...by withholding agent 14a Primary Withholding Agent s Name if applicable 10 Total withholding credit 11 Amount repaid to recipient 12a Withholding agent s EIN 12c Ch* 4 status code 15a Intermediary or flow-through entity s EIN if any 15f Country code 15g Foreign tax identification number if any 12g Foreign taxpayer identification number if any 15h Address number and street 15i City or town state or province country ZIP or foreign postal code 16a Payer s name 16b Payer s TIN 16c Payer s GIIN 16d...Ch* 3 status 17a State income tax withheld For Privacy Act and Paperwork Reduction Act Notice see instructions. Corporations file Form 1120-F all others file Form 1040NR or Form 1040NR-EZ if eligible. You may get the return forms and instructions at any United States Embassy or consulate or by writing Bloomington IL 61705-6613. En r gle g n rale tout tranger non-r sident tout organisme fid icommissaire tranger non-r sident et toute soci t trang re percevant un revenu aux Etats-Unis y compris...tout revenu d riv en fait du fonctionnement d un commerce ou d une affaire aux EtatsUnis doit produire une d claration d imp t sur le revenu aupr s des services fiscaux des Etats-Unis. Cependant aucune d claration d imp t sur le revenu n est exig e d un tranger non-r sident d un organisme fid icommissaire tranger non-r sident ou d une soci t trang re s ils n ont pris part aucun commerce ou affaire aux EtatsUnis aucun moment pendant l ann e fiscale et si les imp ts dont ils sont redevables ont t...enti rement acquitt s par une retenue la source sur leur salaire.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1042-S

How to edit IRS 1042-S

How to fill out IRS 1042-S

Instructions and Help about IRS 1042-S

How to edit IRS 1042-S

To edit an IRS 1042-S form, you can utilize various tools that facilitate form alterations. First, obtain a blank version of the IRS 1042-S. Then, make necessary adjustments using a PDF editor like pdfFiller, which provides features for adding text, modifying fields, and updating information accurately. Ensure that all changes reflect the correct information required by the IRS guidelines.

How to fill out IRS 1042-S

Filling out the IRS 1042-S involves a systematic approach to ensure compliance with tax reporting requirements. Start by providing the name and address of the entity making the payment, followed by details regarding the recipient. Include specific information about the type of income being reported. Use the IRS instructions as a guide to complete each section accurately.

About IRS 1042-S 2016 previous version

What is IRS 1042-S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1042-S 2016 previous version

What is IRS 1042-S?

IRS 1042-S is a tax form used to report income paid to non-resident aliens and foreign entities in the United States. It is primarily utilized by withholding agents to detail various types of income such as interest, dividends, and royalties that are subject to U.S. tax withholding. This form is crucial for both the payers and recipients to ensure proper tax handling and compliance with U.S. tax laws.

What is the purpose of this form?

The purpose of IRS 1042-S is to report certain income types paid to non-resident aliens and foreign entities. It serves as a formal record for the IRS to track income that may be subject to withholding taxes. By completing this form, withholding agents fulfill their obligation to report income and ensure appropriate taxes are withheld, which helps prevent tax evasion and maintains regulatory compliance.

Who needs the form?

Withholding agents, including businesses and institutions that make payments to non-resident aliens, need to file IRS 1042-S. This includes entities that are making payments of U.S.-sourced income like rents, royalties, and dividends. Additionally, individuals who receive such income may also receive this form for their tax records.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1042-S if the payments you made do not fall under the categories subject to U.S. withholding tax. For example, if the income is not from U.S. sources or if the recipient is a U.S. citizen or resident alien, the filing of this form is unnecessary. It's essential to refer to IRS guidelines to determine eligibility for exemptions accurately.

Components of the form

IRS 1042-S consists of several components that include the payer's information, recipient's details, type of income, and the amount that has been withheld. Specifically, the form contains sections that categorize the type of payment and the income code used for tax reporting. Correctly completing all components is critical to ensure compliance and avoid potential penalties.

What are the penalties for not issuing the form?

Failing to issue IRS 1042-S can result in significant penalties for the withholding agent. The IRS may impose fines based on the amount of tax required to be reported. Additionally, there may be consequences including interest on unpaid taxes, lack of recourse for the recipient in claiming tax credits, and potential audits if the tax reporting is found to be non-compliant.

What information do you need when you file the form?

When filing IRS 1042-S, you need specific information including the payer's name, address, and taxpayer identification number, as well as the recipient's details such as their foreign address and tax identification number. It is also necessary to gather details about the type of payments made and the amount withheld for tax purposes. Collecting all this data beforehand simplifies the filing process.

Is the form accompanied by other forms?

IRS 1042-S is typically accompanied by Form 1042 when filing with the IRS. Form 1042 summarizes the total tax withheld and is used to report the overall payments made to foreign persons. Ensure both forms are correctly filled out and submitted together to maintain compliance with IRS filing requirements.

Where do I send the form?

IRS 1042-S should be sent to the address specified in the IRS instructions for the form. Generally, this will be the address for filing forms with the Internal Revenue Service, but specific mailing addresses can vary based on whether the form is filed electronically or by paper. Always verify the correct submission address on the IRS website or in the form instructions to avoid delays.

See what our users say