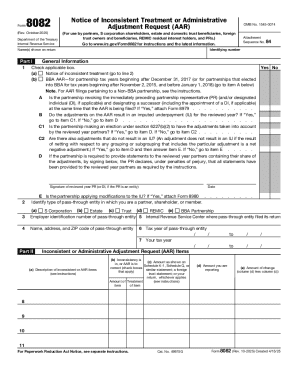

IRS 8082 2023 free printable template

Show details

Cat. No. 49975G Form 8082 Rev. 10-2023 Page 2 Explanations Enter the Part II item number before each explanation. Show how the IU was calculated and how modifications were applied.. Form Rev* October 2023 Department of the Treasury Internal Revenue Service Notice of Inconsistent Treatment or Administrative Adjustment Request AAR For use by partners S corporation shareholders estate and domestic trust beneficiaries foreign trust owners and beneficiaries REMIC residual interest holders TMPs and...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8082

Edit your IRS 8082 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8082 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8082 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 8082. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8082 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8082

How to fill out IRS 8082

01

Download IRS Form 8082 from the IRS website.

02

Fill in your name and address at the top of the form.

03

Indicate the tax year for which you are filing the form.

04

Provide the name and EIN of the partnership or S corporation.

05

Choose the appropriate box regarding the type of entity.

06

Describe the item or activity that is the subject of the IRS 8082.

07

Include any required supporting documents and explanations.

08

Sign and date the form.

09

Submit the completed form to the appropriate IRS address.

Who needs IRS 8082?

01

Individuals or entities who are reporting a certain item from a partnership or S corporation.

02

Taxpayers who received a notice regarding inconsistencies in partnership or S corporation income.

03

Those who need to notify the IRS of their intent to treat certain partnership items differently.

Fill

form

: Try Risk Free

People Also Ask about

Can form 8082 be filed electronically?

Form 8082 is electronically fillable however, it does not have a separate export option. By following the instructions below, you will suppress the export of Form 1065 pages 1-5 for electronic filing. Only Form 8082 and the amended K-1s will be exported.

Who has to file form 8082?

Partners, S corporation shareholders, beneficiaries of an estate or trust, owners of a foreign trust, or residual interest holders in a real estate mortgage investment conduit (REMIC) file this form if they wish to report items differently than the way they were reported to them on Schedule K-1, Schedule Q, or a

How do I check the status of my 8832 form?

The IRS will accept or deny your Form 8832 filing request within 60 days. The acceptance or denial letter will go to the address you listed when completing your form. If 60 days go by and you don't hear anything, call the IRS at 1-800-829-0115 or send a letter to the service center to check on the status of the form.

What is proof of filing form 8832?

If the IRS questions whether Form 8832 was filed, an acceptable proof of filing is: A certified or registered mail receipt (timely postmarked) from the U.S. Postal Service, or its equivalent from a designated private delivery service; Form 8832 with an accepted stamp; Form 8832 with a stamped IRS received date; or.

What happens if an LLC does not file form 8832?

An LLC that is not automatically classified as a corporation and does not file Form 8832 will be classified, for federal tax purposes under the default rules. An LLC that has one member will be classified as a “disregarded entity.” A disregarded entity is one that is disregarded as an entity separate from its owner.

What is a form 8082?

Use Form 8082 to notify the IRS of any inconsistency between your tax treatment of an item and the way the pass-through entity treated and reported the same item on its return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 8082 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your IRS 8082 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I fill out IRS 8082 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your IRS 8082, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out IRS 8082 on an Android device?

Use the pdfFiller mobile app and complete your IRS 8082 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is IRS 8082?

IRS Form 8082 is a notice of inconsistent treatment or a request for a private letter ruling. It is primarily used to inform the IRS and taxpayers about how they intend to treat certain items on their tax returns.

Who is required to file IRS 8082?

Taxpayers who have inconsistencies between a tax return and information provided by a pass-through entity, or those who wish to clarify their treatment of specific tax items, are required to file IRS Form 8082.

How to fill out IRS 8082?

To fill out IRS Form 8082, taxpayers need to provide personal identification information, specify the tax year involved, describe the inconsistency, and provide detailed reasons for their tax treatment. Additionally, any supporting documentation should be attached.

What is the purpose of IRS 8082?

The purpose of IRS Form 8082 is to formally notify the IRS of any inconsistencies in the tax treatment of items on a return, and to provide the taxpayer an opportunity to explain their treatment, thus helping to prevent misunderstandings and potential penalties.

What information must be reported on IRS 8082?

On IRS Form 8082, taxpayers must report their name, address, taxpayer identification number, the tax year in question, a description of the inconsistency, the nature of the inconsistency, and any relevant legal provisions or rulings that support their position.

Fill out your IRS 8082 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8082 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.