IRS 709 Instructions 2023 free printable template

Show details

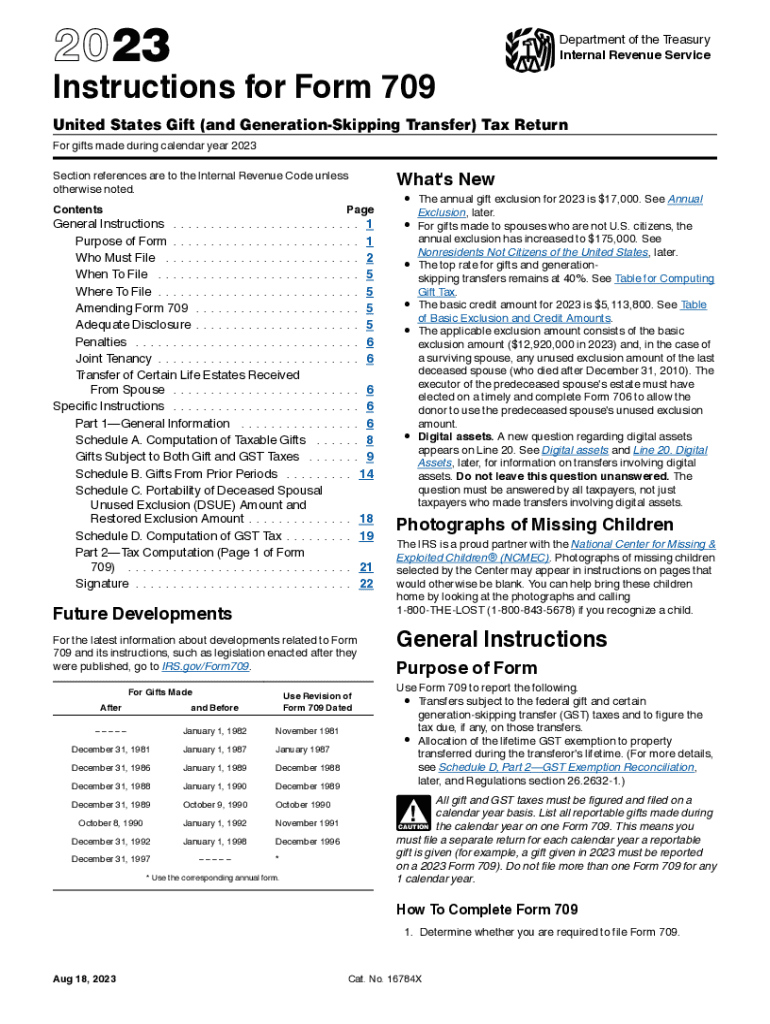

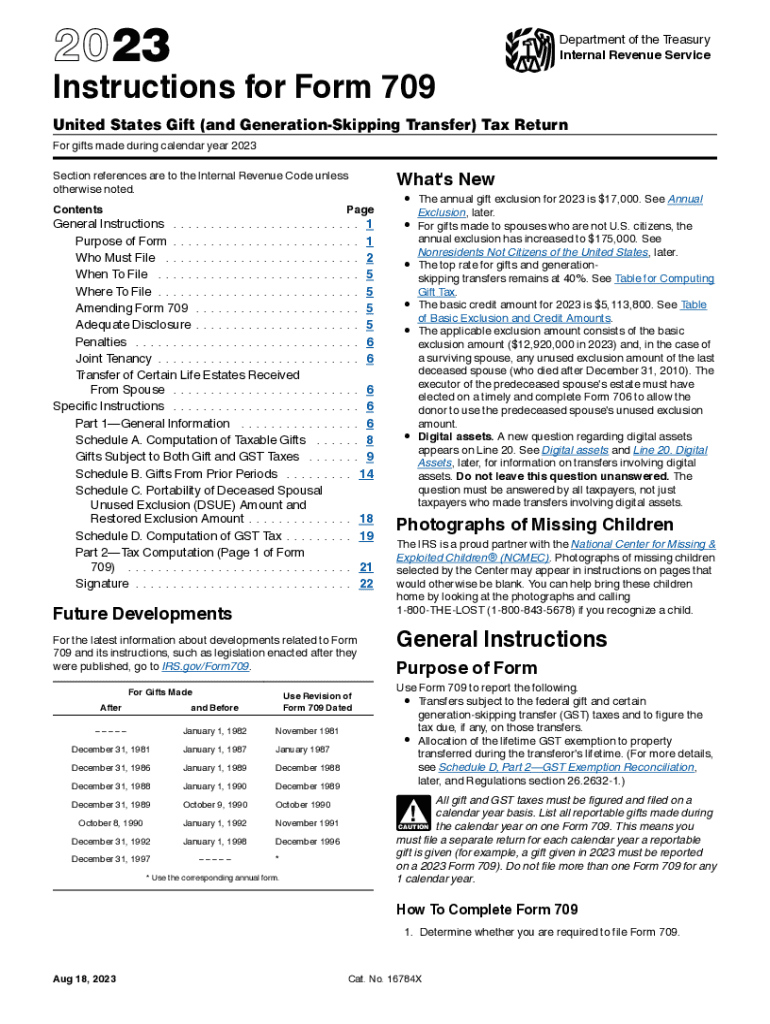

2023Instructions for Form 709Department of the Treasury

Internal Revenue ServiceUnited States Gift (and GenerationS kipping Transfer) Tax Return

For gifts made during calendar year 2023What's Resection

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 709 Instructions

Edit your IRS 709 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 709 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 709 Instructions online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 709 Instructions. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 709 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 709 Instructions

How to fill out IRS 709 Instructions

01

Gather necessary personal information, including your name, address, and social security number.

02

Collect information regarding the gift you are reporting, including the recipient's details and the value of the gift.

03

Complete the applicable parts of IRS Form 709, ensuring to include any prior gifts that may affect your annual exclusion.

04

Calculate the total amount of gifts made during the year and determine if you exceed the annual exclusion limit.

05

Sign and date the form before submission.

06

Submit Form 709 to the IRS by the deadline, typically April 15 of the following tax year.

Who needs IRS 709 Instructions?

01

Individuals who have made gifts exceeding the annual exclusion limit set by the IRS.

02

Those who are required to report gifts to non-citizen spouses or gifts that qualify for gift splitting.

03

People who need to calculate their lifetime gift tax exemption.

Fill

form

: Try Risk Free

People Also Ask about

What is the requirement to file Form 709?

IRS Form 709 – Filing Requirements Generally, Form 709: U.S. Gift (and Generation-Skipping Transfer) Tax Return is required if any of the following apply: An individual makes one or more gifts to any one person (other than his or her citizen spouse) that are more than the annual exclusion for the year.

Do you have to report all gifts on Form 709?

In general, a gift will be considered adequately disclosed if the return or statement includes the following. A full and complete Form 709. A description of the transferred property and any consideration received by the donor. The identity of, and relationship between, the donor and each donee.

Do you report charitable gifts on 709?

Donors are required to report gifts on Form 709, U.S. Gift (and Generation-Skipping Transfer) Tax Return. Several types of gifts do not have to be reported, such as gifts that do not exceed the annual exclusion amount, deductible charitable gifts, gifts to a spouse, and gifts that the donee properly disclaims.

How does the IRS know if you give a gift?

The IRS finds out if you gave a gift when you file a form 709 as is required if you gift over the annual exclusion. If you fail to file this form, the IRS can find out via an audit.

What is the IRS rule for gifting money to family members?

The gift tax limit was $16,000 in 2022 and is $17,000 in 2023. The gift tax rates range from 18% to 40%. The gift giver is the one who generally pays the tax, not the receiver.

Do you have to report all gifts on gift tax return?

Whenever a donor is required to file a gift tax return for the purpose of reporting taxable gifts, he or she must also report all charitable gifts made during the applicable tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IRS 709 Instructions?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your IRS 709 Instructions to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in IRS 709 Instructions without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your IRS 709 Instructions, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the IRS 709 Instructions electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your IRS 709 Instructions in seconds.

What is IRS 709 Instructions?

IRS 709 Instructions refer to the guidelines provided by the Internal Revenue Service for completing and filing Form 709, which is the United States Gift (and Generation-Skipping Transfer) Tax Return.

Who is required to file IRS 709 Instructions?

Individuals who give gifts exceeding the annual exclusion amount to any person (other than their spouse) during the calendar year, or who make gifts of certain future interests, are required to file IRS 709.

How to fill out IRS 709 Instructions?

To fill out IRS 709, one must provide personal information, details of the gifts made, and itemize any gifts that exceed the annual exclusion limit, along with calculating any applicable gift tax.

What is the purpose of IRS 709 Instructions?

The purpose of IRS 709 Instructions is to inform taxpayers about their responsibilities regarding gift taxes, including how to properly report gifts made during the tax year and understand any tax implications.

What information must be reported on IRS 709 Instructions?

Information that must be reported includes the names and addresses of recipients, descriptions of the gifts, their fair market value, any deductions claimed, and any applicable exemptions or exclusions.

Fill out your IRS 709 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 709 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.