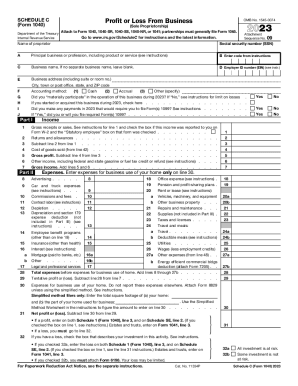

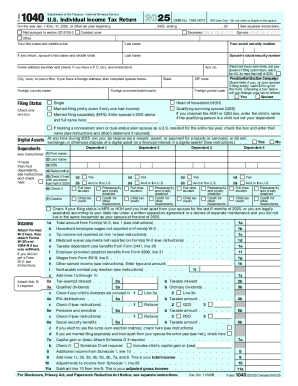

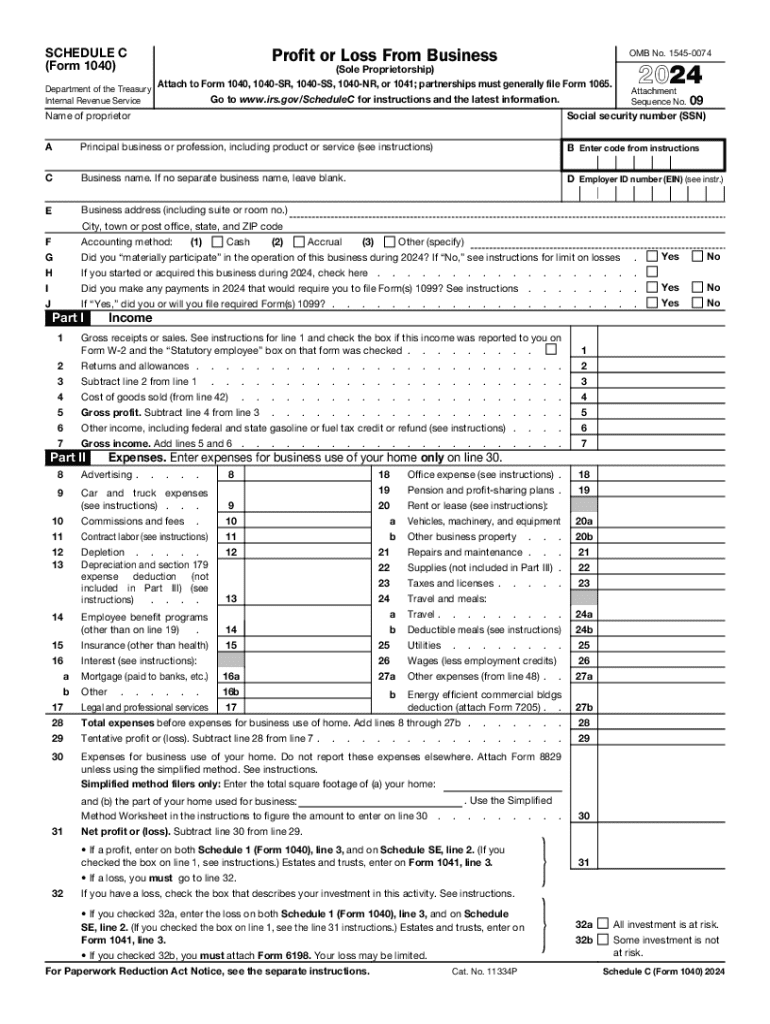

IRS 1040 - Schedule C 2025-2026 free printable template

Instructions and Help about IRS 1040 - Schedule C

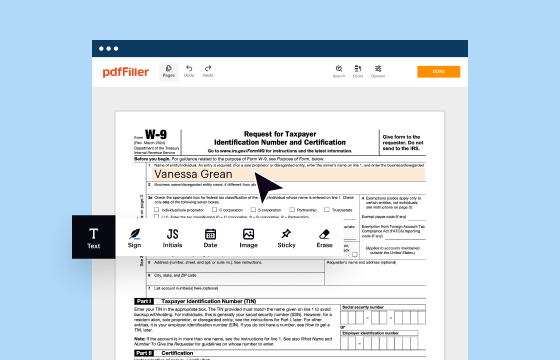

How to edit IRS 1040 - Schedule C

How to fill out IRS 1040 - Schedule C

Latest updates to IRS 1040 - Schedule C

All You Need to Know About IRS 1040 - Schedule C

What is IRS 1040 - Schedule C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

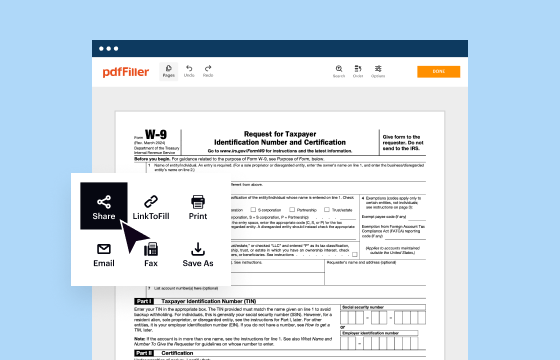

Where do I send the form?

FAQ about IRS 1040 - Schedule C

What should I do if I realize I made a mistake on my IRS 1040 - Schedule C?

If you discover an error after filing your IRS 1040 - Schedule C, you should file an amended return using Form 1040-X. Ensure that you include the corrected information from the Schedule C along with the requested amendments to your overall tax return. It's essential to act quickly, as waiting to correct the mistake could lead to penalties or interest.

How can I track the status of my IRS 1040 - Schedule C filing?

To track the status of your IRS 1040 - Schedule C, you can use the IRS 'Where's My Refund?' tool, which provides information on your filing status and refund if applicable. Additionally, keep an eye on your e-file notifications for any potential rejections or issues that may arise during processing.

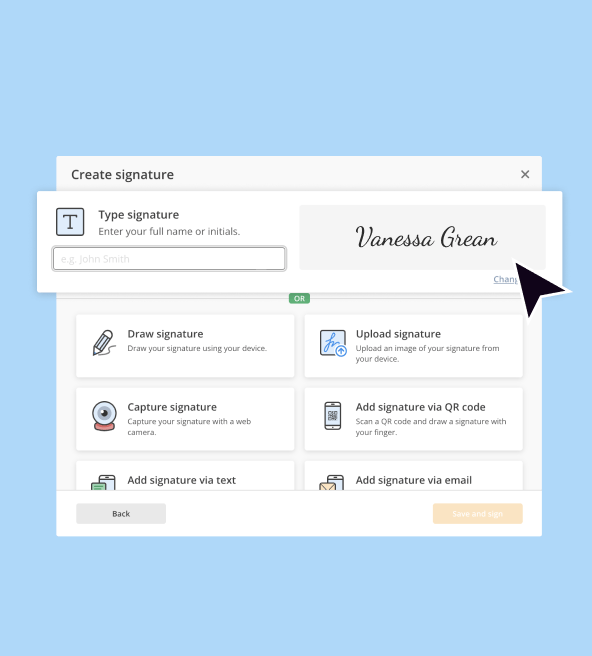

Are e-signatures acceptable when filing the IRS 1040 - Schedule C electronically?

Yes, electronic signatures are accepted when filing your IRS 1040 - Schedule C through authorized e-filing software. Ensure that the software complies with IRS requirements for e-signatures to guarantee the validity of your submission. Always keep a copy of your signed document for your records.

What are some common errors to avoid when completing the IRS 1040 - Schedule C?

Common errors on the IRS 1040 - Schedule C include miscalculating income and deductions, neglecting to report certain income, and classifying expenses incorrectly. To avoid these pitfalls, double-check your entries and consider using tax preparation software, which can help minimize errors and ensure accuracy in your filing.

See what our users say