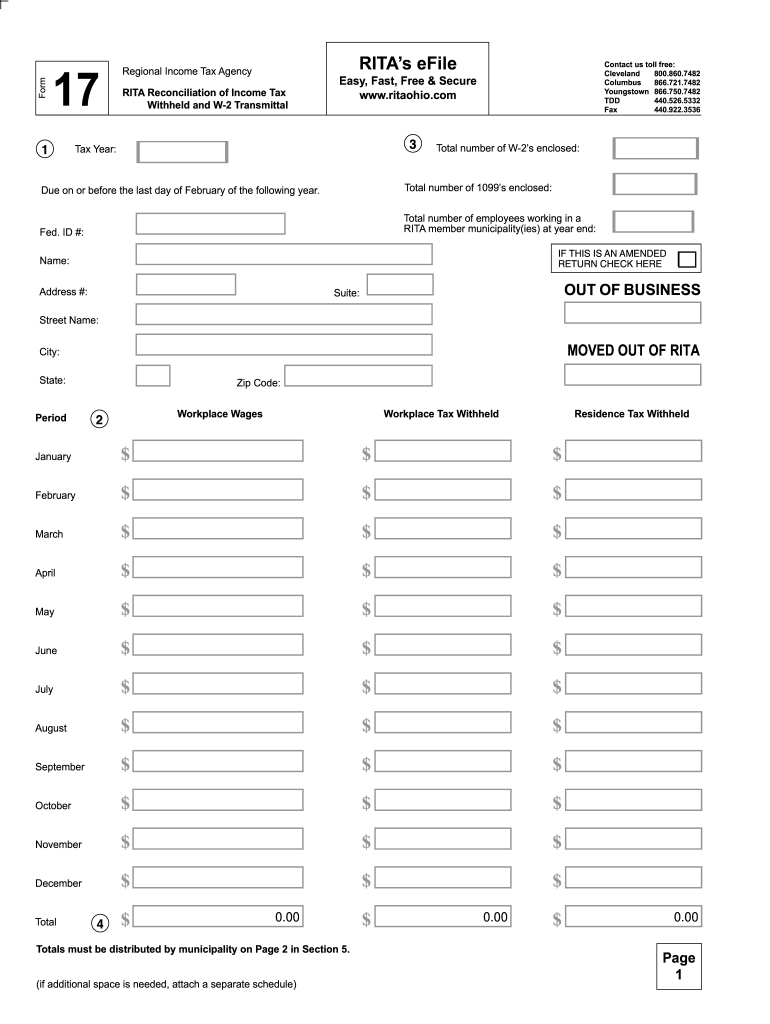

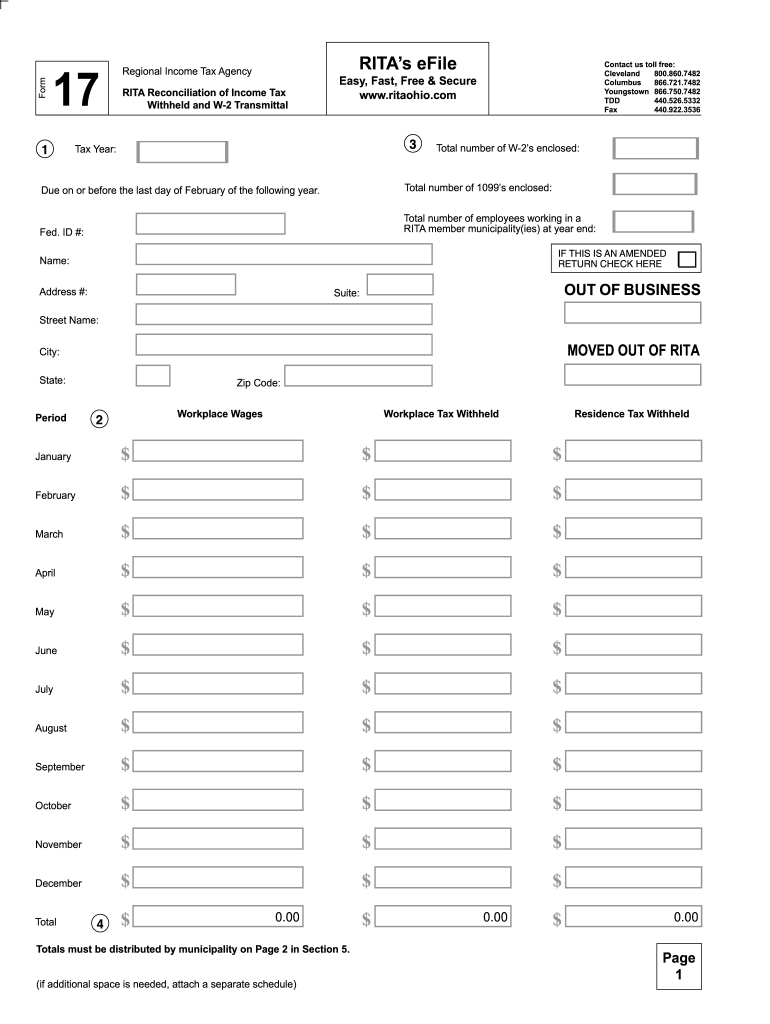

OH RITA 17 2016 free printable template

Get, Create, Make and Sign OH RITA 17

Editing OH RITA 17 online

Uncompromising security for your PDF editing and eSignature needs

OH RITA 17 Form Versions

How to fill out OH RITA 17

How to fill out OH RITA 17

Who needs OH RITA 17?

Instructions and Help about OH RITA 17

Men are residents and businesses with taxable income are required to file a municipal income tax return and pay a two percent municipal income tax these taxes make up over two-thirds of the city's revenue and pay for important city services those monies are used for the entire day-to-day operations of the city including our safety and security forces police fire our road crew when they maintain roads the administrative functions throughout the city all of our Park activities are tracked through the general funds it truly is the lifeblood and supports the day-to-day operations of the city filing a municipal income tax return is simple and convenient through the regional income tax agency or as they are more commonly known Rita acts as the income tax administrator for the city of manner and 4 230 plus other communities around the state of Ohio men are residents are granted one hundred percent credit from municipal income tax paid to other communities up to two percent residents owing tax other than the tax withheld must make quarterly tax payments and file an annual tax return as a resident of matter you are required to file an annual tax return if you don't have any taxable income maybe just a simple exemption form with the check-out box that indicates why it is that you don't own anything senior citizens with the only retirement income with pension or interest income or dividends are exempt folks that are younger in age under the age of 18 would also be example most income is not exempt, and you need to make sure that you report all sources of income to avoid interest in penalty charges the best no type of income that's taxable for municipal income taxes would be wage income you would earn as an employee gambling or lottery winnings you won't go in business you may have a rental income that you own personal all taxpayers in the Rita database or mail postcards at tax time reminding them to file tax forms are available at the men are municipal center men or library on the Rita website, or you may file electronically through the Rita website if you need to help the Lake County Rita office is located on the second floor of the men are municipal center they can get assistance again directly here at the city of men our city hall on Tuesdays and Thursdays, and we have a very experienced Rita auditor here during those days to assist anybody that comes in taxpayers can also get assistance by calling our agency we have a 1-800 number they can use they can as a first step who would also would always be my advice to stop and look at our website that website is chock-full of information Rita has an information sharing agreement with the Internal Revenue Service to make sure that all taxable income is reported I'm going to do is compare our records up against the IRS database and look for the types of income that's taxable community allies and make sure those folks are actually reporting that and paying that to the city of men is call the regional income tax...

People Also Ask about

Who pays Rita tax in Ohio?

What cities in Ohio have Rita tax?

What are RITA taxes in Ohio?

What is the relocation income tax allowance?

What is Ohio Form 17?

Who qualifies for RITA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OH RITA 17 for eSignature?

Can I create an electronic signature for signing my OH RITA 17 in Gmail?

How do I edit OH RITA 17 on an Android device?

What is OH RITA 17?

Who is required to file OH RITA 17?

How to fill out OH RITA 17?

What is the purpose of OH RITA 17?

What information must be reported on OH RITA 17?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.