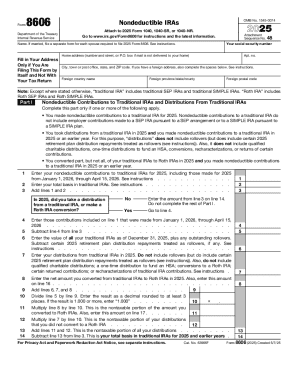

IRS 8606 2024 free printable template

Instructions and Help about irs form 8606

How to edit irs form 8606

How to fill out irs form 8606

Latest updates to irs form 8606

All You Need to Know About irs form 8606

What is irs form 8606?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8606

What should I do if I realize I made a mistake on my submitted irs form 8606?

If you discover a mistake after submitting your irs form 8606, you can correct it by submitting an amended return using Form 1040-X. Be sure to attach the corrected form 8606 with the amended return and provide a clear explanation of the changes made.

How can I verify that my irs form 8606 was received and processed?

To verify the status of your irs form 8606, you can use the IRS 'Where's My Refund?' tool if you are expecting a refund. For tracking e-filed returns, you can also check through your tax software or contact the IRS directly for updates on processing.

Are there specific legal considerations when filing irs form 8606 for international transactions?

When filing irs form 8606 for international transactions, it's important to consider the rules regarding nonresidents and foreign payees. Ensure you understand how U.S. tax laws apply to these situations and consult a tax professional if necessary to avoid legal complications.

What common errors should I watch out for when filing my irs form 8606?

Common errors when filing the irs form 8606 include miscalculating basis or distributions, failing to report all transactions accurately, and not signing the form. Double-check your entries and refer to instructions to ensure you meet all requirements.

What technical requirements should I keep in mind when e-filing my irs form 8606?

When e-filing your irs form 8606, ensure that your software is compliant with IRS e-file standards. Additionally, check that your browser is updated and stable to avoid any technical issues during submission.

See what our users say