HI N-11 2023 free printable template

Show details

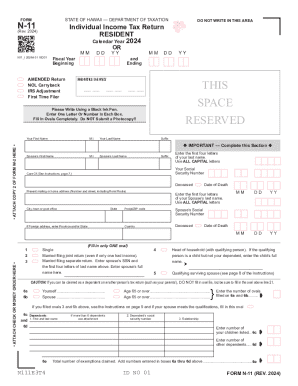

FORMN11(Rev. 2023)STATE OF HAWAII DEPARTMENT OF TAXATIONN11_I 2023A 01 VID01MMORDDYYFiscal YearBeginningAMENDED Return

NOT Carry back

IRS Adjustment

First Time File rand

EndingMMDD Your First Name.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form n 11

Edit your hawaii form n 11 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your n 11 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hawaii n 11 instructions online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit n 11 1 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI N-11 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out hawaii n 11 form

How to fill out HI N-11

01

Gather necessary personal information such as your Social Security number and address.

02

Complete the top portion of the form with your name and identification details.

03

Provide information regarding your household income and any applicable deductions.

04

Fill out the sections related to your health insurance coverage for the reporting period.

05

Review all entries for accuracy and completeness.

06

Sign and date the form.

07

Submit the form to the appropriate state agency as directed.

Who needs HI N-11?

01

Individuals who are applying for or renewing Hawaii's Medicaid program.

02

Residents seeking state financial assistance for health insurance coverage.

03

Those who have experienced a change in household income or size affecting eligibility.

Fill

form n 11 instructions

: Try Risk Free

People Also Ask about hawaii state tax form

What is the Hawaii Form n163?

Purpose of Form Use Form N-163 to figure and claim the fuel tax credit for commercial fishers under sections 235-110.6, HRS, and 18-235- 110.6, Hawaii Administrative Rules.

What is the Form N 356 in Hawaii?

A tax credit that exceeds the taxpayer's income tax liability may be used as a credit against the taxpayer's income tax liability in subsequent years until exhausted. Use Form N-356 to figure and claim the earned income tax credit under section 235- 55.75, Hawaii Revised Statutes.

Who qualifies for food excise credit in Hawaii?

You must have a federal Adjusted Gross Income (AGI) below $50,000 ($30,000 if Single) to claim the Refundable Food/Excise Credit. It's worth from $35 to $110 per person depending on your AGI.

What is Hawaii tax Form N-15?

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

What is Form N 11 Hawaii?

A nonresident married to a Hawaii resident may choose to file a joint return with the resident spouse on Form N-11 or N-13; however, the nonresident will then be taxed on all income from all sources. For more information, see Married Filing Joint Return on page 8.

What is Form N 163 in Hawaii?

Purpose of Form Use Form N-163 to figure and claim the fuel tax credit for commercial fishers under sections 235-110.6, HRS, and 18-235- 110.6, Hawaii Administrative Rules.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit hawaii form n 11 instructions 2024 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your n 11 tax form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I fill out the n 11 hawaii form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign form n 11 hawaii and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit n11 form hawaii on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute hawaii n11 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is HI N-11?

HI N-11 is a form required by certain governmental agencies for reporting health insurance coverage information.

Who is required to file HI N-11?

Individuals and organizations that provide health insurance or are subject to health insurance reporting requirements are required to file HI N-11.

How to fill out HI N-11?

To fill out HI N-11, you need to complete the required fields with accurate information about the health insurance policy, including policyholder details, coverage dates, and types of coverage.

What is the purpose of HI N-11?

The purpose of HI N-11 is to ensure compliance with health insurance reporting regulations and to provide necessary information for tracking health coverage and benefits.

What information must be reported on HI N-11?

The information that must be reported on HI N-11 includes the policyholder's name, address, Social Security number, policy number, coverage periods, and any other relevant details as mandated by the reporting guidelines.

Fill out your HI N-11 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hawaii n11 Instructions is not the form you're looking for?Search for another form here.

Keywords relevant to hawaii n 11 instructions 2024

Related to n 11 instructions 2024

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.