IRS 1065 - Schedule D-1 2011-2025 free printable template

Show details

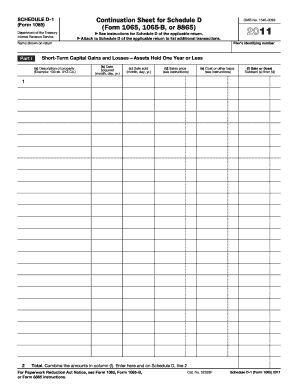

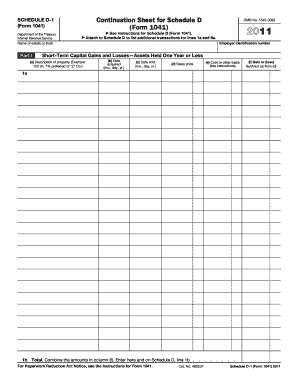

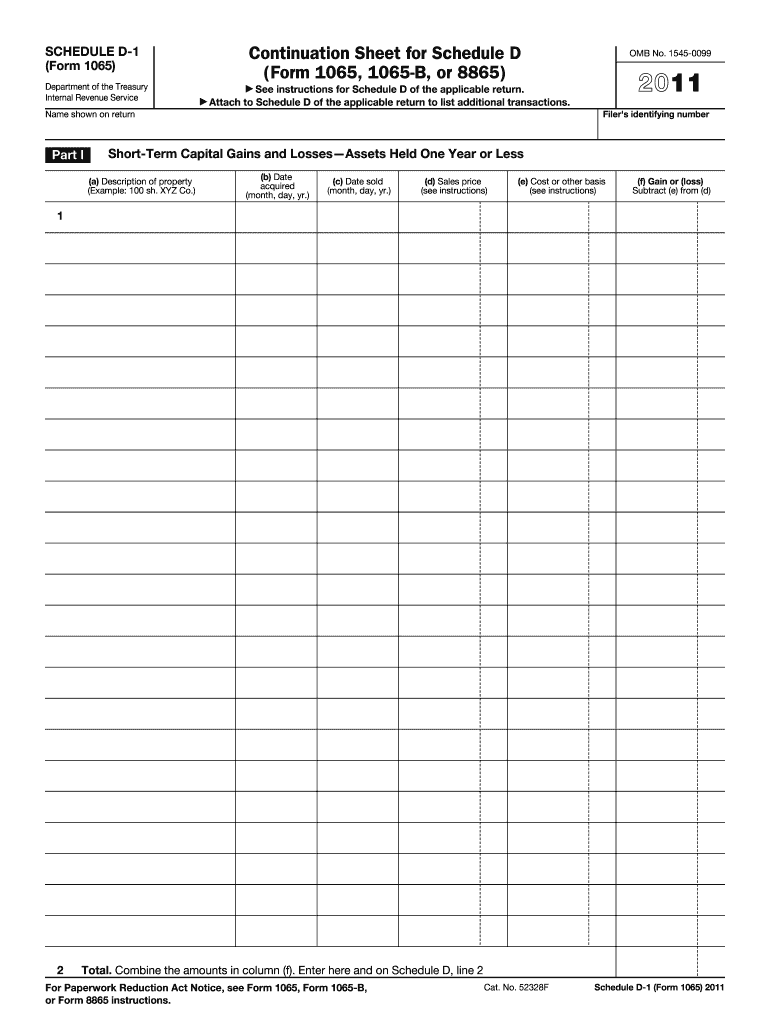

Continuation Sheet for Schedule D

(Form 1065, 1065-B, or 8865)

SCHEDULE D-1

(Form 1065)

Department of the Treasury

Internal Revenue Service

▶ Attach

2011

▶ See instructions for Schedule D

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1065 - Schedule D-1

How to edit IRS 1065 - Schedule D-1

How to fill out IRS 1065 - Schedule D-1

Instructions and Help about IRS 1065 - Schedule D-1

How to edit IRS 1065 - Schedule D-1

To edit IRS 1065 - Schedule D-1, you can use tools like pdfFiller that allow for digital modifications. This is particularly useful for correcting any errors or updating information before submission. Simply upload the form to pdfFiller, utilize the editing tools to make necessary changes, and save the updated version.

How to fill out IRS 1065 - Schedule D-1

To fill out IRS 1065 - Schedule D-1, start by gathering relevant financial information and supporting documentation. Follow these steps:

01

Access the IRS 1065 - Schedule D-1 form either online or through a tax preparation book.

02

Begin at the top of the form, filling in identification details such as your partnership’s name, address, and employee identification number (EIN).

03

Complete the sections that apply to your partnership’s income and deductions.

04

Review all entries for accuracy before finalizing your filing.

Latest updates to IRS 1065 - Schedule D-1

Latest updates to IRS 1065 - Schedule D-1

Stay informed about updates to IRS 1065 - Schedule D-1 by checking the IRS website regularly. Changes may affect filing deadlines, form requirements, or compliance regulations. Tax professionals also often provide updates regarding significant changes impacting partnership taxation.

All You Need to Know About IRS 1065 - Schedule D-1

What is IRS 1065 - Schedule D-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 1065 - Schedule D-1

What is IRS 1065 - Schedule D-1?

IRS 1065 - Schedule D-1 is a supplemental form used by partnerships to report partner transactions and capital accounts. This tax form ensures transparency in the distribution of profits and losses among partners and details changes in equity due to contributions or withdrawals.

What is the purpose of this form?

The purpose of IRS 1065 - Schedule D-1 is to provide the IRS with a detailed account of each partner's capital account as it relates to their share of the partnership. This helps the IRS to verify the partners' reported income, ensuring compliance with tax obligations.

Who needs the form?

Partnerships that operate in the United States and have more than one partner are required to file IRS 1065 - Schedule D-1. This includes general partnerships, limited partnerships, and limited liability companies (LLCs) treated as partnerships. Individual partners do not file this form separately but must report their share on their personal tax returns.

When am I exempt from filling out this form?

Filing IRS 1065 - Schedule D-1 is not necessary for partnerships that do not have any reportable transactions during the tax year. If a partnership had no income, expenses, or changes in ownership throughout the year, it may be exempt from completing this form. Additionally, sole proprietorships do not file this form.

Components of the form

IRS 1065 - Schedule D-1 consists of several key components. These include sections for reporting each partner's name, capital contributions, drawing amounts, and overall changes in capital account balances. Each partner's information, as well as the total amounts for the partnership, must be accurately reported.

What are the penalties for not issuing the form?

Failure to file IRS 1065 - Schedule D-1 can result in significant penalties. Partnerships may be subjected to a failure-to-file penalty, which can accumulate over time for each month the form is late. Additionally, incorrect information may lead to audits and further scrutiny by the IRS, resulting in additional fines and interest on unpaid taxes.

What information do you need when you file the form?

When filing IRS 1065 - Schedule D-1, it's essential to have specific information ready. You will need each partner's social security number or EIN, their respective ownership percentages, and details of any capital contributions or withdrawals made during the tax year. Accurate accounting records will assist in ensuring that all reported figures are accurate.

Is the form accompanied by other forms?

IRS 1065 - Schedule D-1 is typically filed in conjunction with Form 1065, the partnership tax return. Other forms that may accompany it include Schedule K and Schedule K-1, which report individual income and expenses for each partner. It’s important to check the IRS guidelines for any additional required documentation for your specific form submission.

Where do I send the form?

Completed IRS 1065 - Schedule D-1 forms are submitted alongside Form 1065 to the address specified in the IRS instructions. The mailing address may vary depending on the principal place of business of the partnership and whether payment accompanies the return. Refer to the IRS's official instructions for the most current and accurate submission details.

See what our users say