Get the free Attachment G

Get, Create, Make and Sign attachment g

Editing attachment g online

Uncompromising security for your PDF editing and eSignature needs

How to fill out attachment g

How to fill out attachment g

Who needs attachment g?

A Comprehensive Guide to Filling Out the Attachment G Form

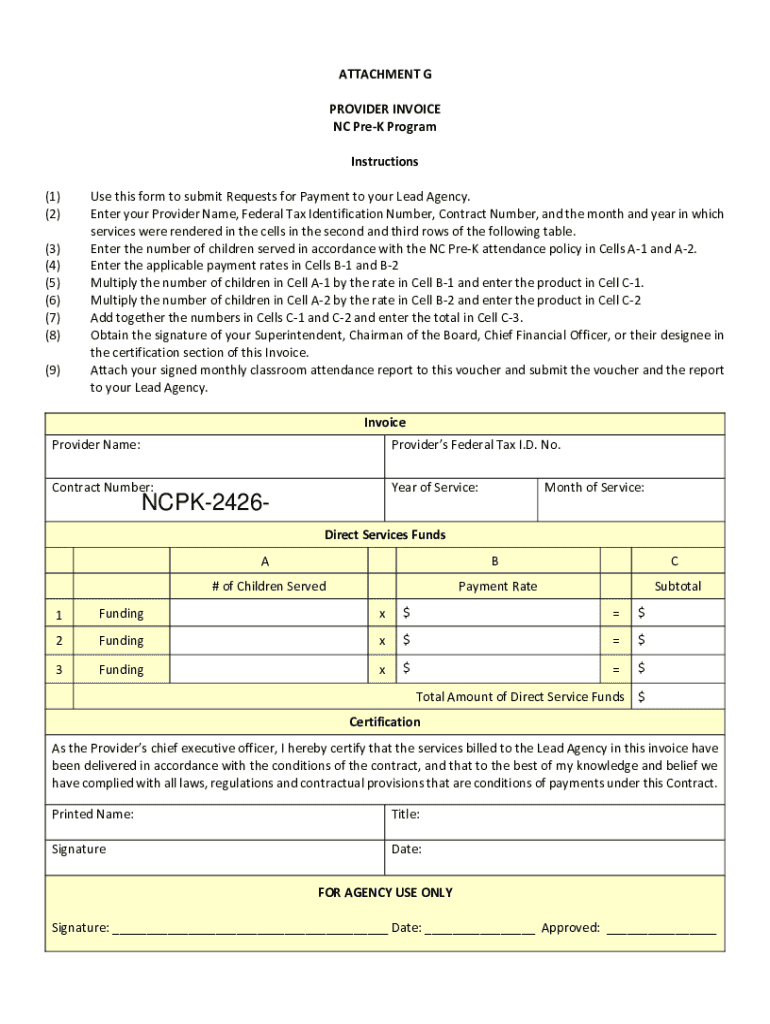

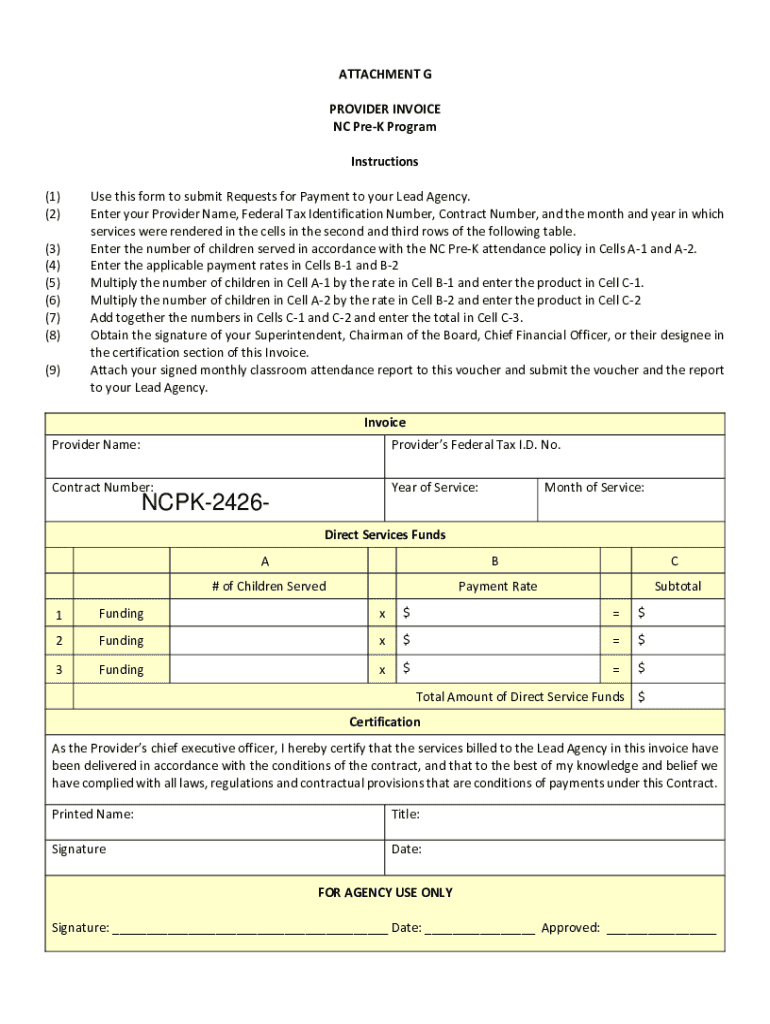

Understanding Attachment G

Attachment G is a crucial document in the context of Form 5500-1, providing vital information about employee benefit plans. This form is primarily used by pension plan administrators to report information concerning their plans to the U.S. Department of Labor (DOL) and the Internal Revenue Service (IRS). The significance of Attachment G lies in its ability to ensure compliance with federal regulations regarding pension funding and reporting.

Filling out Attachment G accurately is essential not just for legal compliance, but also for providing transparency regarding plan assets and liabilities. It holds significance for various stakeholders, including employers, employees, and regulatory agencies, as it facilitates a better understanding of pension plan operations.

Who needs to fill out Attachment G?

The primary obligation to complete Attachment G typically falls on plan administrators or fiduciaries of pension benefit plans. This requirement is pertinent for organizations with a defined benefit plan that is covered under the Employee Retirement Income Security Act (ERISA). Smaller employers may not be exempt and must ensure they meet the required documentation standards.

Specifically, entities likely to fill out Attachment G include:

Key components of Attachment G

Completing Attachment G involves providing essential data that reflects the financial status and operational characteristics of the pension plan. Users should be prepared to detail various financial components as well as demographic information regarding plan participants.

The key components of the Attachment G form include:

Common errors can lead to delays and possible penalties, so it’s crucial to avoid pitfalls such as incorrect EINs, missing signatures, or incomplete financial information. Thoroughly reviewing your entries prior to submission can significantly reduce these risks.

The filling process: step by step

The process of filling out Attachment G can be daunting, but breaking it down into manageable steps helps streamline the experience. Here’s how to complete the form effectively.

Step 1: Gathering necessary documentation

Before starting, ensure you have all relevant documents ready. This will aid in ensuring accuracy and completeness in your submission.

Step 2: Completing the form

Once you’ve collected the necessary documentation, proceed to fill out each section of Attachment G. An interactive guide indicates how to efficiently complete each segment.

Step 3: Review and verification

After filling out Attachment G, it’s crucial to double-check all entries. Ensure completeness and accuracy to avoid delays in processing or penalties. Utilize tools like pdfFiller to make the review process simpler and more reliable, providing a digital means for signature approval.

Editing and modifying with pdfFiller

If you need to modify your completed Attachment G form, pdfFiller makes it straightforward to edit previous submissions. Accessing and making changes is as easy as a few clicks.

To make changes after initial completion, follow these steps:

Moreover, pdfFiller’s markup tools enable better clarity in communications. You can highlight, comment, or even add explanatory notes using various annotation features, ensuring the intent behind your entries is well understood.

Signing and submitting Attachment G

Once reviewed, it’s time to sign and submit Attachment G. pdfFiller supports multiple electronic signature options that comply with government regulations.

Following the signing process, make sure to adhere to the submission guidelines established by governmental organizations. Proper filing ensures that you stay compliant and avoids any potential legal issues associated with delays or inaccuracies.

Managing your submission

Tracking the status of your form submission can be efficiently done with pdfFiller’s tracking features. This functionality allows you to monitor when your Attachment G was viewed or processed by the relevant authorities.

To track your submission, use the following tips:

Frequently asked questions

Completing Attachment G can pose challenges, but addressing common issues can simplify the experience considerably. If you encounter problems, knowing where to look for solutions can save you time and effort.

Final thoughts

Utilizing pdfFiller to manage your Attachment G process cannot just ease the burden of paperwork; it also enhances overall document management. The streamlined functionalities provided enable you to edit, eSign, and collaborate effectively from a centralized platform.

Exploring additional features of pdfFiller can also benefit users in diverse document management solutions, positioning it as an essential tool in your administrative toolkit. This makes compliance simpler while empowering organizations to keep accurate records related to Attachment G and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my attachment g directly from Gmail?

Can I edit attachment g on an iOS device?

Can I edit attachment g on an Android device?

What is attachment g?

Who is required to file attachment g?

How to fill out attachment g?

What is the purpose of attachment g?

What information must be reported on attachment g?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.