IRS 8959 2024 free printable template

Show details

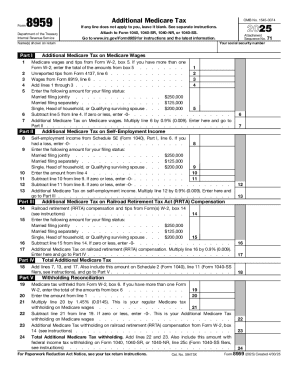

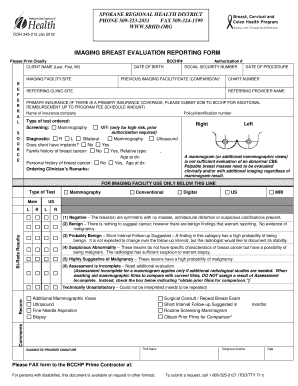

For Paperwork Reduction Act Notice see your tax return instructions. Cat. No. 59475X Form 8959 2024. Form Department of the Treasury Internal Revenue Service Additional Medicare Tax If any line does not apply to you leave it blank. See separate instructions. Attach to Form 1040 1040-SR 1040-NR or 1040-SS. Go to www.irs.gov/Form8959 for instructions and the latest information. Name s shown on return Part I Total Additional Medicare Tax Add lines 7 13 and 17. Also include this amount on...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8959

Edit your IRS 8959 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8959 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 8959 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 8959. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8959 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8959

How to fill out IRS 8959

01

Gather your tax information: Collect your income, deductions, and previous tax returns.

02

Download IRS Form 8959: Obtain the form from the IRS website.

03

Fill in your personal information: Provide your name, Social Security number, and filing status at the top of the form.

04

Calculate your total income: Report all income that is subject to Medicare tax.

05

Determine your threshold: Identify if your income exceeds the threshold of $200,000 (single filers) or $250,000 (married filing jointly) to see if additional Medicare tax applies.

06

Calculate additional Medicare tax: If applicable, compute the additional Medicare tax at a rate of 0.9% on income above the threshold.

07

Complete Part I: Enter the applicable amounts in Part I of the form, including total wages and net investment income.

08

Complete Part II: Calculate the total Medicare tax and any additional amount owed.

09

Review your form: Double-check all entries for accuracy and ensure all required fields are filled out.

10

Submit your form: Include IRS Form 8959 with your annual tax return when filing.

Who needs IRS 8959?

01

Individuals who earn income above the specified thresholds for Medicare tax need to file IRS Form 8959.

02

Self-employed individuals who have net earnings exceeding the thresholds should also file Form 8959.

03

Taxpayers who have additional Medicare tax withheld from their paychecks should file this form to reconcile their taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is form 8959 for?

Purpose of Form Use Form 8959 to figure the amount of Additional Medicare Tax you owe and the amount of Additional Medicare Tax withheld by your employer, if any. You will carry the amounts to one of the following returns. • Form 1040.

What is the IRS additional Medicare tax withholding?

Additional Medicare Tax withholding applies only to wages paid to an employee that are in excess of $200,000 in a calendar year. Withholding rules for this tax are different than the income tax withholding rules for supplemental wages in excess of $1,000,000 as explained in Publication 15, section 7.

Who needs to file form 8959?

The tax applies to wages from employment, self-employment income and railroad retirement income, but if you are receiving W-2 income, the tax will most likely be withheld from your wages. Either way, anyone subject to the tax is required to file Form 8959 with their annual income tax filing.

What is IRS form 8959 for?

Purpose of Form Use Form 8959 to figure the amount of Additional Medicare Tax you owe and the amount of Additional Medicare Tax withheld by your employer, if any. You will carry the amounts to one of the following returns.

Who must file IRS form 8959?

The tax applies to wages from employment, self-employment income and railroad retirement income, but if you are receiving W-2 income, the tax will most likely be withheld from your wages. Either way, anyone subject to the tax is required to file Form 8959 with their annual income tax filing.

Who is required to file Form 8959?

The tax applies to wages from employment, self-employment income and railroad retirement income, but if you are receiving W-2 income, the tax will most likely be withheld from your wages. Either way, anyone subject to the tax is required to file Form 8959 with their annual income tax filing.

Who must pay additional Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How do I claim excess Medicare tax withheld?

Therefore, you need to file Form 8959, Additional Medicare Tax, to document the withholding and to receive a refund of any tax that was withheld in excess of the total tax owed on your individual income tax return.

What form do I use to report additional Medicare tax?

Form 8959. If you owe this tax, file Form 8959, Additional Medicare Tax, with your tax return. You also report any Additional Medicare Tax withheld by your employer on Form 8959.

Who fills out form 8959?

If you have self-employment income, you file form 8959 if the sum of your self-employment earnings and wages or the RRTA compensation you receive is more than the threshold amount for your filing status.

What is the threshold for Form 8959?

12482: Additional Medicare Tax - Form 8959 The threshold amounts are: $250,000 for married taxpayers who file jointly. $125,000 for married taxpayers who file separately. $200,000 for all other taxpayers.

What is the income threshold for Medicare tax?

Key Takeaways. Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax on top of the 1.45%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the IRS 8959 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your IRS 8959.

How do I fill out IRS 8959 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IRS 8959 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit IRS 8959 on an Android device?

You can make any changes to PDF files, like IRS 8959, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is IRS 8959?

IRS Form 8959 is used to figure the Additional Medicare Tax that applies to high-income earners. This tax is an extra 0.9% on wages, compensation, and self-employment income above certain thresholds.

Who is required to file IRS 8959?

Individuals who have wages, compensation, or self-employment income that exceeds the thresholds for Additional Medicare Tax must file IRS Form 8959. These thresholds vary based on filing status.

How to fill out IRS 8959?

To fill out IRS Form 8959, start by providing your personal information including name and Social Security number. Then, calculate your total Medicaid wages and self-employment income, determine if it exceeds the filing thresholds, and then compute the Additional Medicare Tax owed based on the income that exceeds the threshold.

What is the purpose of IRS 8959?

The purpose of IRS Form 8959 is to calculate and report the Additional Medicare Tax owed by high-income individuals to ensure they pay the correct amount of tax based on their earned income.

What information must be reported on IRS 8959?

IRS Form 8959 requires reporting information including total Medicare wages, total self-employment income, the applicable threshold amount based on your filing status, and the Additional Medicare Tax that you owe.

Fill out your IRS 8959 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8959 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.