Get the free Under section 501 ( c), 527 , or 4947 ( a)(1) of the Internal Revenue Code (except p...

Show details

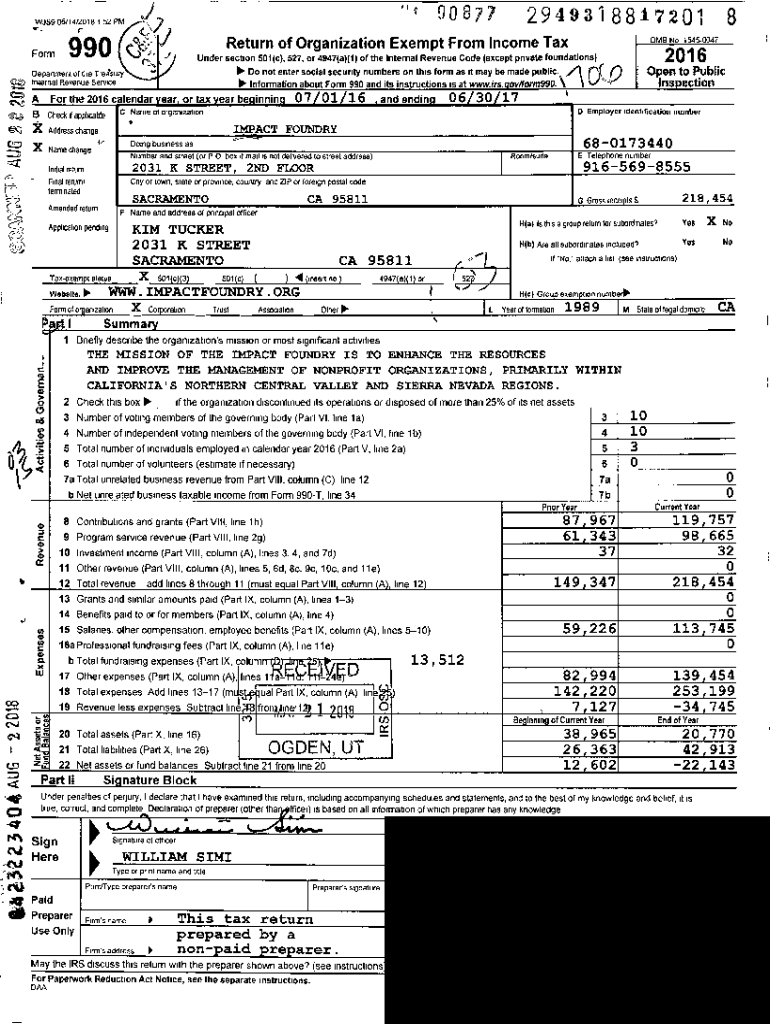

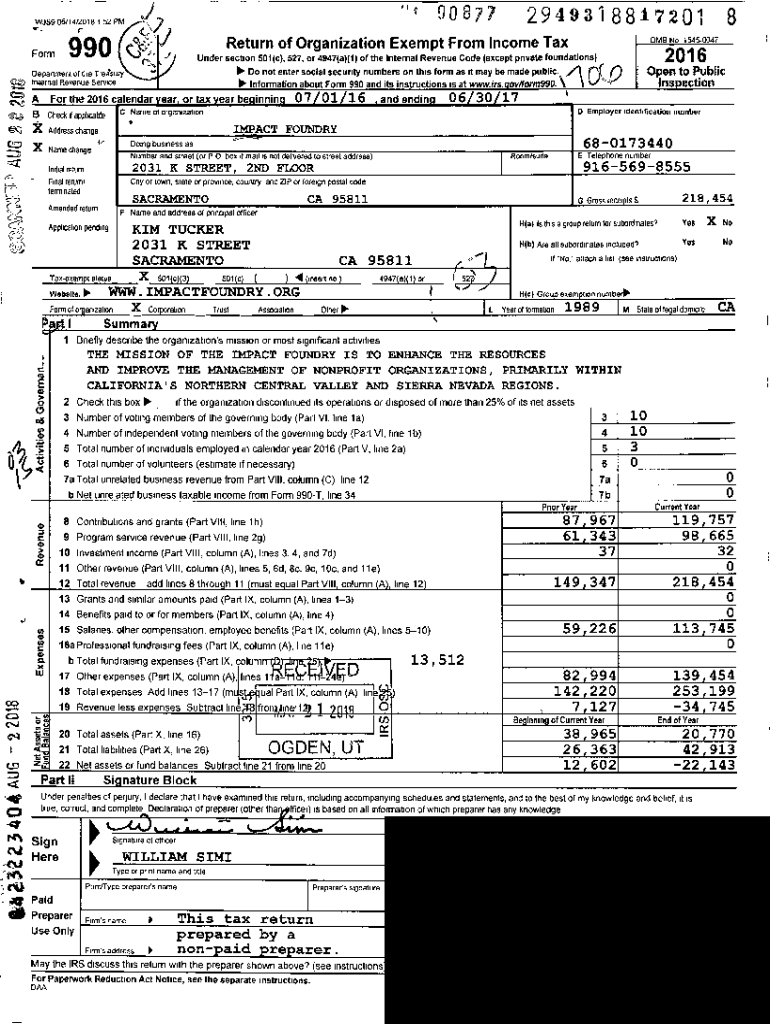

00 877WJS9 05/14/2018 1 52 PMDepartment of the Treasury Internal Reve nue S erviceAUnder section 501 ( c), 527 , or 4947 ( a)(1) of the Internal Revenue Code (except pnvate foundations) 10, Do not

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign under section 501 c

Edit your under section 501 c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your under section 501 c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing under section 501 c online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit under section 501 c. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out under section 501 c

How to fill out under section 501 c

01

Obtain Form 1023 from the Internal Revenue Service (IRS) website or by calling their toll-free number.

02

Read and understand the instructions provided with the form.

03

Fill out the basic information section of the form which includes the organization's name, mailing address, and employer identification number (EIN).

04

Complete Part I of the form which requires you to provide details about the organization's purpose, programs, and activities.

05

Fill out Part II of the form concerning the organization's governance and policies.

06

Provide the required financial information in Part III of the form, including revenue and expenses.

07

Complete the remaining parts of the form, such as disclosing any relationships with other organizations and providing signatures.

08

Attach any necessary supporting documents, such as articles of incorporation or bylaws.

09

Review the completed form for accuracy and completeness before submitting it to the IRS.

10

Mail the completed Form 1023 to the appropriate IRS address as indicated in the form's instructions.

11

Wait for the IRS to review your application and communicate any additional requirements or clarification needed.

12

Once approved, you will receive a determination letter from the IRS confirming your organization's tax-exempt status under section 501(c).

Who needs under section 501 c?

01

Non-profit organizations

02

Charitable organizations

03

Religious organizations

04

Educational organizations

05

Scientific organizations

06

Literary organizations

07

Public safety organizations

08

Testing for public safety organizations

09

Fostering national or international amateur sports competition organizations

10

Preventing cruelty to children or animals organizations

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the under section 501 c in Gmail?

Create your eSignature using pdfFiller and then eSign your under section 501 c immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out under section 501 c using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign under section 501 c and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit under section 501 c on an iOS device?

You certainly can. You can quickly edit, distribute, and sign under section 501 c on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is under section 501 c?

Section 501(c) of the Internal Revenue Code defines various categories of tax-exempt organizations, including charitable, religious, educational, and other types of nonprofits.

Who is required to file under section 501 c?

Organizations seeking to be recognized as tax-exempt under section 501(c) must file for tax exemption with the IRS, including charities, social welfare organizations, and certain other nonprofit entities.

How to fill out under section 501 c?

To fill out an application for tax-exempt status under section 501(c), organizations must complete IRS Form 1023 or Form 1024, providing details about their structure, governance, and planned activities.

What is the purpose of under section 501 c?

The purpose of section 501(c) is to provide tax exemptions to eligible nonprofit organizations that serve public interests, allowing them to reinvest resources into their missions.

What information must be reported on under section 501 c?

Organizations must report information such as their purpose, activities, financial data, and governance structure as part of their application to be recognized under section 501(c).

Fill out your under section 501 c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Under Section 501 C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.