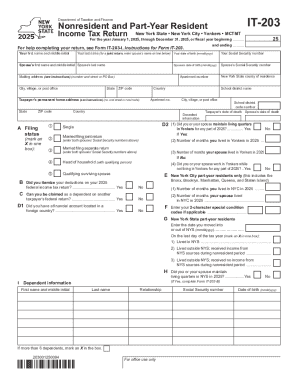

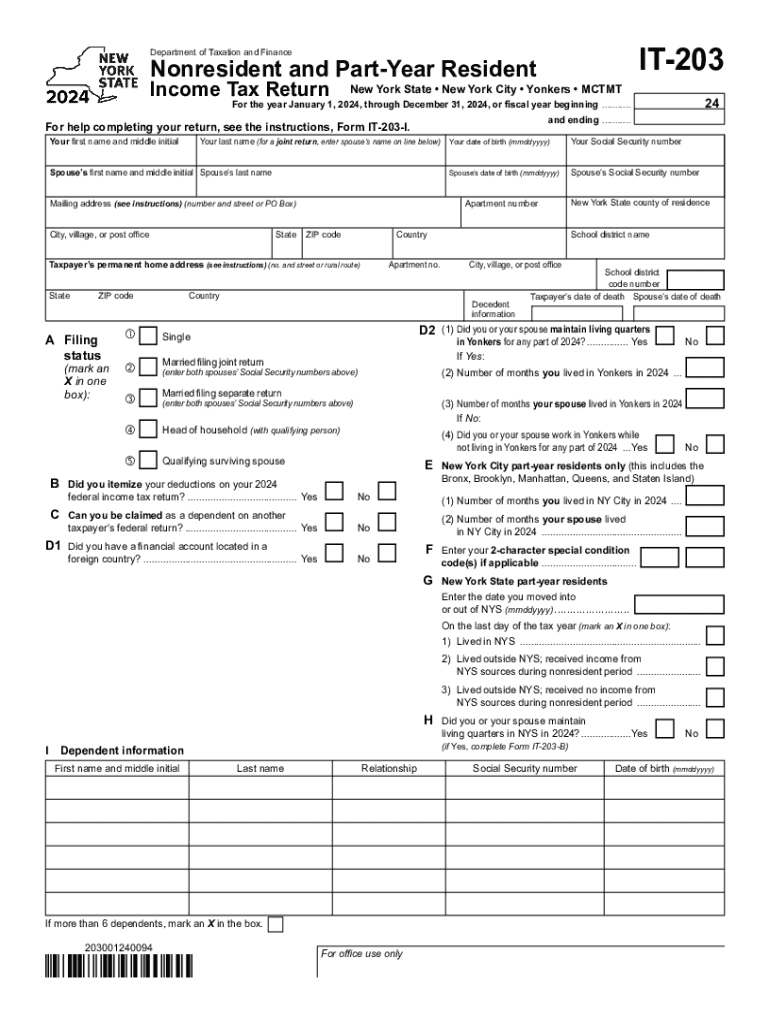

NY IT-203 2024 free printable template

Instructions and Help about NY IT-203

How to edit NY IT-203

How to fill out NY IT-203

Latest updates to NY IT-203

About NY IT previous version

What is NY IT-203?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about NY IT-203

What should I do if I realize I've made a mistake on my NY IT-203 after filing?

If you've filed your NY IT-203 and discover an error, you can correct it by submitting an amended return. Ensure you include the correct information and clearly mark the amended return. Keep a copy of all submitted forms for your records.

How can I verify the status of my filed NY IT-203?

To check the status of your submitted NY IT-203, you can visit the New York State Department of Taxation and Finance website. They provide a tracking tool where you can enter your information to verify receipt and processing updates.

Are there common errors to watch for when filing the NY IT-203 electronically?

Yes, when e-filing the NY IT-203, common errors include incorrect social security numbers, failure to sign electronically, and input errors in income amounts. Double-check all entries to minimize the chances of rejection.

What should I do if I receive notice of an audit regarding my NY IT-203?

If you receive an audit notice for your NY IT-203, promptly review the information requested. Gather the relevant documentation, and consider consulting a tax professional to assist you with your response to the audit.

How long should I retain records related to my filed NY IT-203?

Record retention for your NY IT-203 should generally extend for at least three years after the due date of the return. This ensures that you have adequate documentation in case of inquiries or audits regarding your tax filings.

See what our users say