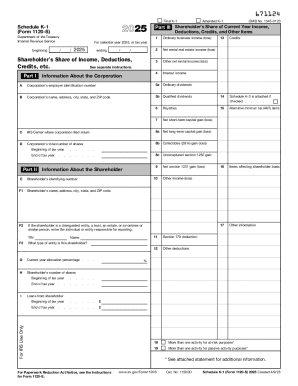

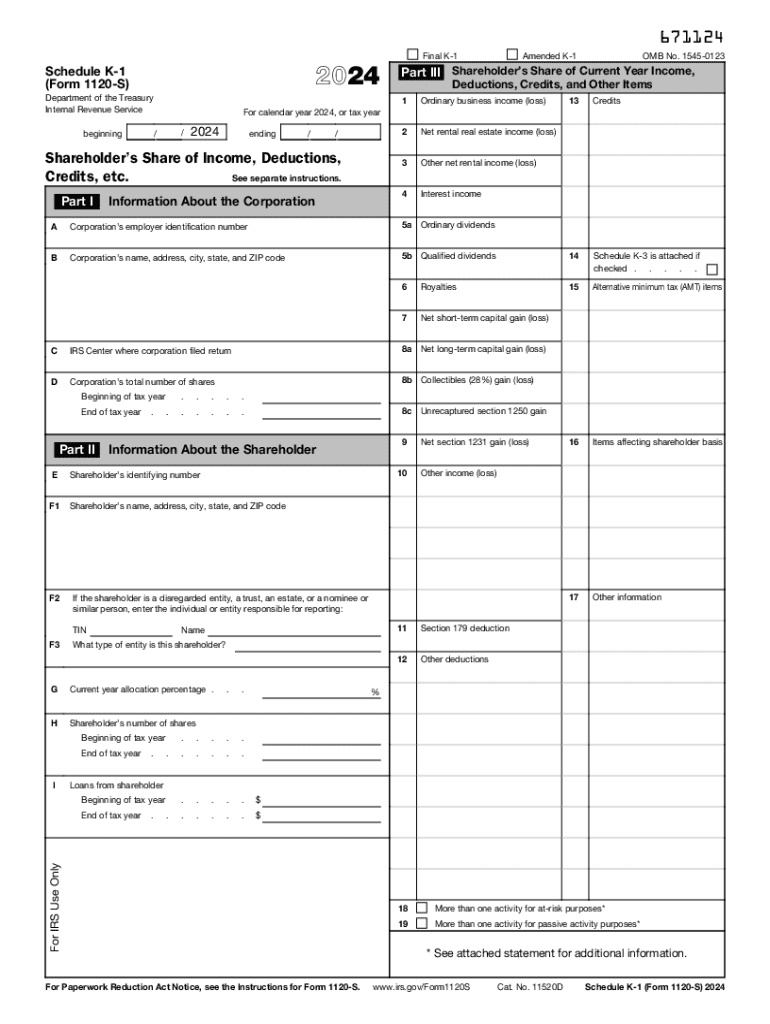

IRS 1120S - Schedule K-1 2024 free printable template

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

How to fill out IRS 1120S - Schedule K-1

Latest updates to IRS 1120S - Schedule K-1

About IRS 1120S - Schedule K-1 2024 previous version

What is IRS 1120S - Schedule K-1?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

FAQ about IRS 1120S - Schedule K-1

What should I do if I find an error on my IRS 1120S - Schedule K-1 after submission?

If you discover an error on your IRS 1120S - Schedule K-1 after it has been submitted, you need to file an amended return. This can be done using the same form with the correct information and marking it as amended. Ensure to provide any additional documentation that justifies the changes made.

How can I check the status of my submitted IRS 1120S - Schedule K-1?

To verify the status of your submitted IRS 1120S - Schedule K-1, you can contact the IRS directly or utilize their online portal. It's crucial to have your details ready, such as Social Security Number or Employer Identification Number, to assist in tracking your submission.

Are there special considerations for foreign payees when completing the IRS 1120S - Schedule K-1?

Yes, special considerations apply to foreign payees when completing the IRS 1120S - Schedule K-1. Nonresidents must ensure form compliance with IRS guidelines and may need to provide additional documentation such as forms W-8BEN or W-8BEN-E to reflect their foreign status correctly.

What common mistakes should I look out for when submitting my IRS 1120S - Schedule K-1?

Common mistakes when submitting the IRS 1120S - Schedule K-1 include incorrect taxpayer identification numbers, missing signatures, and failing to report all relevant income. Review your form carefully to ensure accuracy and completeness before submission.

What should I do if I receive a notice from the IRS about my IRS 1120S - Schedule K-1?

If you receive a notice from the IRS regarding your IRS 1120S - Schedule K-1, carefully read the notice for specific instructions. Typically, you will need to address the issue presented, which may involve providing additional documentation or clarification, and responding within the stipulated timeframe.

See what our users say