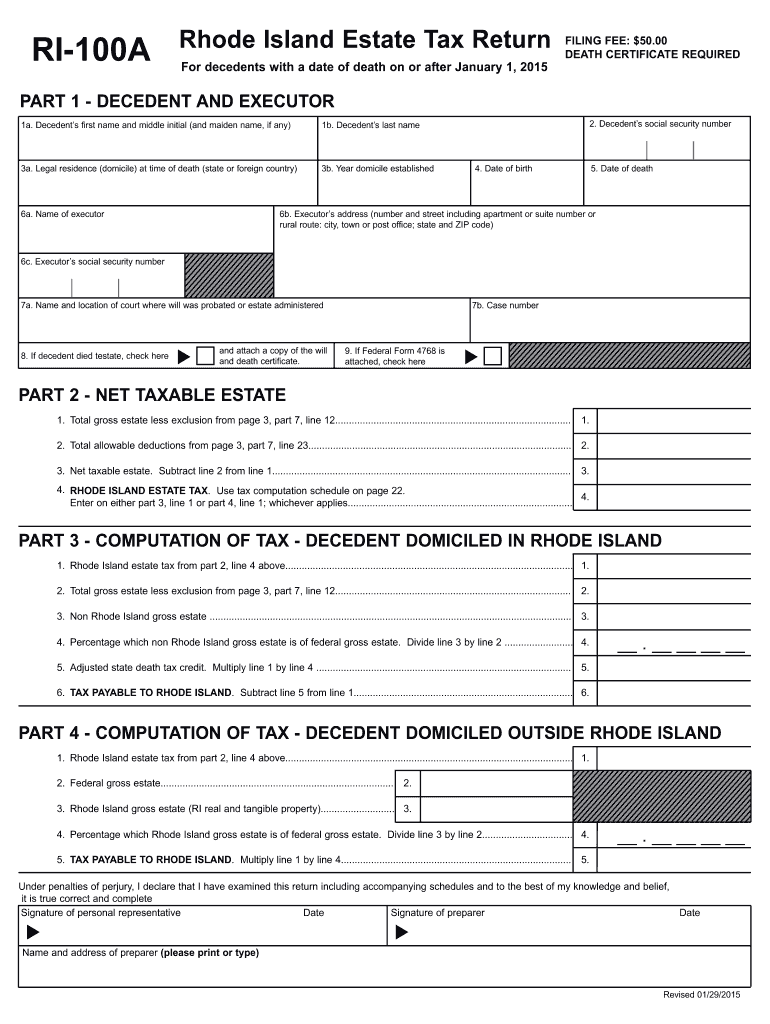

Who needs an RI-100A form?

Form RI-100A must be filed by the executor of the deceased’s estate. There are two requirements to meet:

- The total value of the deceased’s gross estate must be at least $5,450,000 including adjusted taxable gifts and specific exemptions; or

- The executor must decide to transfer the DUE amount to the surviving spouse without taking the size of the decedent’s gross estate into consideration.

What is form RI-100A for?

Form RI-100A is used to calculate the estate tax imposed by Chapter 11 of the Internal Revenue Code. This tax is levied on the entire estate, not just on the share received by a particular beneficiary. Also form RI-100A is used to figure the generation-skipping transfer (GST) tax imposed on direct skips (transfers to skip persons of interest in property included in the deceased’s gross estate).

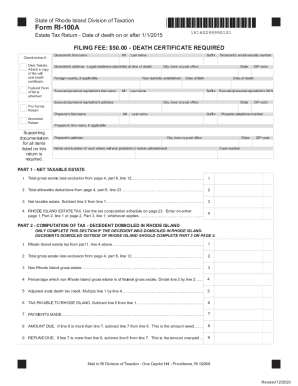

Is it accompanied by other forms?

It is necessary to include a death certificate with this form. There is also a filing fee of $50. A signed copy of the form 706 is necessary if the estate is required to file, regardless if tax is due. Provide a copy of approved federal extension, a copy of approved Rhode Island extension Form RI-4768, and a check in the amount of tax due, if applicable.

When is form RI-100A due?

The executor must file this form within 9 months of the date of deceased’s death. For a 6-month extension to file form RI-100A, the executor must file form 4768.

How do I fill out a form RI-100A?

Use the section-by-section instructions for the Form 706 to learn more about how to fill out this form, as RI-100A was designed after 706 for the estate in Rhode Island.

Where do I send it?

The mailing address for paper copies of the form is:

Department of Treasury

Internal Revenue Service Center

Cincinnati, OH 45999