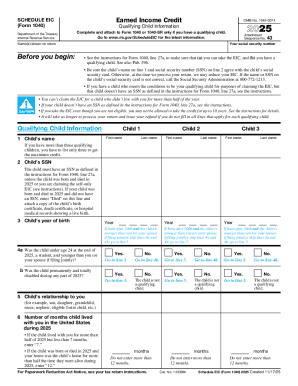

IRS 1040 - Schedule EIC 2024 free printable template

Instructions and Help about IRS 1040 - Schedule EIC

How to edit IRS 1040 - Schedule EIC

How to fill out IRS 1040 - Schedule EIC

Latest updates to IRS 1040 - Schedule EIC

About IRS 1040 - Schedule EIC 2024 previous version

What is IRS 1040 - Schedule EIC?

Who needs the form?

What are the penalties for not issuing the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

FAQ about IRS 1040 - Schedule EIC

What should I do if I realize I made an error on my IRS 1040 - Schedule EIC after submitting it?

If you discover an error after filing your IRS 1040 - Schedule EIC, you can file an amended return using Form 1040-X. This allows you to correct mistakes and ensure your tax information is accurate. Be sure to follow the instructions for submitting the amendment, as it may affect your refund or tax liability.

How can I verify if my IRS 1040 - Schedule EIC was received and is being processed?

You can check the status of your IRS 1040 - Schedule EIC by using the IRS 'Where's My Refund?' tool on their website. By entering your personal details, you can track the progress of your return and confirm if it has been processed. This tool will also inform you of any issues that may have arisen during processing.

What should I know about security and privacy when filing my IRS 1040 - Schedule EIC online?

When filing your IRS 1040 - Schedule EIC online, ensure that the software you use complies with IRS security standards. Use e-filing services that utilize encryption and have robust privacy policies to protect your personal information. Always save copies of your return and maintain confidential records for future reference.

What common errors should I be aware of when filing the IRS 1040 - Schedule EIC?

Common errors when filing the IRS 1040 - Schedule EIC include incorrect Social Security numbers, not claiming eligible children, and miscalculating the earned income credit. To avoid these mistakes, double-check all information, ensure eligibility requirements are met, and review your calculations before submission.

Can nonresidents file an IRS 1040 - Schedule EIC, and what are the specific requirements?

Nonresidents generally cannot file the IRS 1040 - Schedule EIC since it is meant for U.S. citizens and residents who meet certain eligibility criteria. However, if a nonresident has a valid Social Security number and meets other requirements, they may be eligible for certain credits but will need to seek specific guidance for their situation.

See what our users say