IRS 3903 2024 free printable template

Show details

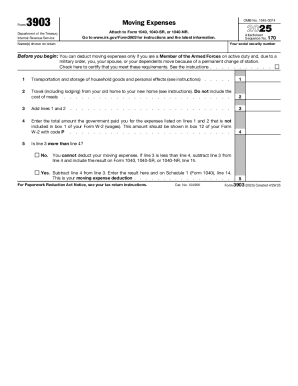

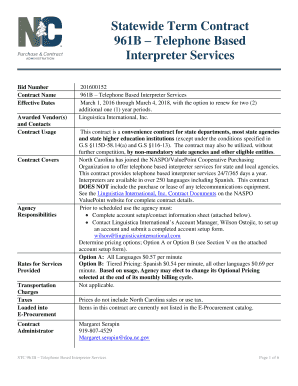

For Paperwork Reduction Act Notice see your tax return instructions. Cat. No. 12490K Form 3903 2024. Moving Expenses Department of the Treasury Internal Revenue Service Attach to Form 1040 1040-SR or 1040-NR* Go to www*irs*gov/Form3903 for instructions and the latest information* Form OMB No* 1545-0074 Attachment Sequence No* 170 Your social security number Name s shown on return Before you begin You can deduct moving expenses only if you are a Member of the Armed Forces on active duty and...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 3903

Edit your IRS 3903 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 3903 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 3903 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 3903. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 3903 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 3903

How to fill out IRS 3903

01

Obtain IRS Form 3903 from the IRS website or your tax preparation software.

02

Enter your name, address, and Social Security number at the top of the form.

03

Fill out the 'Part I' section to report moving expenses, detailing the moving company details and amounts paid.

04

Use 'Part II' to calculate the deductible moving expenses based on your situation, including distance and time related to the new job.

05

Complete 'Part III' if you are claiming expenses for travel and lodging during the move.

06

Keep all receipts and documentation to support your claims.

07

Submit the form along with your tax return to the IRS by the tax deadline.

Who needs IRS 3903?

01

Individuals who have moved for a new job or business location.

02

Taxpayers who are eligible to deduct moving expenses on their tax returns.

03

Members of the Armed Forces who are moving due to a military order may also need to fill out this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form for moving?

Use Form 8822 to notify the Internal Revenue Service of a change to your home mailing address.

What is included in above-the-line deductions?

Above-the-line deductions are those that are deducted from your gross income to calculate your adjusted gross income. Some of the most common above-the-line deductions that taxpayers take include retirement contributions, student loan interest, healthcare expenses, and business expenses.

Can you claim a PCS move on your taxes?

If you're a member of the Armed Forces on active duty, you may be eligible to deduct moving expenses if your move was due to a military order and permanent change of station. You may be able to deduct your unreimbursed moving expenses for you, your spouse and dependents.

What deductions can I claim without receipts?

10 Deductions You Can Claim Without Receipts Home Office Expenses. This is usually the most common expense deducted without receipts. Cell Phone Expenses. Vehicle Expenses. Travel or Business Trips. Self-Employment Taxes. Self-Employment Retirement Plan Contributions. Self-Employed Health Insurance Premiums. Educator expenses.

Are moving expenses an above the line deduction?

Above-the-line deductions are things like educator expenses, moving expenses, contributions to savings accounts (there's a full list below). Below-the-line deductions are the everyday expenses you're most familiar with: business mileage, rent, office supplies.

What are the rules for deducting moving expenses?

You can deduct the expenses of moving your household goods and personal effects, including expenses for hauling a trailer, packing, crating, in-transit storage, and insurance. You can't deduct expenses for moving furniture or other goods you bought on the way from your old home to your new home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 3903 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your IRS 3903 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I edit IRS 3903 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing IRS 3903.

How do I edit IRS 3903 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute IRS 3903 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IRS 3903?

IRS 3903 is a tax form used to claim moving expenses for members of the Armed Forces who move due to a permanent change of station.

Who is required to file IRS 3903?

Members of the Armed Forces who relocate due to a permanent change of station and seek to deduct moving expenses on their tax return are required to file IRS 3903.

How to fill out IRS 3903?

To fill out IRS 3903, provide personal information, details about the move, and the specific moving expenses incurred. Follow the instructions provided on the form carefully.

What is the purpose of IRS 3903?

The purpose of IRS 3903 is to allow eligible members of the Armed Forces to deduct certain expenses related to moving as a result of a permanent change of station.

What information must be reported on IRS 3903?

The form requires reporting personal details such as name and social security number, the date of the move, moving expenses breakdown, and any reimbursements received.

Fill out your IRS 3903 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 3903 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.