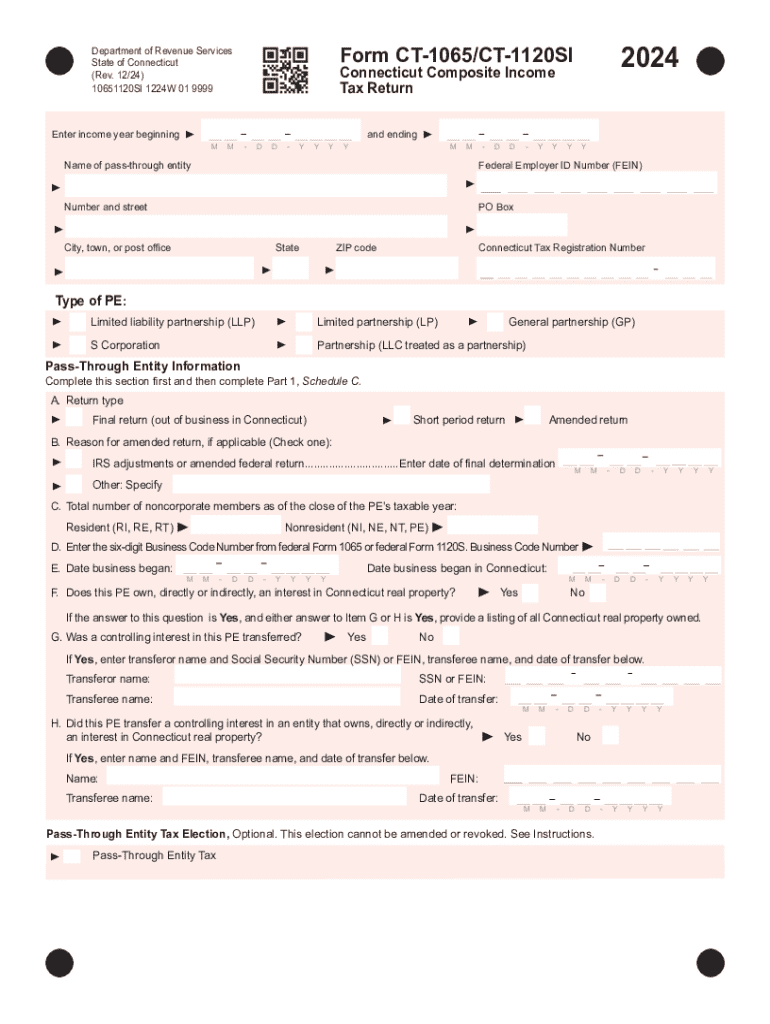

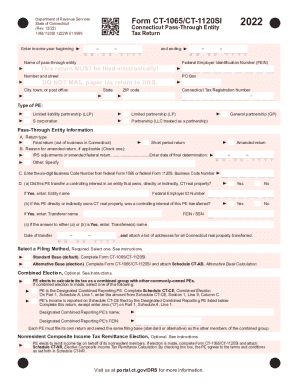

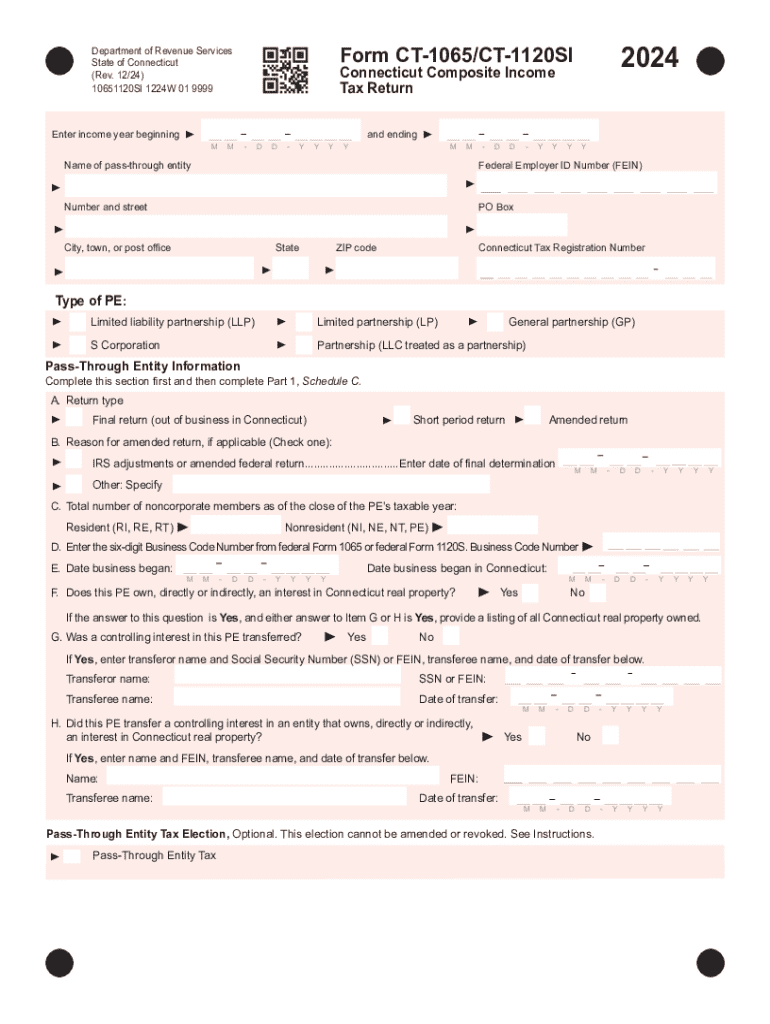

CT DRS CT-1065/CT-1120SI 2024-2025 free printable template

Get, Create, Make and Sign connecticut income form

Editing ct 1065 instructions online

Uncompromising security for your PDF editing and eSignature needs

CT DRS CT-1065/CT-1120SI Form Versions

How to fill out ct 1065 form

How to fill out ct-1065ct-1120si

Who needs ct-1065ct-1120si?

Video instructions and help with filling out and completing ct return

Instructions and Help about connecticut return

Our speaker today is Garth Jacobsen with our government relations attorney xyg thank you and welcome guys welcome everyone I in the past few months the latest tax act or most significant tax Act passed and during that time there was a number of us chatting back and forth about what the laws are going to mean and how theyre going to affect us and all the other aspects of it and in the forefront of the discussion was Bob Keating who oftentimes had some very interesting thoughts and ideas about this and so a couple months ago I was able to catch up with Bob at one of the meetings I attended and we chatted about this and I asked Bob if he would be willing to do a program and Bob graciously agreed to do the program for us and so what youre going to hear in the next hour and a half is probably some of the most important information you will gain this year about the tax issues relating to LLCs and corporations and unincorporated entities now for those of you who are not familiar with Bob he is probably one of the most qualified people in the area of tax and business entity law he serves as of counsel with Holland at heart and he practices and business entities and tax hes co-authored at least two major publications books on choice of entity and limited liability companies and constantly publishing various articles that are scattered and many law journals hes been a visiting professor at various in universities and he is a fellow of the American College of Tax Counsel he is presently the chair of the Professional Responsibility Committee of the ABA business law section and serves on the ABA cyber security task force and Toomey notably hes the former chair of the LLC partnership and unincorporated entity committee the ABA business law section and I might add finally that hes a Luber awful Ward recipient of that committee which has special meaning to those of us who serve on that committee so with that I will pass control to Bob who Im sure will offer you some of the best advice or I shouldnt say advice but information you will receive in this area this year thank you so much Bob Thank You Garth I appreciate the kind words and I will pass along some information but I think that probably the disclaimer at the beginning of these slides is as apt for this program as any program Ive ever spoken at as will be discussion discussing in a few minutes we are dealing with a statute that was adopted quickly adopted shortly became before it went into effect and was adopted without most of the public discourse that those of us who practice tax law are accustomed to in terms of learning how the new statute is going to work the trust that I am going to attempt to to make with regard to this is not an in depth or exhaustive review of the entire Act but more to try to provide some basic information as to how some of the more important provisions within the Act work Ill point out a couple of places where uncertainty is already arisen and will strongly counsel people who...

People Also Ask about ct return

Who needs to file CT 1065?

What is CT 1065?

What is the tax rate for CT 1065?

Who must file a CT return?

What is CT Form 1065?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find avats?

How do I fill out the ct form 1065 form on my smartphone?

How do I complete ct 1065 ct 1120si instructions fill on an Android device?

What is ct-1065ct-1120si?

Who is required to file ct-1065ct-1120si?

How to fill out ct-1065ct-1120si?

What is the purpose of ct-1065ct-1120si?

What information must be reported on ct-1065ct-1120si?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.