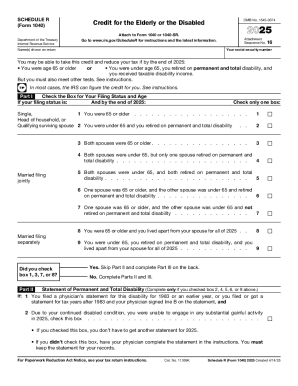

IRS 1040 Schedule R 2024 free printable template

Instructions and Help about irs1040 schedule r 2

How to edit irs1040 schedule r 2

How to fill out irs1040 schedule r 2

Latest updates to irs1040 schedule r 2

All You Need to Know About irs1040 schedule r 2

What is irs1040 schedule r 2?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040 Schedule R

What should I do if I make mistakes on my irs1040 schedule r 2024-2025?

If you realize there are mistakes on your irs1040 schedule r 2024-2025 after submitting it, you can file an amended return using Form 1040-X. This allows you to correct any errors, including income or credits. Make sure to attach the corrected schedule and provide an explanation of the changes made.

How can I verify the status of my submitted irs1040 schedule r 2024-2025?

To verify the status of your submitted irs1040 schedule r 2024-2025, you can use the IRS 'Where's My Refund?' tool online. This allows you to track the status of your return and any potential refund. Additionally, keeping a copy of your submission confirmation can help in checking any processing issues.

What should I do if I receive an IRS notice after filing my irs1040 schedule r 2024-2025?

If you receive an IRS notice after filing your irs1040 schedule r 2024-2025, carefully read the notice to understand the issue. Respond within the specified timeframe and gather any required documentation to support your case. It's wise to consult a tax professional if the matter seems complex or if you're unsure how to proceed.

Are there common errors I should avoid when filling out the irs1040 schedule r 2024-2025?

Yes, some common errors to avoid on the irs1040 schedule r 2024-2025 include incorrect social security numbers, miscalculating credits, and failing to sign the form. Double-check your entries and ensure that all necessary information matches your records to prevent delays processing your return.

What privacy considerations should I keep in mind when filing the irs1040 schedule r 2024-2025 electronically?

When filing the irs1040 schedule r 2024-2025 electronically, it's essential to ensure that you are using secure internet connections and reputable e-filing software. Protect your personal information by using strong passwords and enabling two-factor authentication if available to safeguard your data from unauthorized access.

See what our users say