IRS 1042-S 2024 free printable template

Instructions and Help about IRS 1042-S

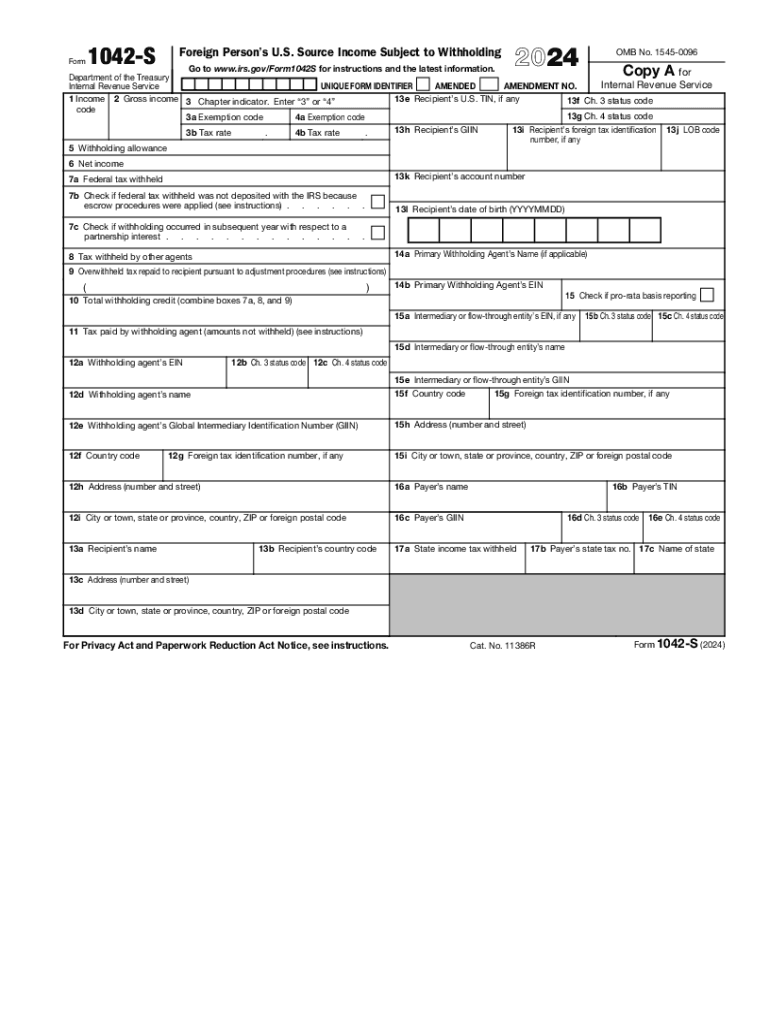

How to edit IRS 1042-S

How to fill out IRS 1042-S

About IRS 1042-S 2024 previous version

What is IRS 1042-S?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1042-S

What should I do if I notice an error on my filed IRS 1042-S?

If you discover a mistake on your filed IRS 1042-S, you should file a corrected form as soon as possible. The correction can be submitted electronically or on paper, ensuring you indicate it's an amended return. Make sure to keep copies of both the originally filed and corrected forms for your records.

How can I verify if my IRS 1042-S has been received by the IRS?

To verify the receipt of your IRS 1042-S, you can check the tracking status if you filed electronically or contact the IRS directly. Using IRS e-file, you'll typically receive an acknowledgment of receipt, which serves as confirmation.

What are common errors people make when filing the IRS 1042-S?

Common errors when filing the IRS 1042-S include incorrect taxpayer identification numbers, providing inaccurate payment amounts, and failing to include all required information. It's crucial to double-check your entries and ensure compliance with IRS guidelines to avoid complications.

If my IRS 1042-S is rejected during e-filing, what should I do?

If your IRS 1042-S is rejected during e-filing, review the rejection codes provided in the e-filing system to identify the issue. Correct the problems indicated and resubmit your form promptly to prevent delays in processing your tax information.

What should I know about submitting IRS 1042-S for a foreign payee?

When submitting IRS 1042-S for a foreign payee, it's essential to ensure accurate reporting of income and tax withholding as per U.S. tax regulations. Different countries may have tax treaties that affect withholding rates, so verify any applicable treaty benefits to ensure compliance with reporting requirements.