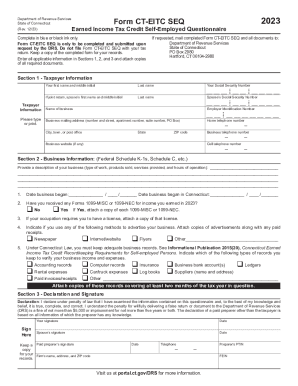

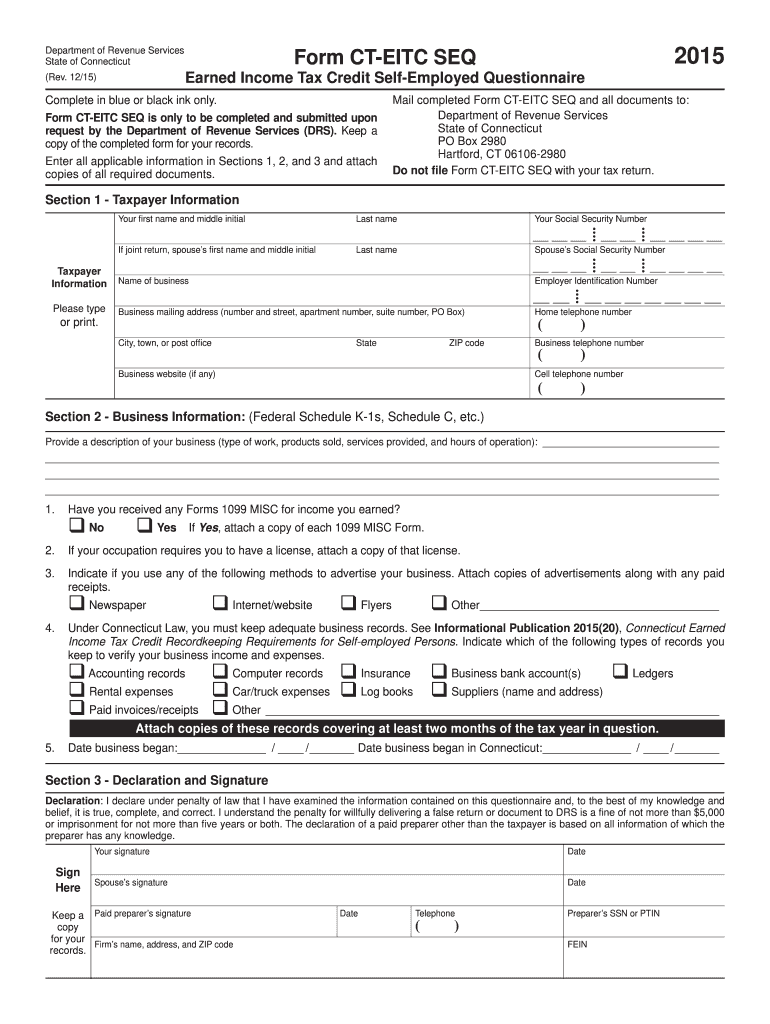

CT DRS CT-EITC SEQ 2015 free printable template

Instructions and Help about CT DRS CT-EITC SEQ

How to edit CT DRS CT-EITC SEQ

How to fill out CT DRS CT-EITC SEQ

About CT DRS CT-EITC SEQ 2015 previous version

What is CT DRS CT-EITC SEQ?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

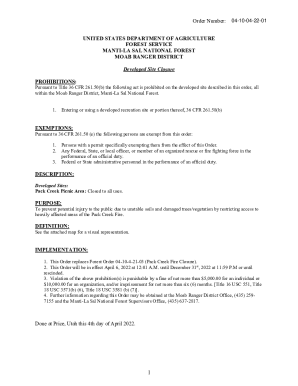

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

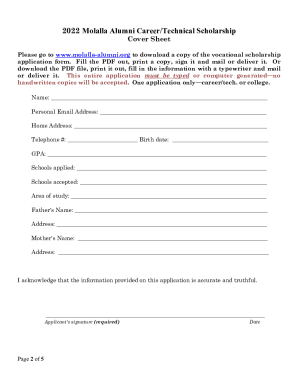

What information do you need when you file the form?

Where do I send the form?

FAQ about CT DRS CT-EITC SEQ

How can I correct a mistake on my filed CT DRS CT-EITC SEQ?

To amend a submitted CT DRS CT-EITC SEQ, you must complete a corrected version of the form, clearly marking it as 'Corrected'. Ensure that you follow any specific instructions provided by the Connecticut Department of Revenue Services for corrections.

How can I check the status of my CT DRS CT-EITC SEQ submission?

To verify the receipt and processing of your CT DRS CT-EITC SEQ, visit the Connecticut DRS website where you can find tools to check your submission's status. Keep your identification details handy for a seamless process.

What should I do if my CT DRS CT-EITC SEQ submission is rejected?

If your CT DRS CT-EITC SEQ is rejected, review the error codes provided upon rejection. Address the indicated issues and resubmit your form as soon as possible to ensure compliance and avoid penalties.

Are e-signatures accepted for the CT DRS CT-EITC SEQ?

Yes, electronic signatures are permitted on CT DRS CT-EITC SEQ forms, provided they meet the state's requirements. Ensure your electronic signature complies with the guidelines to avoid processing issues.

What should I do if I receive a notice regarding my CT DRS CT-EITC SEQ?

Upon receiving a notice about your CT DRS CT-EITC SEQ, review the details carefully, gather relevant documentation, and respond within the specified timeframe. If clarification is needed, contact the Connecticut Department of Revenue Services directly.