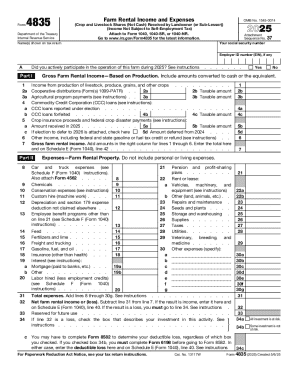

IRS 4835 2024 free printable template

Instructions and Help about form 4835

How to edit form 4835

How to fill out form 4835

Latest updates to form 4835

All You Need to Know About form 4835

What is form 4835?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 4835

What should I do if I need to correct a mistake on my form 4835 after it has been submitted?

If you've discovered an error on your form 4835 post-filing, you can file an amended return to correct the mistake. Ensure you include all relevant information and clearly mark it as an amendment. This submission should be sent to the same address as your original form 4835.

How can I verify the processing status of my filed form 4835?

To track the status of your form 4835 after submission, visit the IRS website and utilize their online tools. You can also contact the IRS directly for updates. Have your information handy to expedite the process.

What are some common errors to watch out for when completing form 4835?

Common mistakes on form 4835 include incorrect income reporting and missing supporting documentation. Double-check all entries and ensure that you have complete records to avoid delays and potential issues with your submission.

In what scenarios might a business filer differ in requirements from an individual filer when using form 4835?

Business filers may need to include additional information and documentation not required of individual filers on form 4835. This might involve reporting different types of payments or utilizing specific accounting methods, so it's essential to consult IRS guidelines that pertain to your business structure.

What should I focus on regarding data security when filing form 4835 electronically?

When e-filing your form 4835, ensure that the platform you use is secure and complies with data protection regulations. Use strong passwords and consider encrypting sensitive personal information to safeguard against unauthorized access.

See what our users say