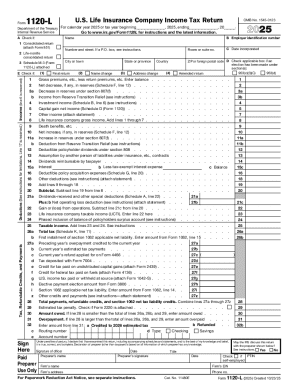

IRS 1120-L 2024 free printable template

Instructions and Help about IRS 1120-L

How to edit IRS 1120-L

How to fill out IRS 1120-L

Latest updates to IRS 1120-L

About IRS 1120-L 2024 previous version

What is IRS 1120-L?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1120-L

What steps should I take if I need to correct mistakes on my IRS 1120-L after submission?

If you realize there are mistakes in your submitted IRS 1120-L, you should file an amended return using Form 1120-L and indicate that it is correcting a previously filed return. Ensure to provide clear explanations for the changes made to avoid confusion. Keep in mind that corrections may delay processing times, so anticipate additional time for acceptance.

How can I verify the status of my IRS 1120-L submission?

To verify the status of your IRS 1120-L submission, you can use the IRS's online tools for tracking e-filed documents or contact the IRS directly. Note that it may take several weeks for the IRS to update submission statuses, so patience is key during this period.

What are common errors that filers make with the IRS 1120-L, and how can I avoid them?

Common errors with IRS 1120-L include incorrect data entry and missing signatures or dates. To avoid these issues, double-check all information against your records prior to submission and ensure that all required fields are completed. Utilizing electronic filing can also reduce errors as many programs include built-in checks.

What should I do if I receive a notice or letter from the IRS regarding my 1120-L filing?

If you receive a notice or letter from the IRS about your IRS 1120-L filing, read it carefully to understand the issue being addressed. Gather any necessary documentation that supports your response and reply within the specified timeframe to avoid further complications. Consulting a tax professional may also be beneficial in addressing complex matters.

Are there specific technical requirements I should be aware of when e-filing my IRS 1120-L?

When e-filing your IRS 1120-L, ensure that your software is compatible with IRS e-filing standards. Most modern tax software meets these requirements, but check for updates and ensure your browser supports the e-filing platform. Additionally, keeping your system secure from data breaches is crucial while submitting sensitive information electronically.