Get the free Comprehensive Personal Liability Insurance Application

Get, Create, Make and Sign comprehensive personal liability insurance

Editing comprehensive personal liability insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out comprehensive personal liability insurance

How to fill out comprehensive personal liability insurance

Who needs comprehensive personal liability insurance?

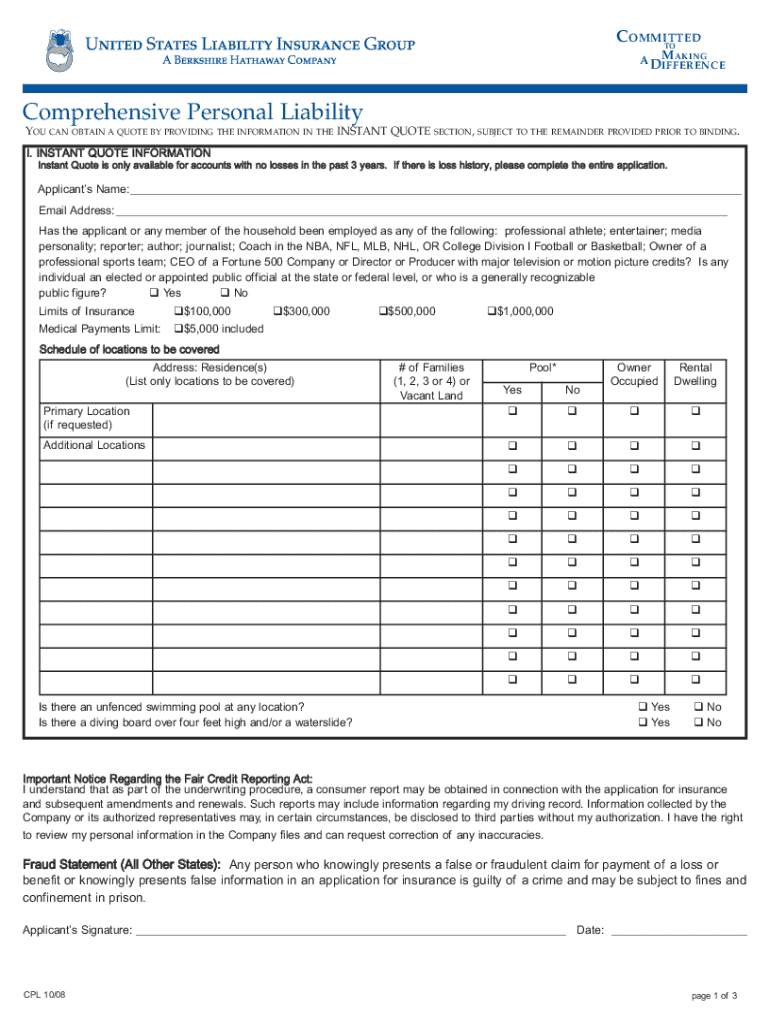

Understanding the Comprehensive Personal Liability Insurance Form

Understanding comprehensive personal liability insurance

Comprehensive personal liability insurance is a critical component of an individual’s risk management strategy. This type of insurance covers legal liabilities arising from personal actions that may cause harm to others or damage to their property. In essence, it protects you against claims filed by third parties for bodily injury or property damage, helping to cover both legal defense costs and any settlements or judgments.

The importance of this insurance in personal finance cannot be overstated. It acts as a safeguard for individuals and families, insuring them against unexpected events that could lead to significant financial losses. Without it, one misstep, such as a visitor getting injured on your property, could result in damages far exceeding your financial capacity.

Determining eligibility for coverage

When considering a comprehensive personal liability insurance form, it’s essential to understand the eligibility criteria. Typically, applicants must meet specific age and residency requirements, usually being at least 18 years old and residing within the jurisdiction where they’re applying for insurance. Furthermore, prior insurance history can influence eligibility. Those with claims history may face challenges in securing coverage.

Common exclusions are also crucial to note. Policies often do not cover risks associated with certain business activities or injuries sustained while engaging in illegal activities. Understanding these exclusions can save applicants from unpleasant surprises when they attempt to use their coverage.

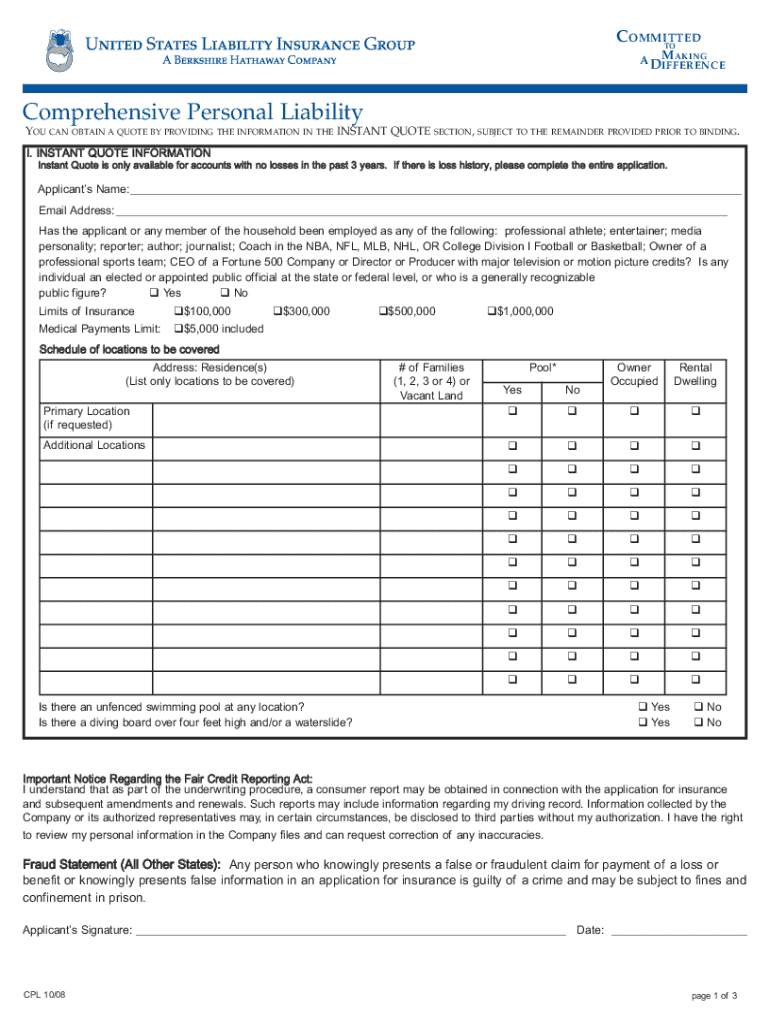

Essential components of the insurance form

The comprehensive personal liability insurance form consists of several crucial sections. The personal details section requires an applicant to provide comprehensive information, including name, address, date of birth, and sometimes additional identifiers like a driver’s license number. Accuracy is vital here, as any discrepancies can affect claims processing and validation of coverage.

Coverage selection options allow policyholders to choose limits and additional features that suit their needs. Assessing the right amount of coverage involves considering personal assets, risk exposure, and potential liabilities. Lastly, claim history disclosure is necessary; applicants must detail any previous claims as they can impact premium rates significantly. Being transparent is the best approach to avoid complications in future claims.

Step-by-step guide to filling out the comprehensive personal liability insurance form

Before you begin completing your comprehensive personal liability insurance form, a pre-completion checklist is highly recommended. Gather necessary documentation, including identification, proof of residence, and any previous insurance policy details. Having all the information in one place streamlines the process significantly.

Filling out the form requires careful attention to detail. Begin with the personal information section, ensuring all details are correct. Proceed to coverage selection, where you’ll choose the desired limits based on your evaluation of your needs. Finish by reviewing the declaration and signature section to confirm your understanding of the terms. Common mistakes to avoid include leaving fields incomplete or providing misleading information, which can lead to issues with your application and claims in the future.

Interactive tools for managing your insurance

For individuals seeking an efficient way to handle their documentation, utilizing platforms like pdfFiller can significantly enhance the management experience. This tool provides easy access to editing documents, allowing users to annotate, add content, and adjust their insurance forms as needed. Benefits of cloud-based access include the ability to work on documents from any device, streamlining the insurance process further.

Additionally, eSigning your insurance form simplifies the submission process. Users can electronically sign documents directly within the platform, eliminating the hassle of printing or scanning paper copies. It’s advisable to verify the legal validity of eSignatures in your jurisdiction, but generally, eSigning offers a secure and efficient way to complete your insurance application.

Reviewing and submitting the completed form

Once you have filled out your comprehensive personal liability insurance form, a final review checklist is crucial. Ensure that all sections are complete, that the information is accurate, and that any claim history is fully disclosed. Double-check your coverage selections to confirm that they align with your personal needs before submission.

Regarding form submission, there are several methods to choose from, including online submission through the insurer’s website or mailing the form directly. After submission, you can expect an acknowledgment confirming your application and an outline of the next steps. Each method has its pros and cons, so opting for online submission is often the quickest way to obtain coverage.

After submission: understanding what happens next

After submitting your comprehensive personal liability insurance form, understand that a waiting period exists for approval. Typically, it takes a few days to several weeks, depending on the insurer and the complexity of your application. Factors affecting this timeline include the thoroughness of your application and the need for additional verification.

Once approved, you will receive documentation outlining the details of your coverage, including liability limits, policy terms, and renewal instructions. However, if your application is denied, common reasons may include poor claim history or exceeding eligibility requirements. In such cases, understanding the reasons behind the denial can help in addressing the issues and potentially reapplying in the future under more favorable conditions.

Frequently asked questions (FAQs)

As you navigate your comprehensive personal liability insurance, you may encounter several frequently asked questions. For instance, should your information change after purchasing coverage, notifying your insurer is crucial to ensure that your policy reflects current realities. This keeps your coverage valid and relevant.

Additionally, many wonder if they can adjust their coverage after the initial purchase. The answer is typically yes, but it’s essential to understand how changes might affect premium rates and coverage terms. Finally, claims can impact future premiums, so being savvy about coverage levels and claim filings is important to maintain favorable rates.

Maintaining your comprehensive personal liability insurance

Maintaining your comprehensive personal liability insurance is an ongoing process that requires regular reviews of your policy. Life changes, such as acquiring significant assets or changes in household structure, warrant a re-evaluation of your coverage needs. It’s important to ensure that your limits adequately reflect your current exposure to risk.

Maximizing your coverage can involve adding riders or enhancements to your policy. Furthermore, understanding the renewal process is crucial as well. Mark your calendar for renewal periods and reassess your needs in advance to take advantage of any opportunities for better coverage or lower premiums.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit comprehensive personal liability insurance from Google Drive?

How do I edit comprehensive personal liability insurance in Chrome?

Can I sign the comprehensive personal liability insurance electronically in Chrome?

What is comprehensive personal liability insurance?

Who is required to file comprehensive personal liability insurance?

How to fill out comprehensive personal liability insurance?

What is the purpose of comprehensive personal liability insurance?

What information must be reported on comprehensive personal liability insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.